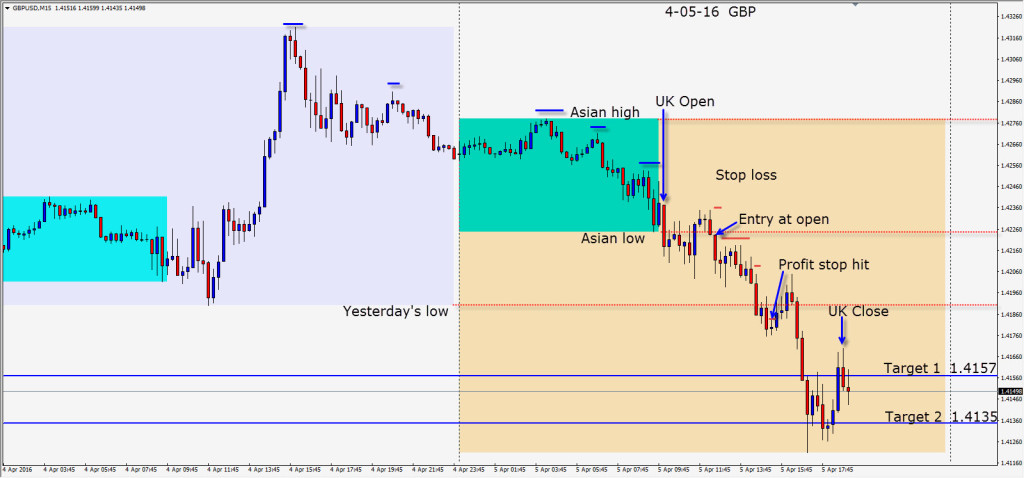

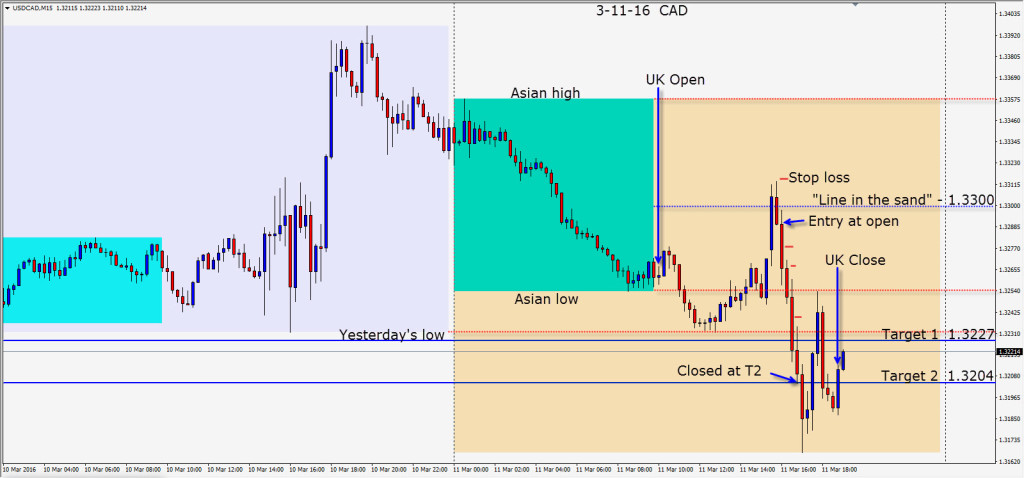

The GBP made a series of lower highs and as it tried and failed to move higher into its Asian range… a short is taken…risking 15 pips for a potential 87 pips to our Target 2.

Price moved down…went sideways and made another move down just as the U.S. traders began. The next candle tagged our profit stop and we were closed just under yesterday’s low – missing the last wave down.

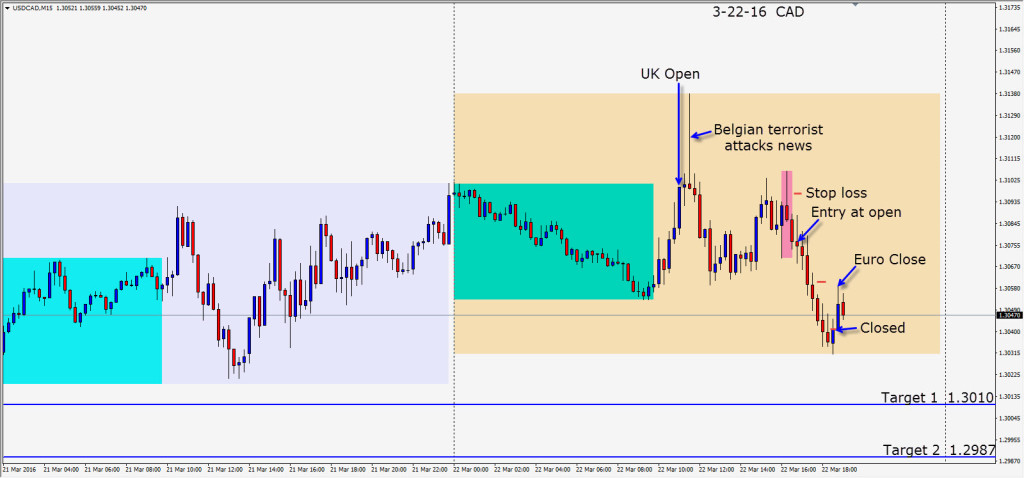

Tomorrow we have crude oil inventories which will affect the CAD pairs. WTI is weak again but $35 is still holding so far…

Good luck with your trading!