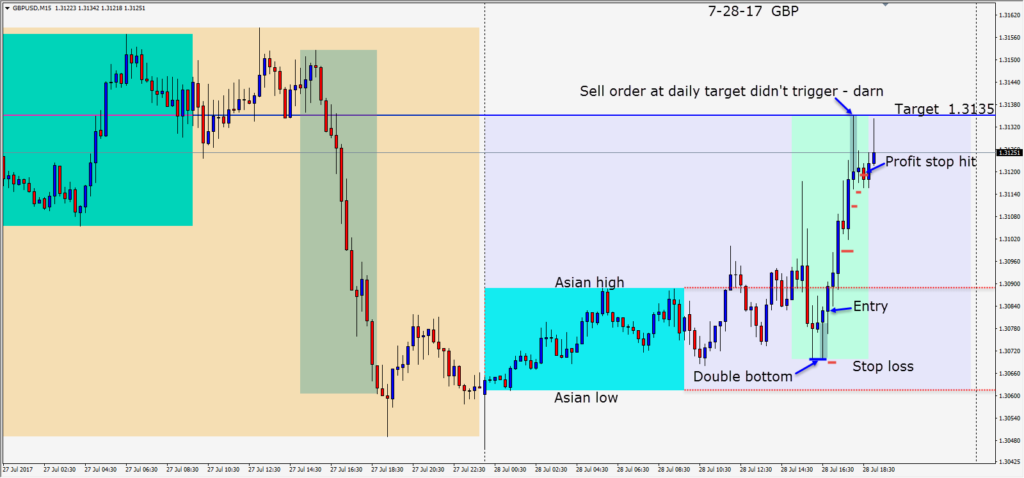

The USD has declined during July against the majors and the GBP is trying to close and stay above 1.3150.

Although the pair struggled in the first half of the U.K. session to get and stay above its Asian session highs, it moved higher after a double bottom in the U.S. session overlap. Once the pair was above the 1.3100 figure, it found support at 1.3115 before moving higher. Our daily target was 1.3135. Price fell just shy of our target and we gave back about 16 pips as sellers entered before our profit stop was hit.

Although it’s been a tough July for the USD – U.S. exporters won’t be complaining.

The coming week’s event risks include the closely watched Non-Farm Employment number on Friday as a gauge of the world’s largest economy. The Bank of England’s rate decision and accompanying press conference on Thursday will also be very important. China’s manufacturing data and Australia’s rate decision begin the week and Euro zone inflation are all significant this coming week.

Good luck with your trading!