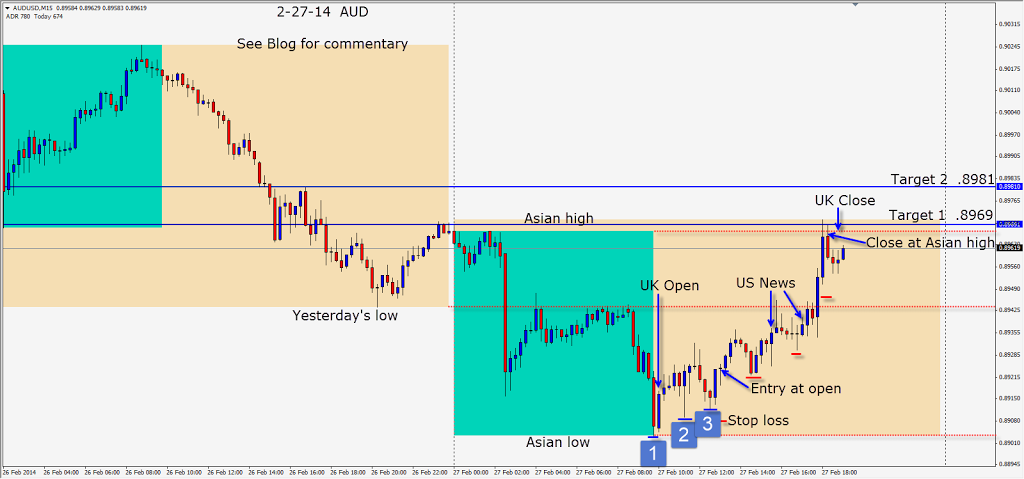

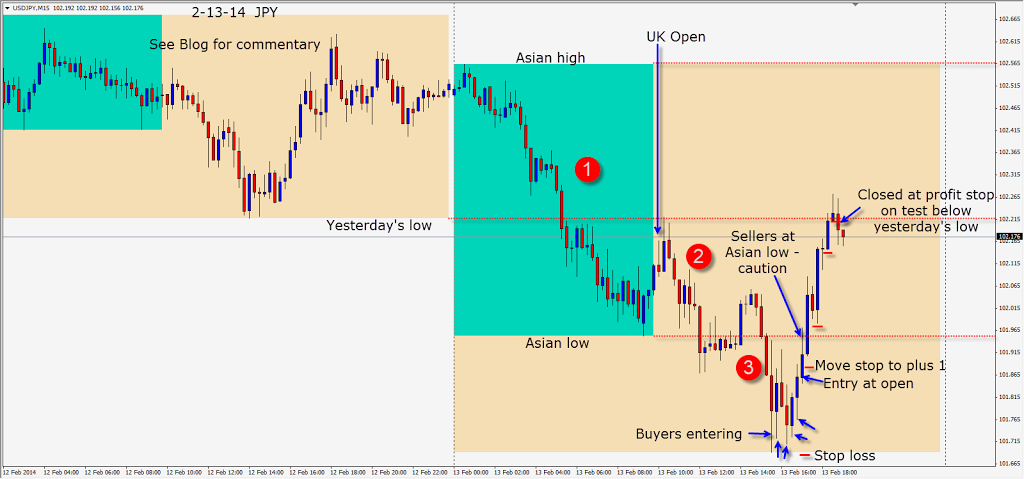

AUD sells off during Asian session and reverses its losses during the UK session.

This is one of my favourite trade setups. When the Asian session moves the AUD one way, the UK traders will very frequently reverse the move. The European traders (starting an hour before the UK traders) ran the stops of the Asian traders creating the low of the day. The London traders seeing the pair has run its range reverse the move and start running stops on the European traders.

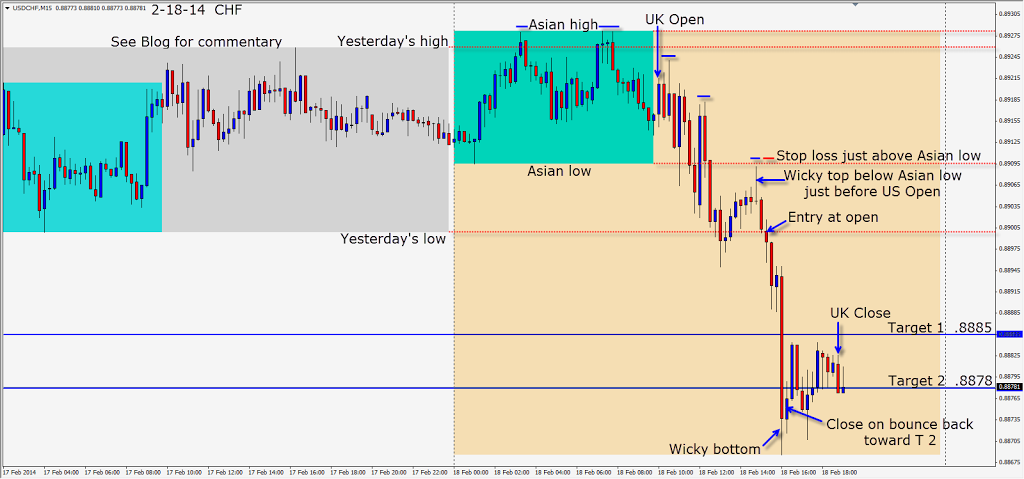

By following the UK traders once price indicates their intention, (not guessing) with an affordable stop loss, the question is how profitable will the trade be before the US news which is in 2 rounds today? We tighten our stop loss in advance of the news – US Employment numbers are always scrutinized and the market tends to be very reactive to surprises.

Although we use our Target 2 for the R:R ratio, in trading this pattern we are hoping to get to the Asian session high – not necessarily to our T1 and T2. There’s an old Wall Street adage -“pigs get fat but hogs get slaughtered”. If the candles indicate there is momentum above the Asian high – wonderful – lock in more profit…but it doesn’t usually with this pattern, so don’t be greedy – read price!

Good luck with your trading!

Back tomorrow if we find a trade. By the way, I have a former student who did a lot better than me yesterday by shorting the EUR after the triple top…while I was focused on the GBP short.