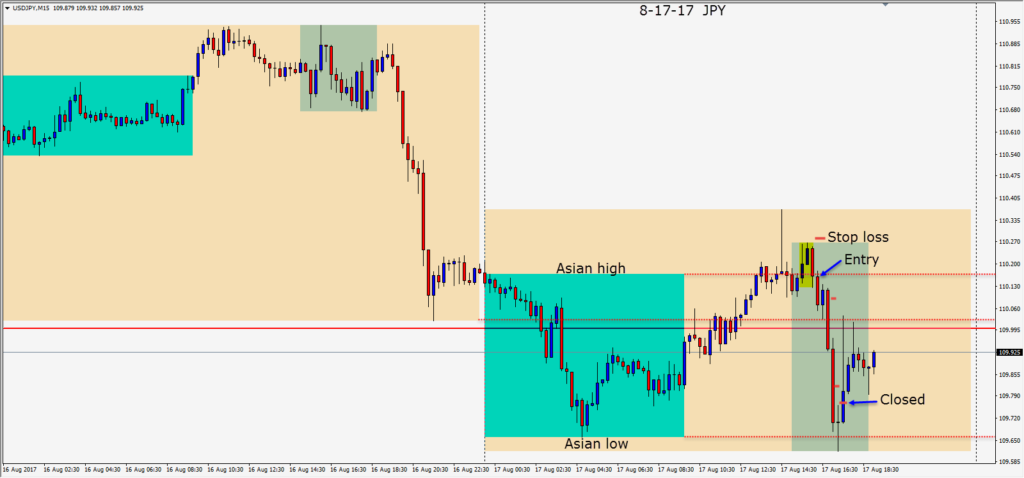

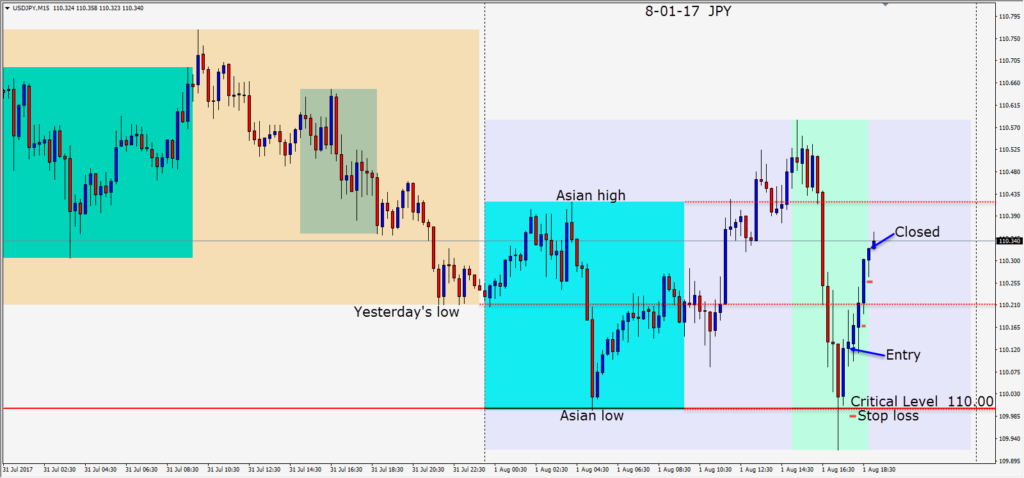

During the Asian session the USDJPY attempted to climb higher but ran into sellers before it could reach 110.00. As the U.K. session got underway price moved up from its Asian lows before setting up for a reversal – where a short was taken risking 16 pips for a potential 48 pips to our daily target.

Although the pair remained range bound for the first few hours, it then made a third lower high and finally began to drop an hour before the U.S. open. We locked in profit as it dropped and we were taken out of the trade as buyers entered at the 109.00 figure.

If the USD continues to be soft and the market sentiment remains as “risk off” then the USDJPY could move down further with 108.50/108.60 area attracting some buyers or possibly a move down to test the 108.00 figure. If 108.00 gives way then the 107.50 area will be in sight.

This week is light on economic news and volume in advance of the Jackson Hole Symposium starting tomorrow as well as summer winding down.

Good luck with your trading.