If you are new to trading or a seasoned veteran, it’s a good idea to be aware of the trading range made in the previous session and the previous day. I find the UK session to be the most productive for trading.

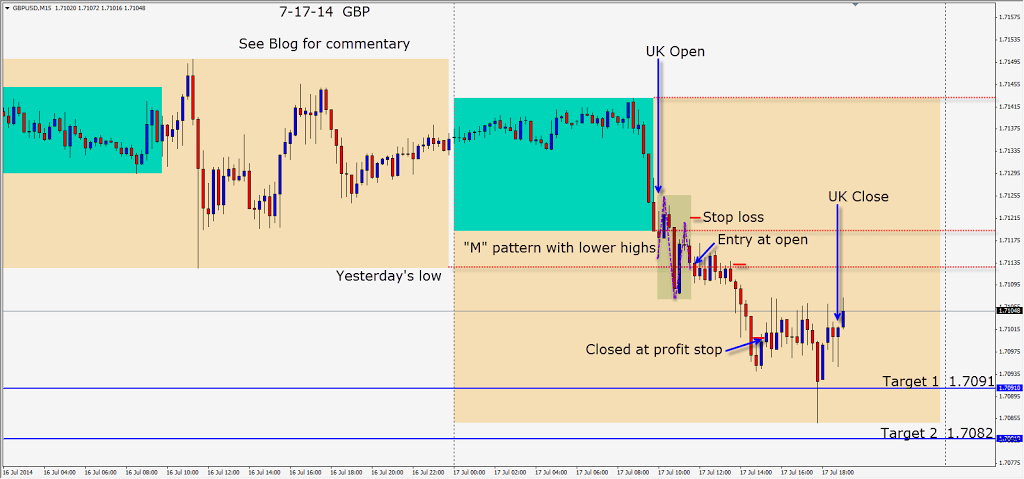

When price tests the previous session’s high or low (sometimes it tests both) … the Asian session high/low and yesterday’s high/low, be aware that it may pause, move above/below and retest it again. This is typical market behavior and occurs most days. I mark these levels in the trade examples that I include each day.

I was taught (years ago) never to be a breakout trader… by one of the largest traders in the world. Wait for price to price to break the range and pull back, Wait one more time for price to push above/below the Asian session and then wait to be convinced of the direction that price will then move. This breakout pull back, break out pull back is known as a “wash and rinse” and essentially is a way to stop out weak hands and accumulate volume before a larger move. About once a week or so, going long/short as price breaks through the previous session’s high/low works, and price runs and the breakout traders are rewarded. This will entice them to do it again and again, but about 80% of the time, it won’t work and stop losses will be triggered and weak hands will be taken out for a loss.

There are a lot of tricks for interpreting market behavior and I won’t be sharing all the tricks here, but the point has hopefully been made that trading 80% of breakouts is not a prudent trading strategy. If price runs away…NEVER chase it…let it go and find another trade or come back tomorrow.

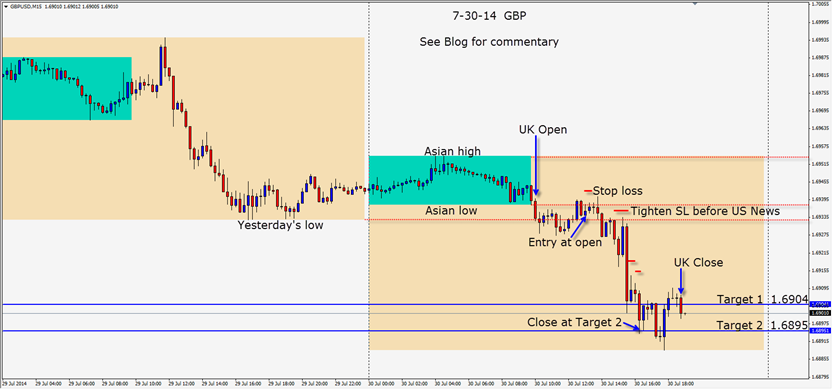

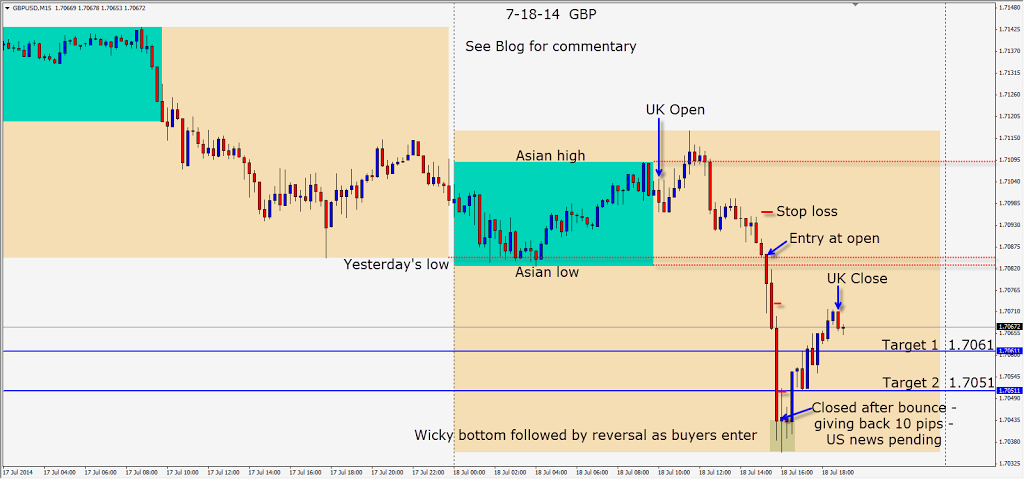

The GBP quickly pushed through its Asian range lows and yesterday’s low as the UK trading got underway today. It then pulled back before pushing down once again. At this stage we wait for a second pull back… and it pulls back within the Asian session range. The next candle it reverses lower… closing below the Asian session low. As price has already pulled back twice – testing the previously mentioned levels, a short is taken with a modest stop loss – giving us a 4:1 Reward for our Risk to our Target 2. The wild card in this trade will be the US economic news releases, so we will have to tighten our stop loss or profit stop in advance.

This trade is with the current trend of the USD, at a sweet spot of the session – with time to run before the US session gets underway, the wash and rinse pattern appears to be complete and 4:1 R/R trades are somewhat irresistible when a pair is trending predictably.

I hope this helps! Good luck with your trading!

I like summer trading although this summer’s ranges have been quite contracted. As long as you follow your trading rules consistently, the strategies remain the same and profitable trades await your analysis and execution.

I had one of my former students – a professional trader with many years of trading experience tell me yesterday that he has just had the best 6 weeks of trading since he began trading. I have every confidence that his trading success and consistency will continue!

Back tomorrow if we find a trade to wrap up the week as we don’t trade NFP Fridays.

If you have any questions, please send me an email and if you are interested in my course, I will be happy to answer any questions you may have over Skype. Check the Contact Me section of my website for details.