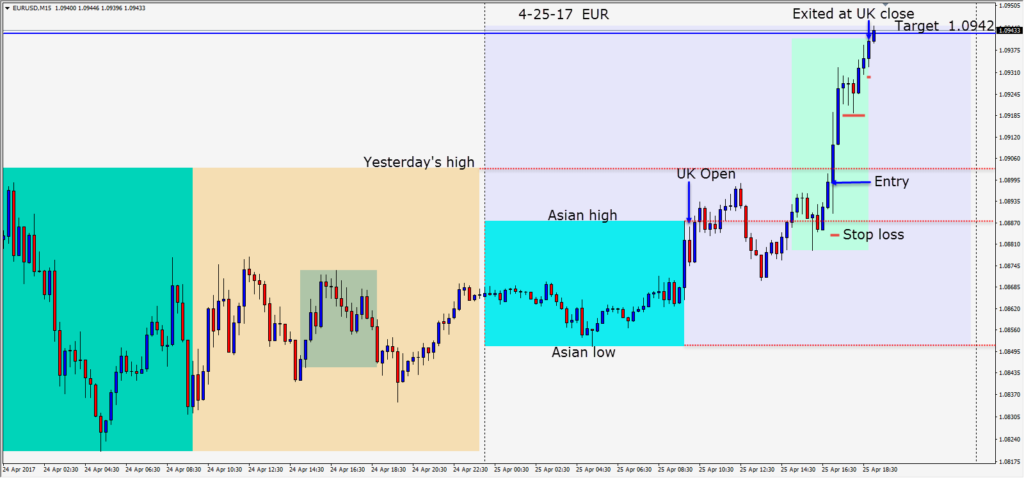

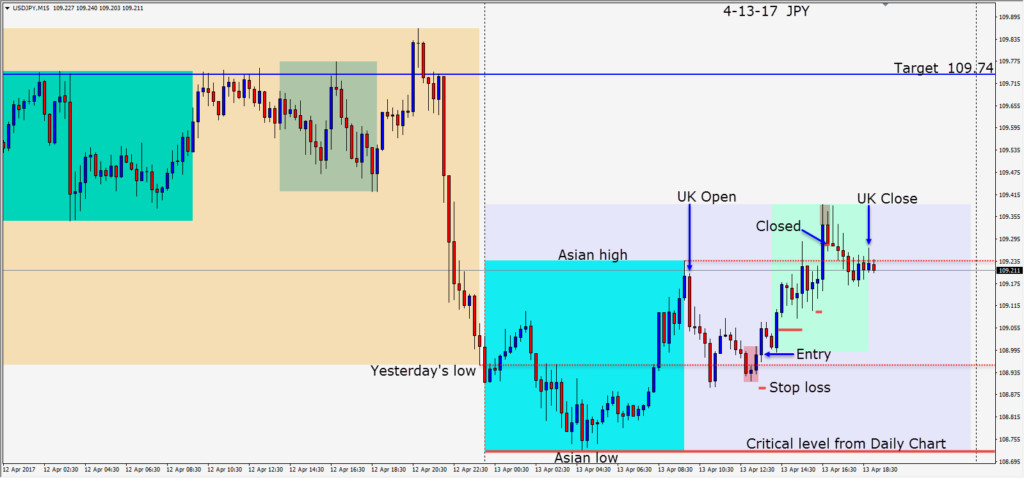

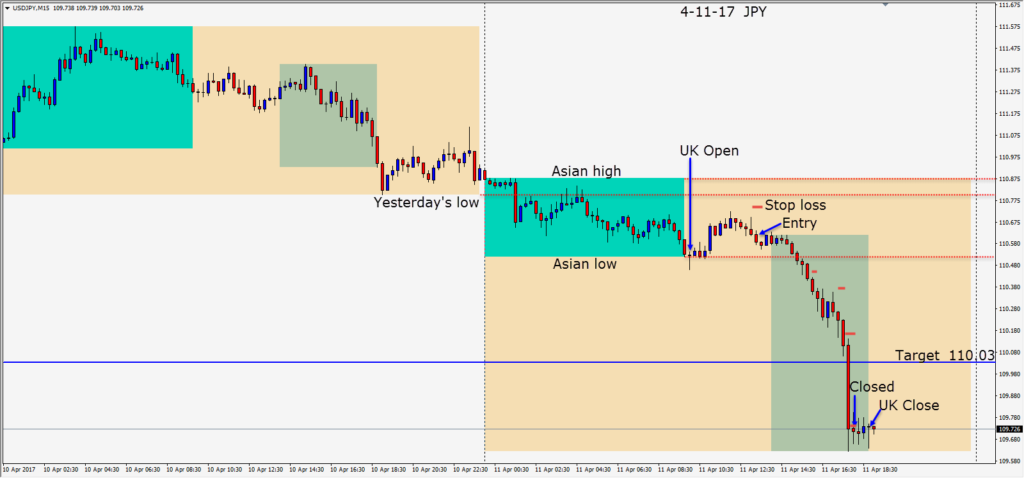

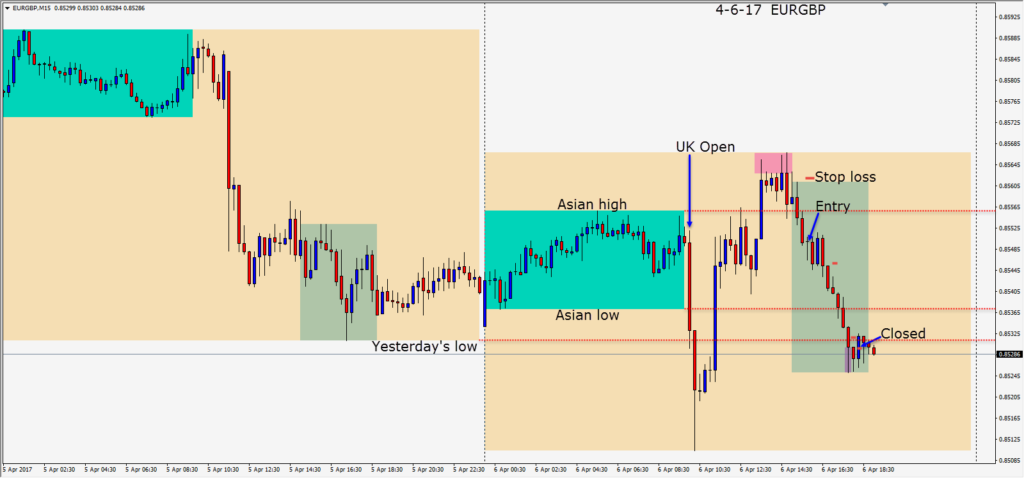

Since the first round of the French election results, the Euro has been bullish, but 110.00 will be very telling as will the ECB Press Conference on Thursday. During the U.S. session overlap a long trade was taken risking 16 pips for a potential 43 pips to our Daily Target.

Price moved up and we closed the trade as the U.K. session ended as it was close enough to our target that we didn’t want to give any back.

