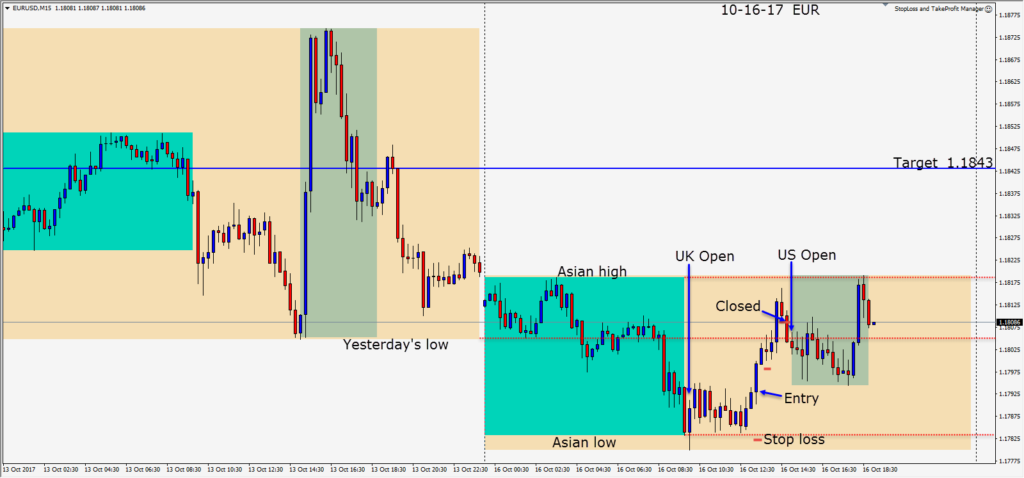

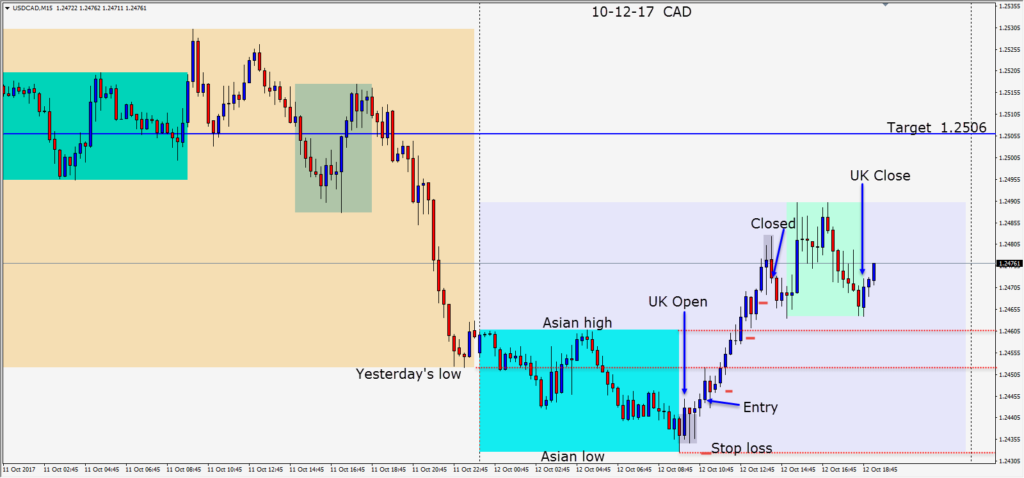

Mario Draghi didn’t surprise the market with his remarks today. The USD was stronger against all the majors. President Trump spoke highly of Janet Yellen yesterday and the markets continues to speculate as to who will be announced as the next FED chairperson.

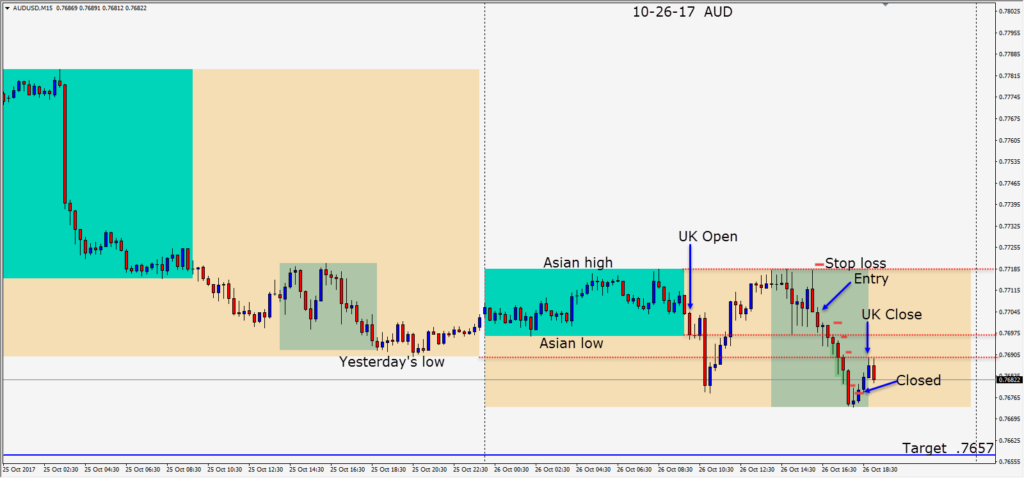

Once the dust had settled today, we chose to short the AUDUSD as it rolled over at its Asian highs – risking 15 pips for a potential 46 pips to our daily target.

As price moved below it’s Asian low, long lower wicks began to form and we tightened our profit stop in case price reversed. Price began to move up in the last hour of the U.K. session and we were taken out of the trade.

On Friday, there is some U.S. economic news and the question is whether the USD strength will continue going into the weekend.

Good luck with your trading!