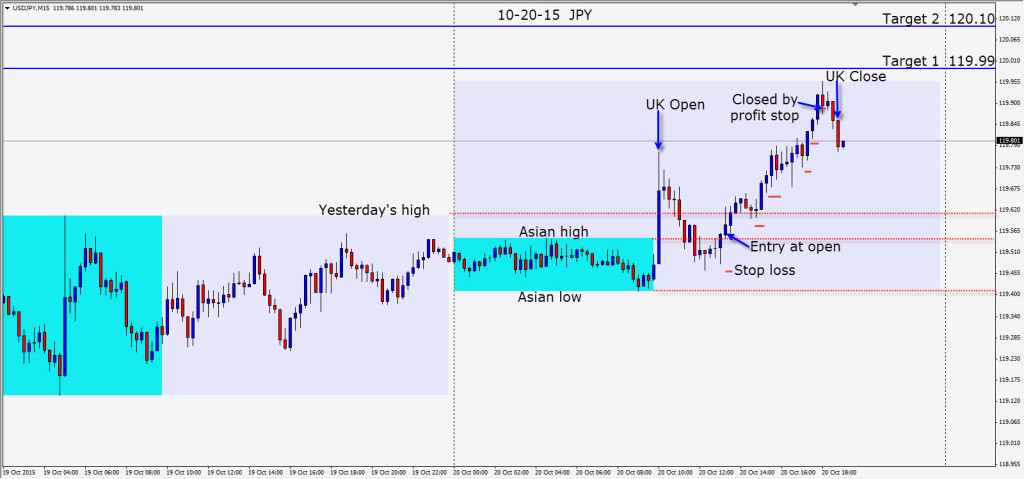

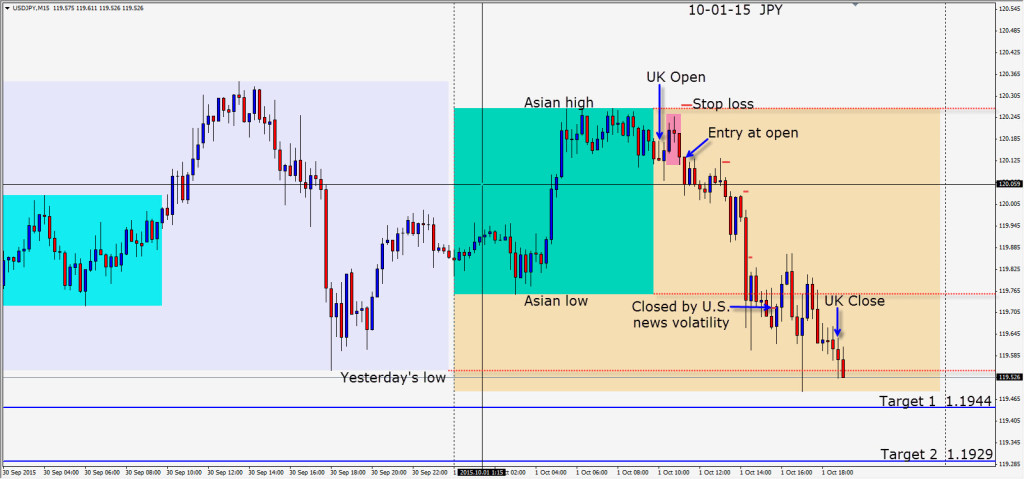

The JPY is trading in a range of approximately 118.00 – 121.00 with a subdued daily range of late. As month end approaches, we expect to see more activity with the BOJ announcement. In the meantime, the JPY continues to move in near 50 pip increments between the figures… 119.50 to 120.00 etc.

At the UK open it soared higher then pulled back into the Asian range where it went sideways. When this range broke, we entered long with a 10 pip stop loss for a potential 55 pips to our Target 2. Knowing that this pair would slow around the 120.00 figure we tightened our profit stop in advance. Price was unable to close above 119.95 and we were taken out at our profit stop.

