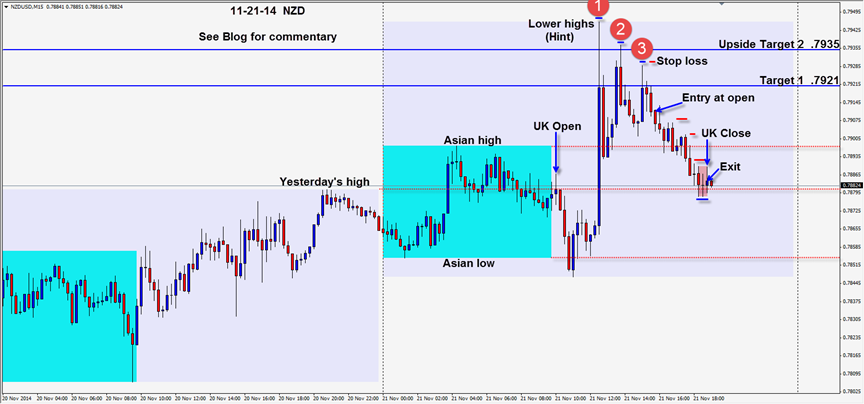

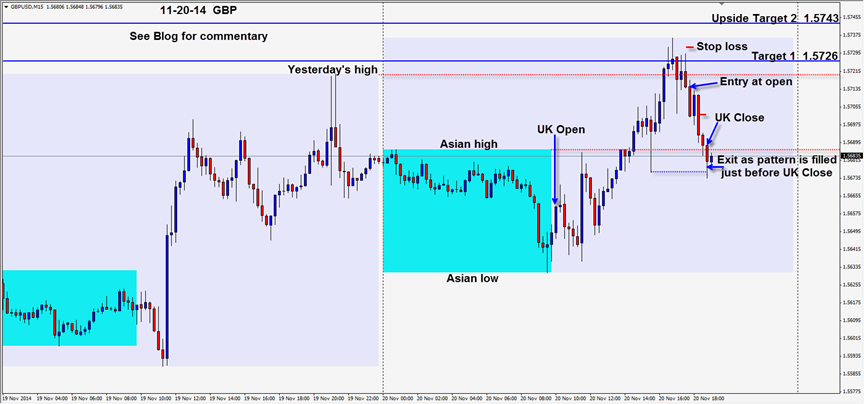

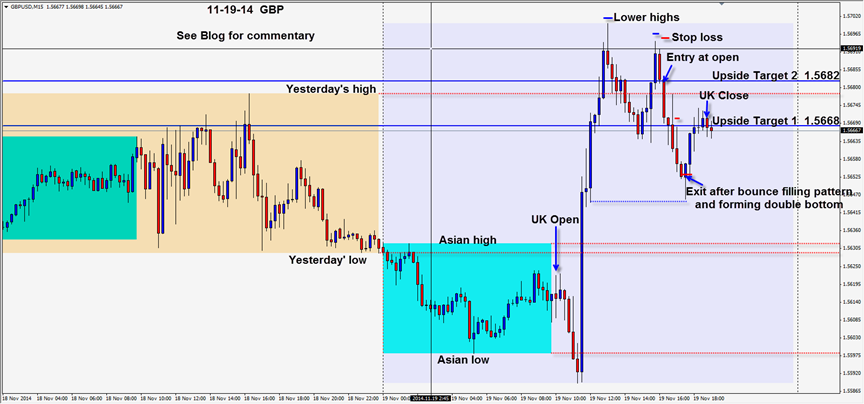

Counter-trend trades have set up this week in advance of the US Thanksgiving holiday.

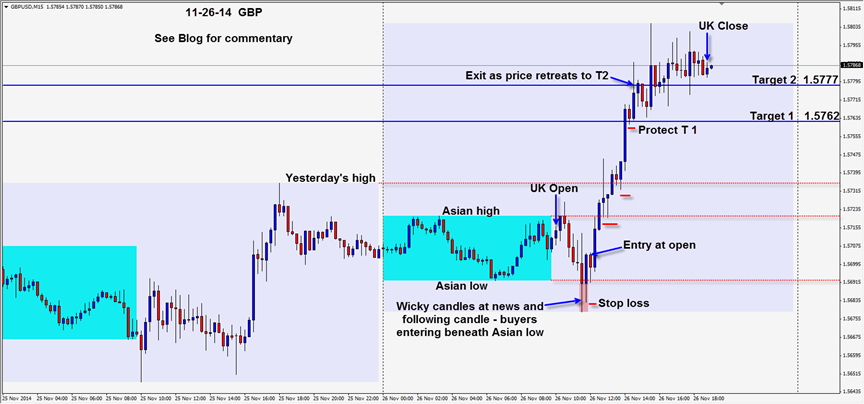

The UK second estimate GDP number came in on target and buyers entered the cable. With a stop well below the Asian lows we enter long – meeting our 3:1 R/R ratio minimum. Price tests the Asian high three times before ascending to our Targets 1 and 2 which we always protect with profit stops.

As price retraces this week in advance of the US holiday, we see lots of trades being squared by the institutional traders. This may allow for some good entries next week back to trend.

Good luck with your trading!

Back tomorrow if we find something we like. It may be pretty quiet for rest of the week but you never know…