It’s been an active week for GBP economic news, and with the last item out of the way, the GBP showed strength against the USD, EUR and CHF this session.

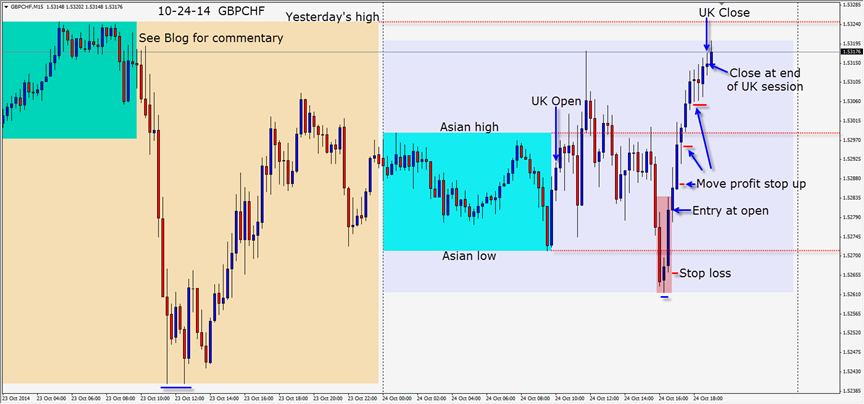

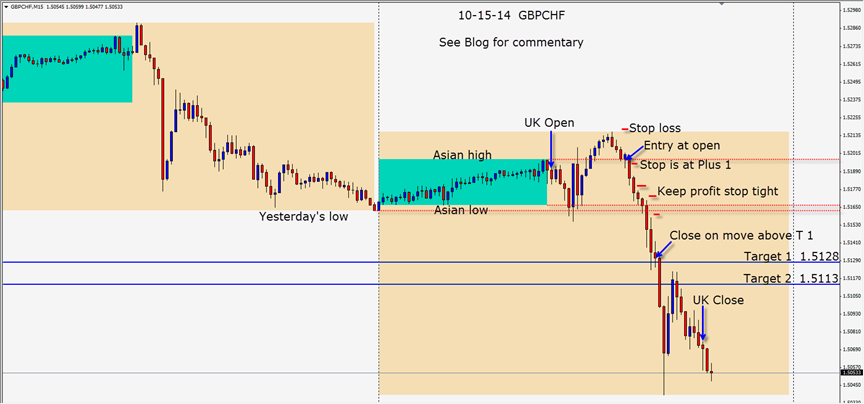

The GBPCHF has been very active lately unlike the EURCHF. It has made higher lows daily since Tuesday. When price attempted to take out the Asian low today…buyers entered. With a stop loss a few pips below the Asian low, a long trade is entered during the US session. The first level for price to challenge will be the Asian high, followed by the post news spike high, then yesterday’s high.

Price did almost that. It moved up to the Asian high retested the level. It moved higher and lost momentum at the post news spike high, producing wicky candle tops indicative of sellers entering at this level. As price has been stalling near the 1.5320 level this week, despite the higher lows…it may be a bit of grind to get higher in the near term. We will see what next week brings us…

Enjoy your weekend!

Back Tuesday if we find a trade.