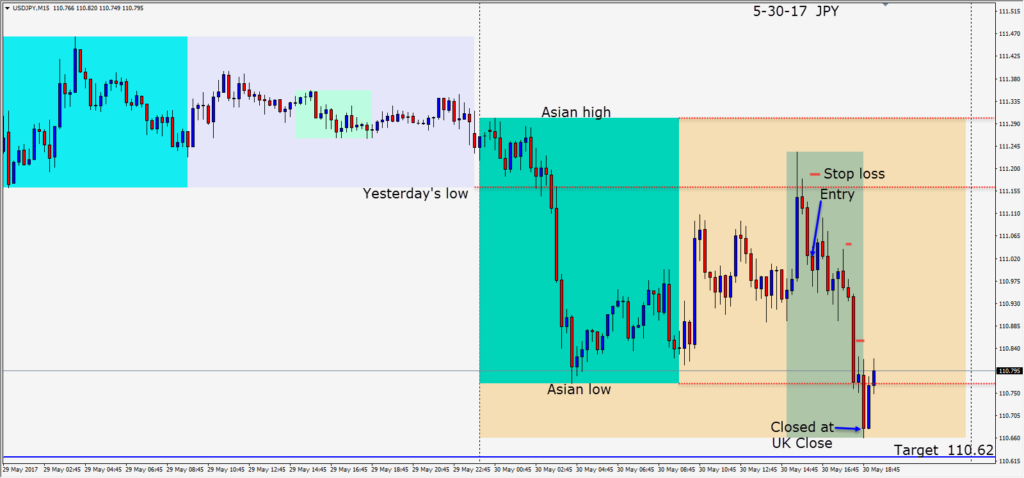

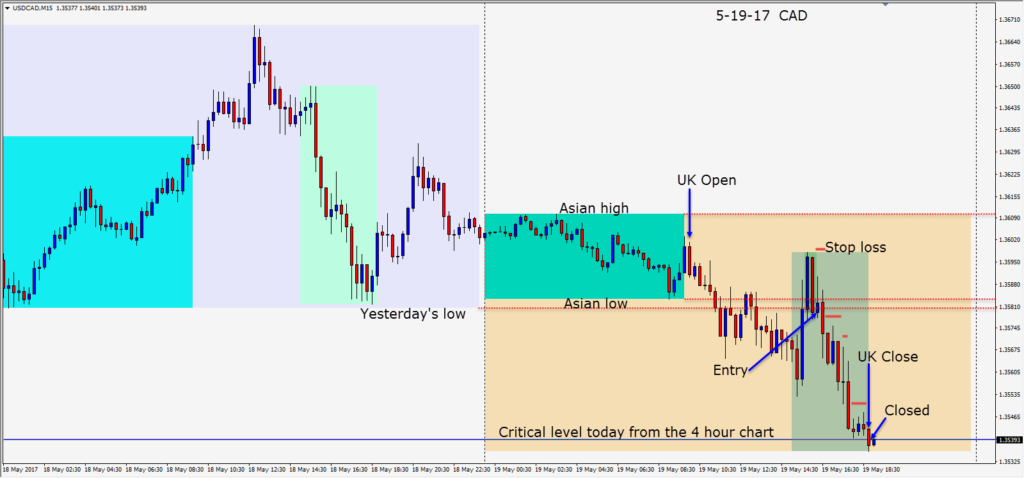

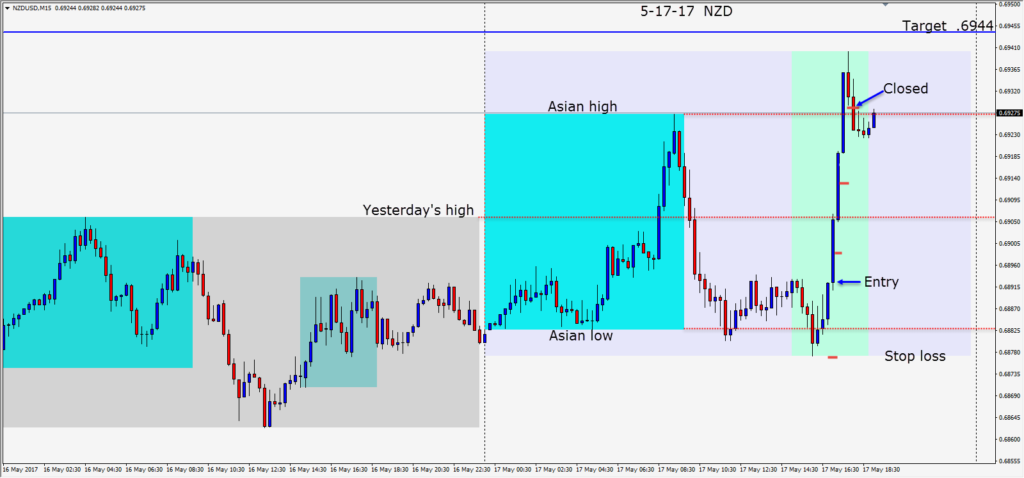

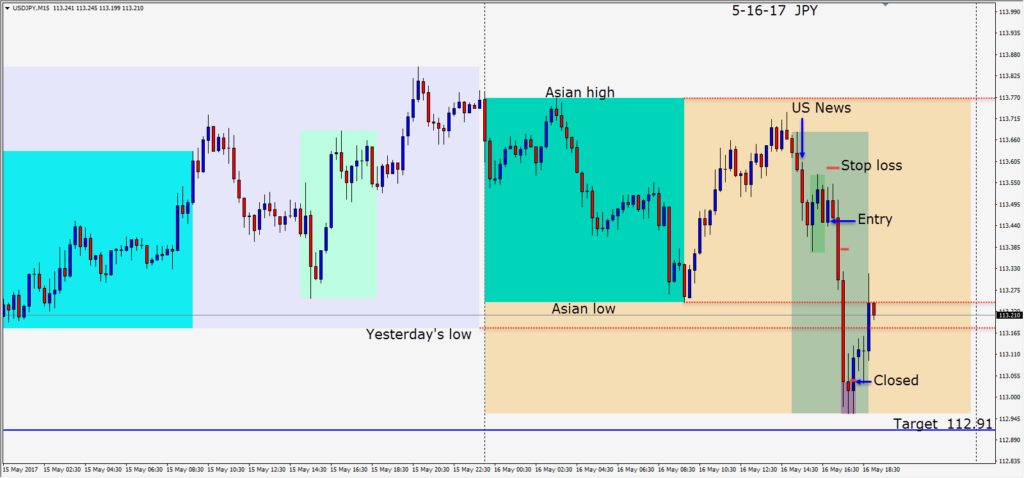

As the USD came under pressure today, the USDJPY set up first among the majors. The commodity pairs followed after the CB Consumer Confidence release.

The GBPUSD continues to be vulnerable as the June 9th election looms. A possible fall election in Italy may be keeping some pressure on the EURUSD today as we approach month end.

Good luck with your trading!