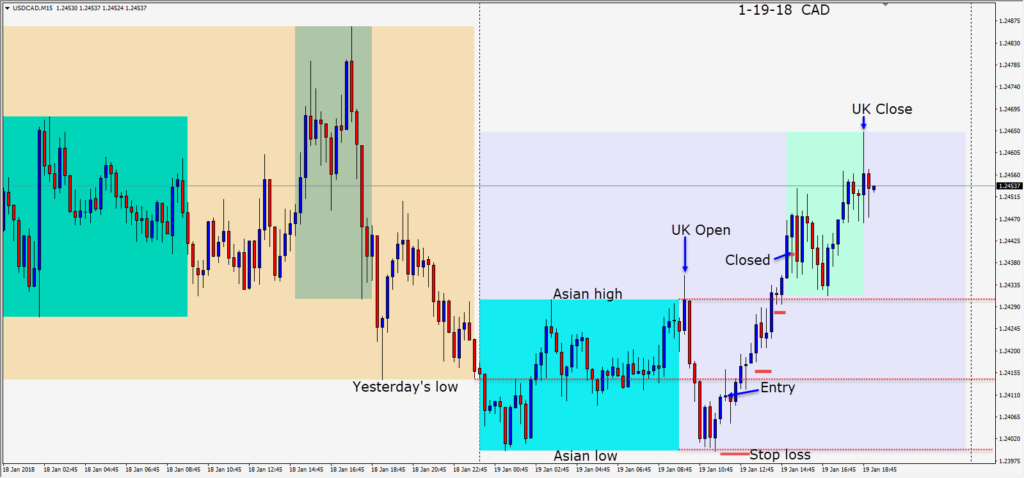

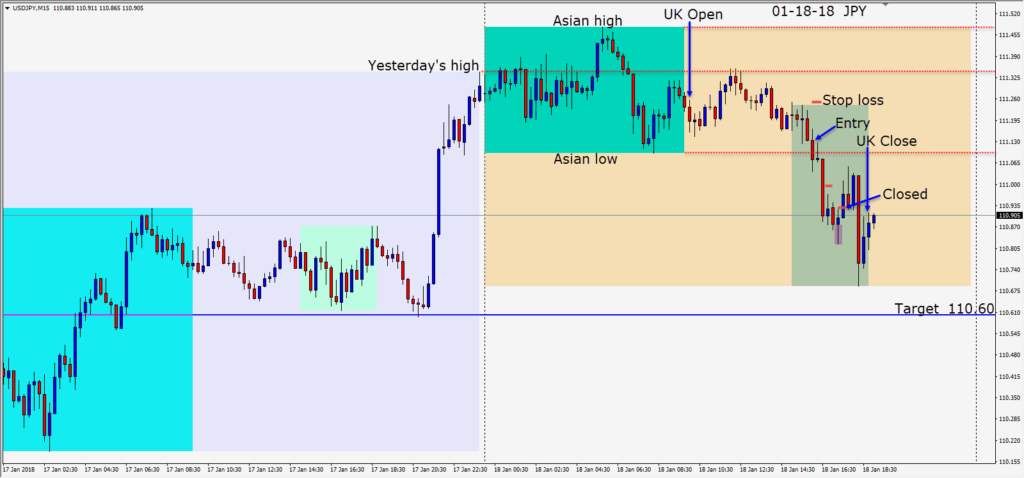

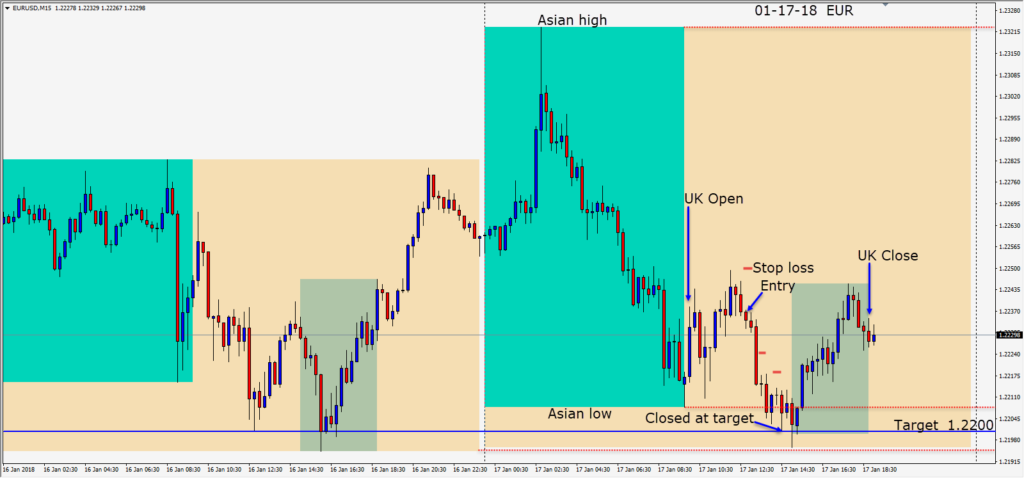

It’s no surprise that the USD was moderately weaker today with the government shut-down unresolved.

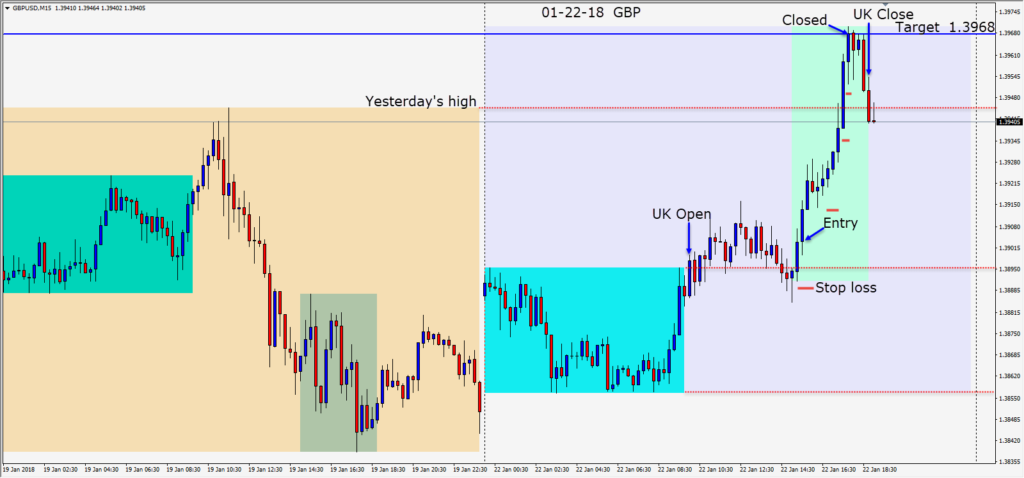

The GBP was very strong today, so with a weak USD and a nice long setup, we entered early in the U.S. session…risking 15 pips for a potential 65 pips to our daily target. The strength of the GBP today was also confirmed by looking at the EURGBP.

Be aware that the GBP although strengthening can be quite volatile around any Brexit headlines.

The annual conference in Davos, Switzerland this week can also give rise to volatility as participants talk with the media.

I will be away tomorrow.

Good luck with your trading!