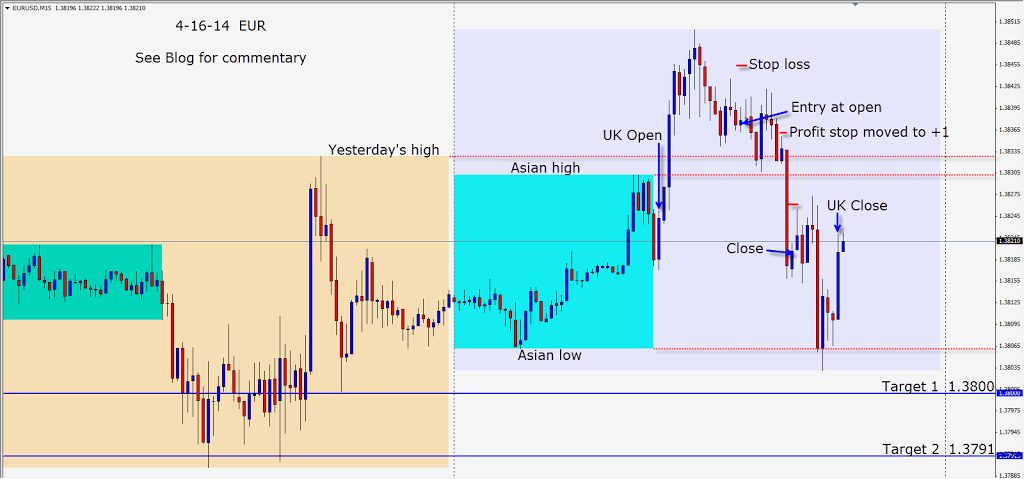

With all the news this week, we have been hoping for a more active market and so far have been rewarded. It’s nice to see life back in the majors this week.

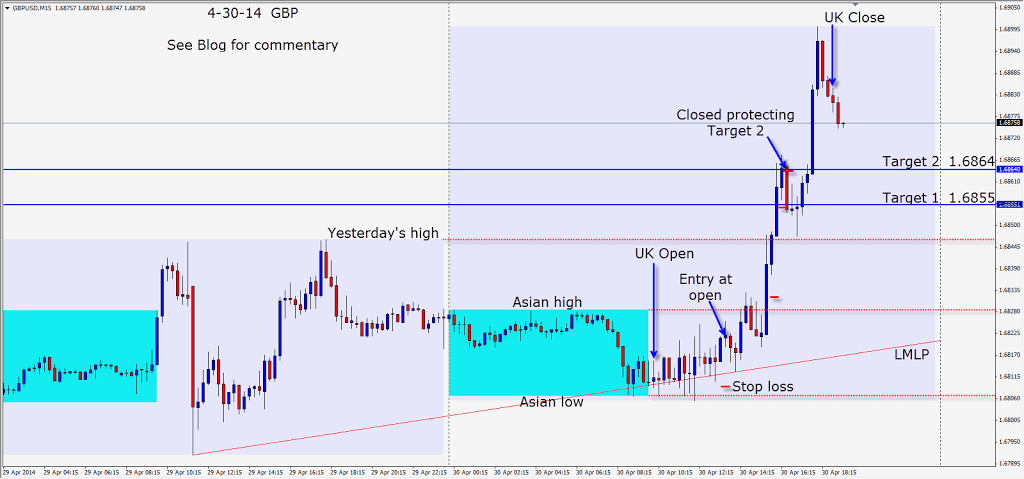

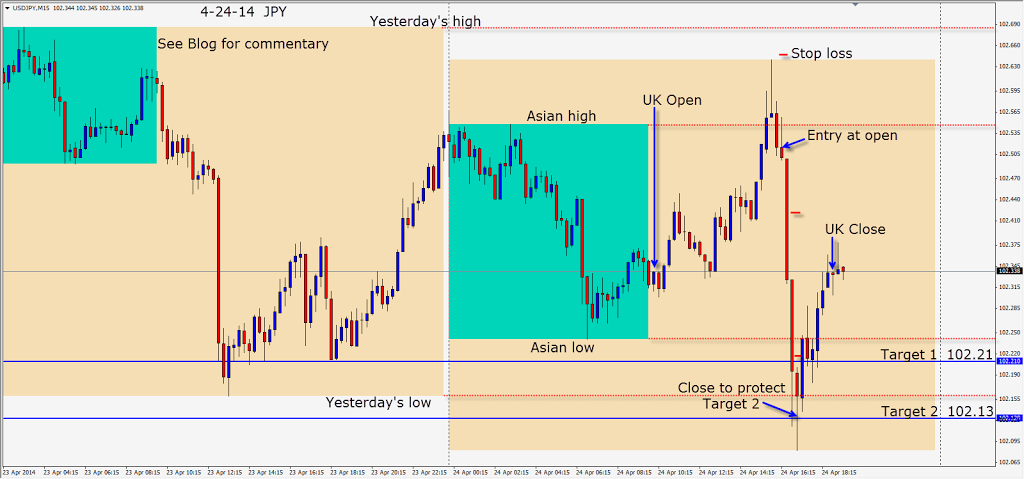

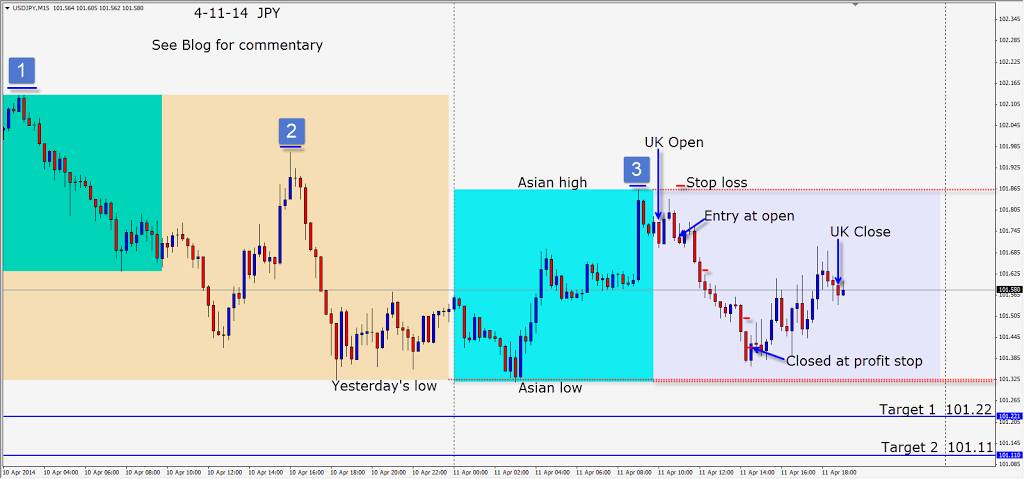

The GBP and JPY (not shown) had very tradeable setups today later on in the session. The GBP set up giving us a greater than 3:1 Reward to Risk ratio. Price was clearly moving away from the Asian session lows as buyers continued to enter. Price eventually moved to our Target 2 and we are taken out at our profit stop protecting this level – missing the last wave to the upside.

Good luck with your trading!

Back tomorrow if we find a trade.