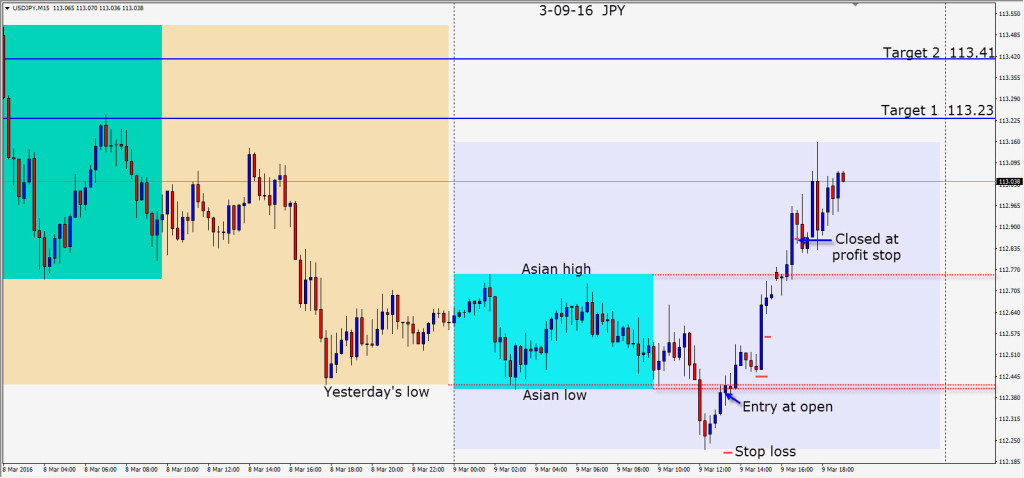

The USDJPY had fairly subdued trading during the Asian part of the session before selling off early in the UK session. As it reversed at a favourite time of the day, we entered long risking 19 pips for a potential 102 pips to our Target 2. Price moved up to test the Asian session low, then began to climb higher as soon as the US session began. As price continued higher, we locked in profits and got closed on the first pullback to our profit stop.

Tomorrow we have Mario Draghi and the ECB press conference and the US unemployment claims.

Good luck with your trading!