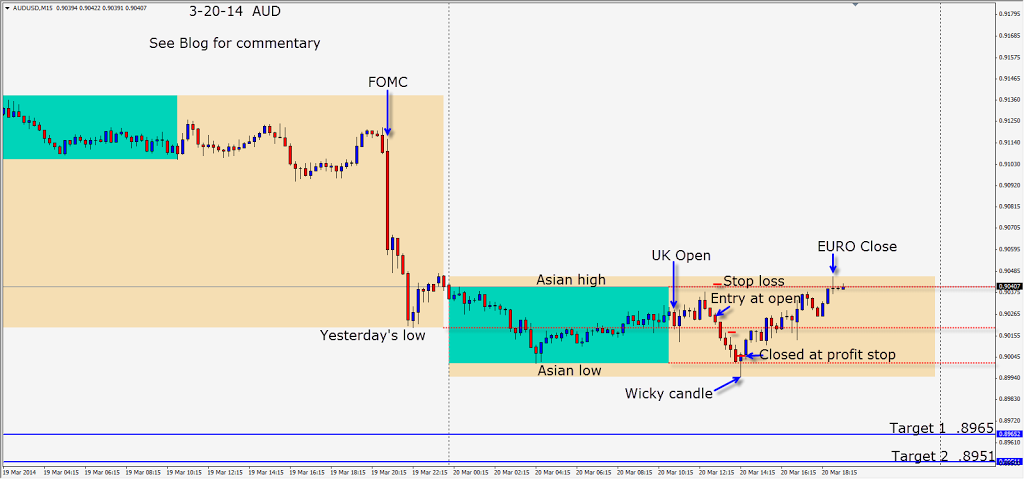

Fed Chair Yellen surprised the market with a unexpected hawkish stance suggesting that rates may rise in the spring of 2015. For now, leaving interest rates and tapering unchanged but projecting unemployment rates to drop by the end of this year. Big moves followed as the USD strengthened after her comments.

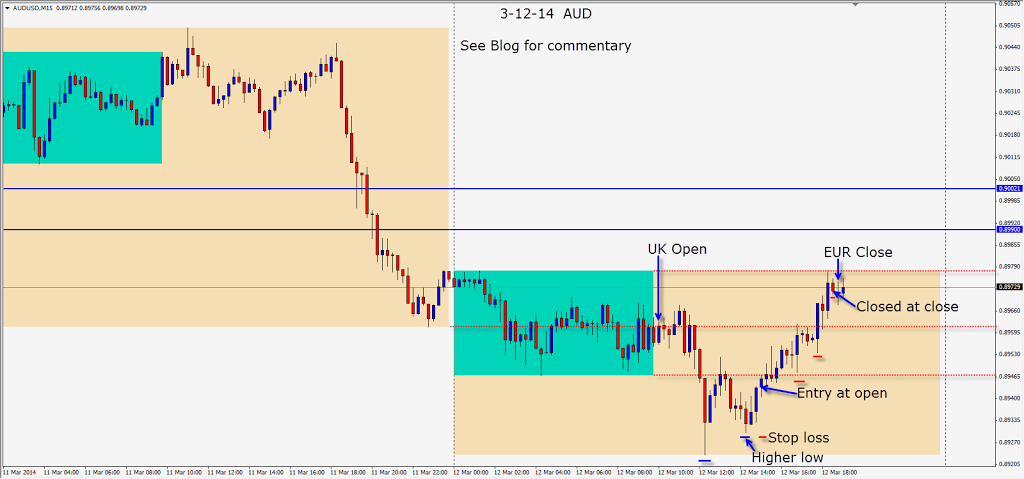

During the UK session as the EUR and GBP weakened, we chose a pair with a more affordable stop loss and enter the AUD short. The pair moves down to its Asian session low and bounces – closing the trade for a modest gain.

Good luck with your trading!

Back tomorrow if we find a trade.