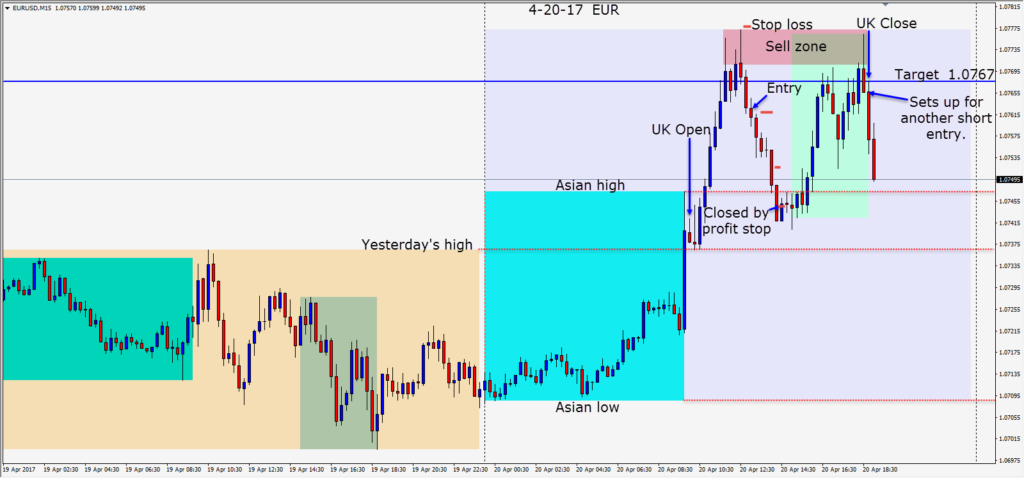

With a lot of the risk that was potentially associated with the outcome of the French election behind us the market has shifted its attention back to President Trump’s policies… especially around his proposed tax cuts.

Although the ECB Press Conference may not be too revealing of any interest rate hikes this year, Mario Draghi is quite capable of saying something that catches the market off-guard.

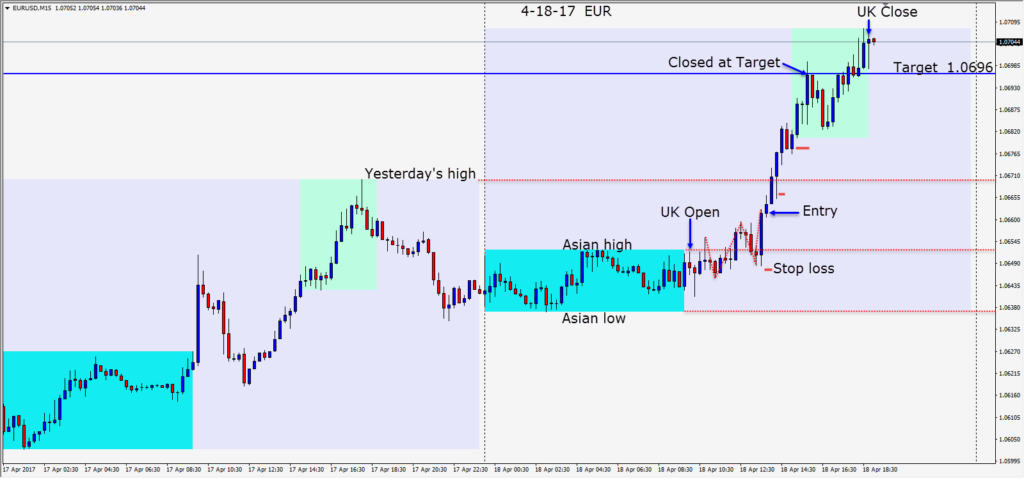

I will be keeping an eye on the EURUSD, EURJPY and EURGBP for trade setups tomorrow.

Good luck with your trading!