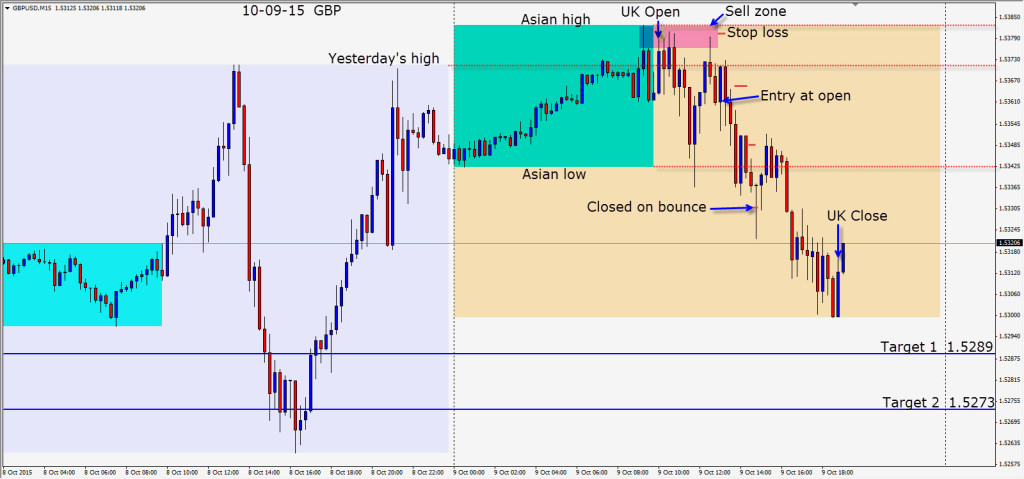

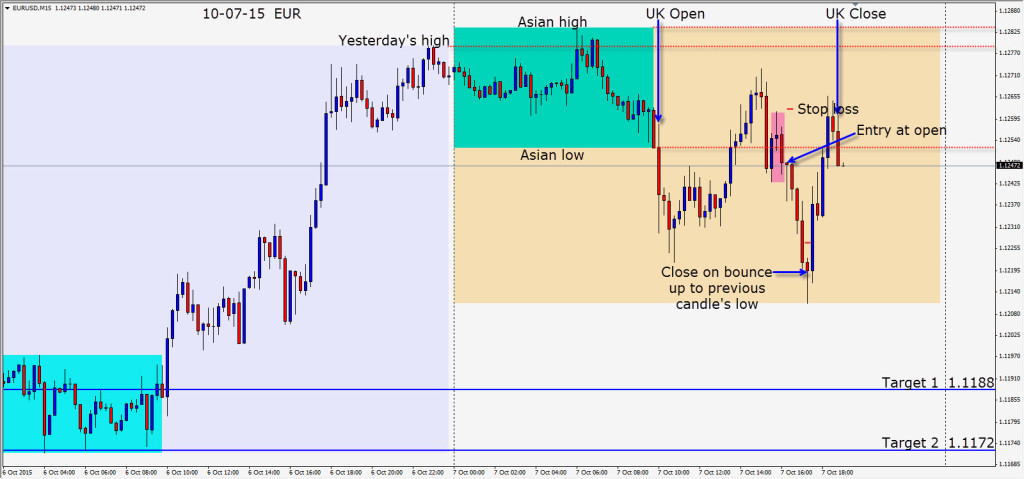

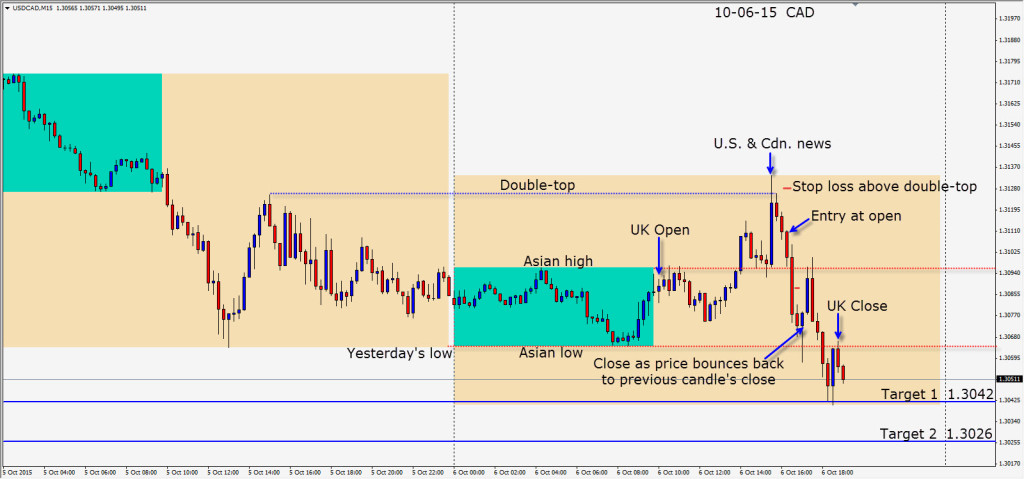

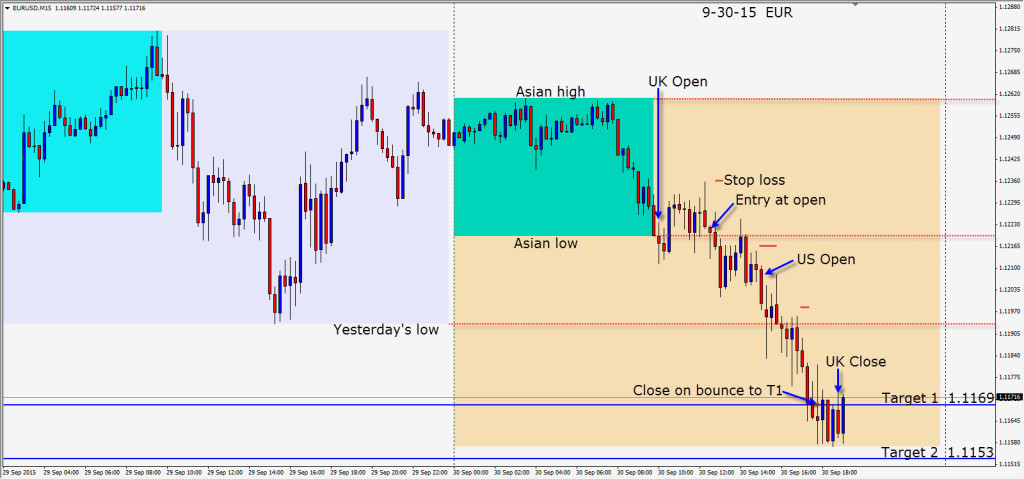

Last week I was unable to find a trade that met our Reward to Risk requirements. I would rather sit on my hands for a week than force a trade and get stopped out for a loss. Discipline is key to trading success.

I remain a USD bull, but not with the same conviction that I had during the summer. The bond market at this stage is lacking enthusiasm for a rate hike any time soon…but this can change with Janet Yellen’s next speech.

Good luck with your trading!

Back tomorrow if we find a trade.