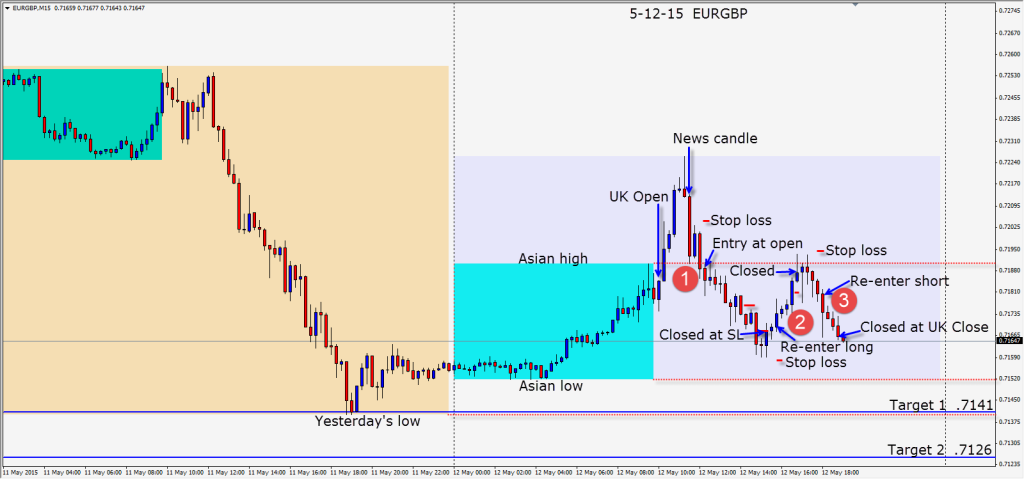

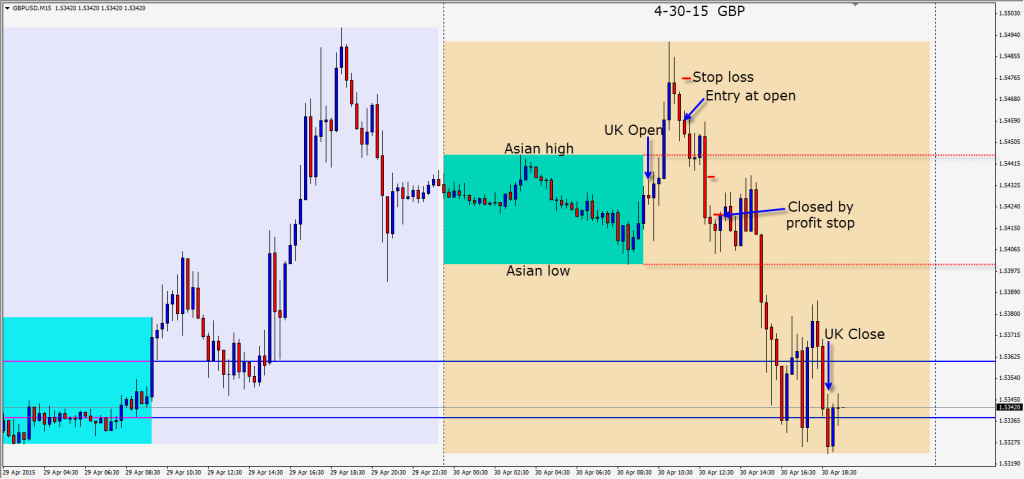

After missing the big move yesterday and hoping for another one today, we waited for the UK economic news to pass. An entry short is taken as price closes below the Asian session high with a 16 pip stop loss for a potential 62 pips to our Target 2. When our profit stop is hit, we are taken out of the trade for 20 pips. We wait 1 more candle and go long with the reversal and a 12 pip stop loss. As price forms a hammer with a long wick above, we close the trade. After the third red candle we re-enter short once more with a 15 pip stop loss for a potential 53 pips to our Target 2. At the close of the UK session – we exit for the day.

Good luck with your trading!

Back tomorrow if we find a trade.