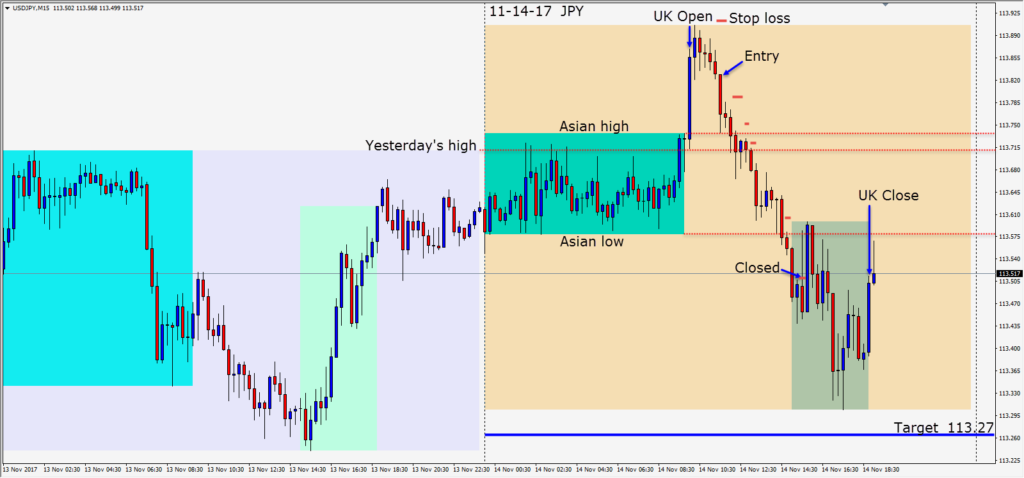

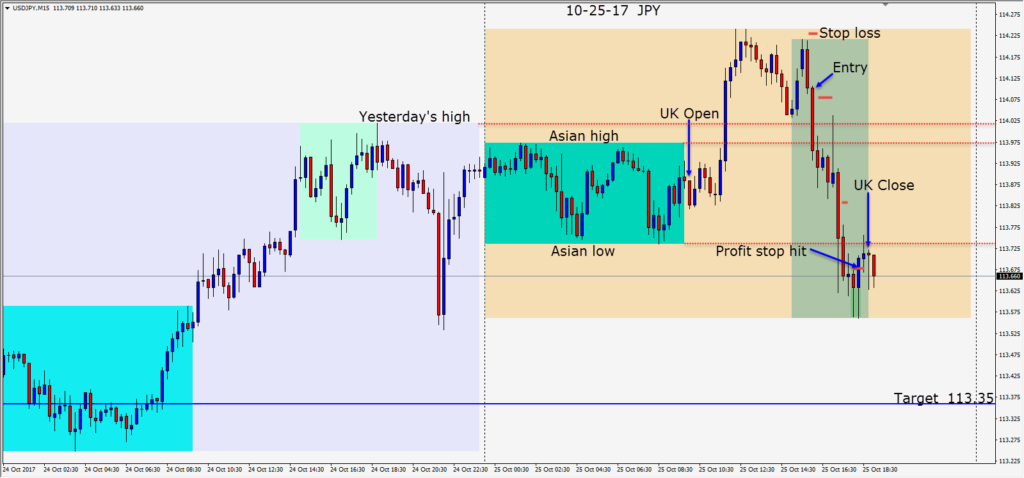

A USDJPY short set up today as politics continue to slow down the U.S. tax reform proposal. An entry short was taken risking 9 pips for a potential 56 pips to our daily target.

Price moved down testing its Asian high, then yesterday’s high, before descending to test and retest its Asian low. Price then continued lower at the U.S. open but reversed and closed our trade – hitting our profit stop before making another wave lower.

Wednesday brings numerous economic releases… so be aware of the potential volatility around them and trade accordingly.

Good luck with your trading!