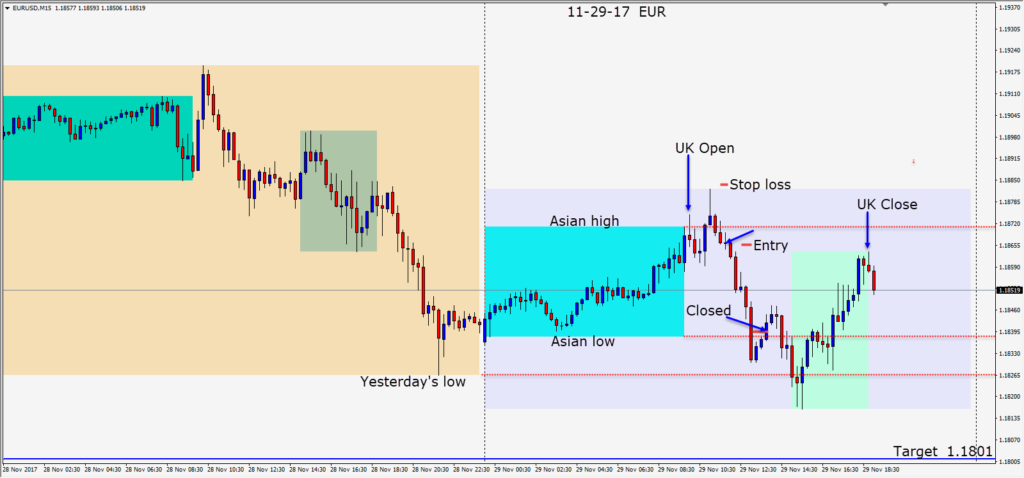

The EURUSD started the U.K. session selling off to test yesterday’s low in advance of the CPI Flash Estimate y/y release, then it clearly found buyers and started to move upward. An entry long was taken…risking 15 pips for a potential 45 pips to our daily target. Price continued upward and once it cleared its Asian range and yesterday’s high… it continued higher with momentum. As price had exceeded our daily target and each candle continued to close bullishly higher, we kept moving our profit stop approximately halfway of each closed candle – until the market took us out of the trade.

Unless the U.S. tax reform bill is passed the USD bulls are finding little to entice them. Even President Trump’s appointment of Marvin Goodfriend to the Fed Board of Governors didn’t impact the USD today. With continued inflation optimism in Europe and Great Britain making headway with the Brexit divorce this week, the Euro and Sterling have more appeal currently than the USD. The EURGBP pair is currently testing an important level on the Daily chart and it will be very bearish if it gives way.

Good luck with your trading!