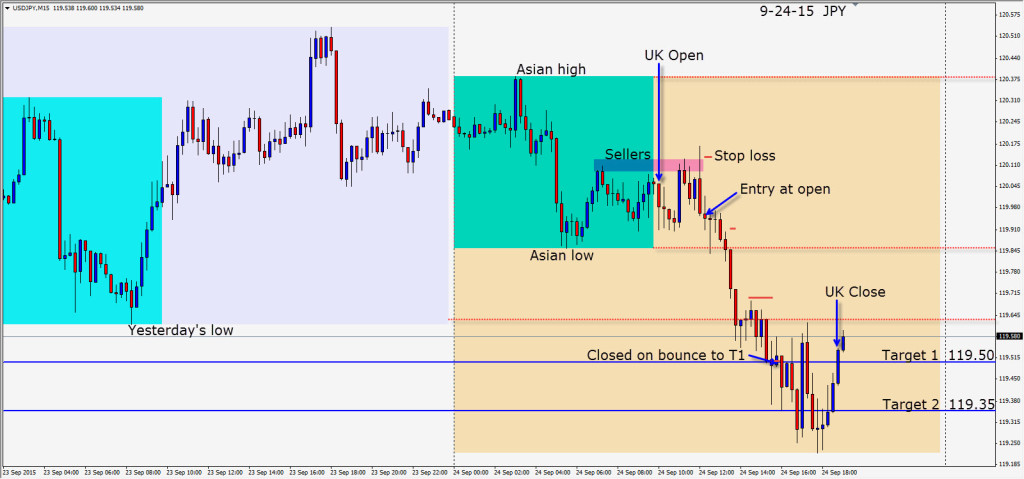

As Japan’s markets re-open after the silver week holidays, the Nikkei sells off 2.76%. This translates to sell the USDJPY coupled with a bit of mid-week reversal today overall in the majors.

Sellers of the USDJPY were entering around the 120.00 big figure today. We found a decidedly bearish candle and entered short with a 17 pip stop loss in the sell zone above 120.00…for a potential 61 pips to our Target 2.

Price moves down to the Asian session lows, before testing and retesting the level. It then moved down to yesterday’s lows to test the level before descending to our Target 1. Buyers began to enter below our T 1 and we took that as a signal to exit at 119.50.

Janet Yellen speaks later today. Final GDP q/q is the early U.S. session focus for tomorrow.

Good luck with your trading!

Back tomorrow if we find a trade.