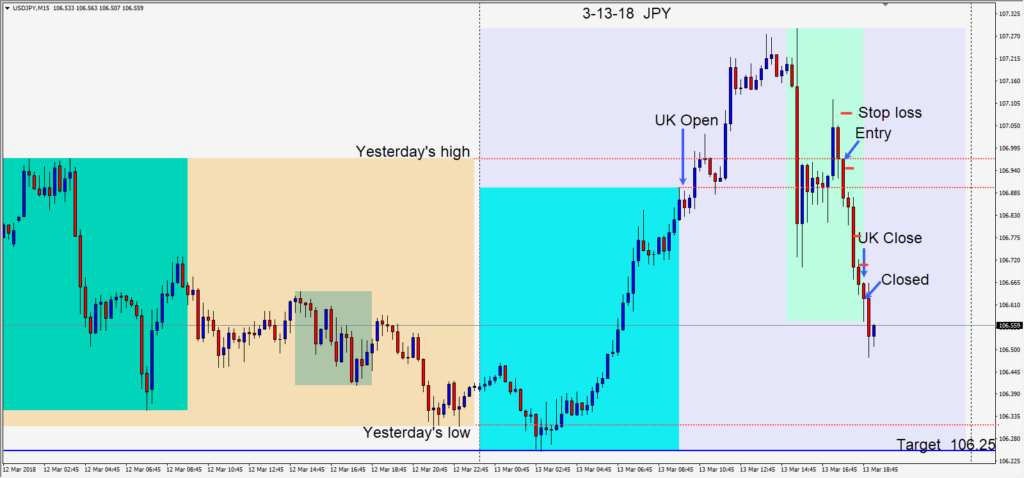

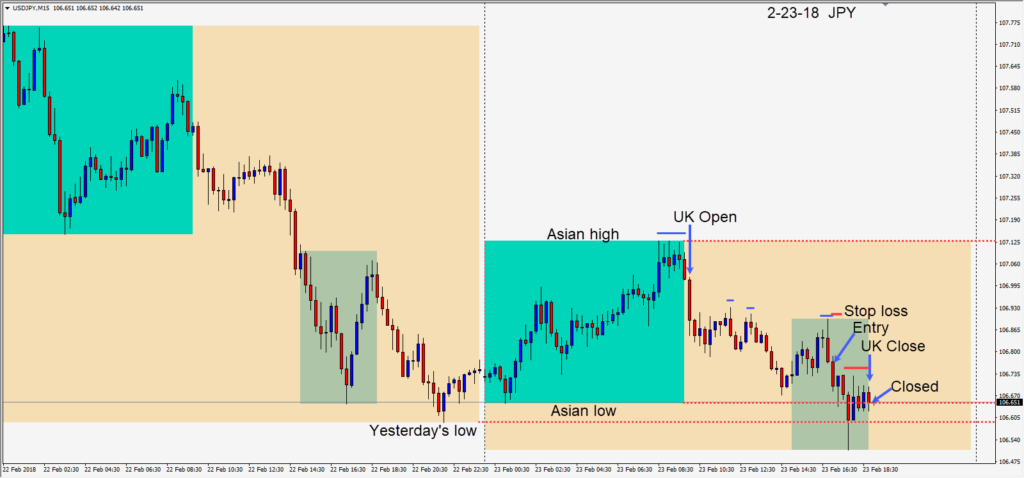

With scandals and politics in both the U.S. and Japan today, the USD came under pressure and we took advantage of a short setup late session. After a very strong day for the USDJPY during the Asian and first half of the U.K. session, it began to unravel as the U.S. session got underway. After a brief move up, the pair reversed downward and we risked 12 pips for a potential 72 pips to our downside target (106.25). With a lower high in place, we went short and rode price lower…closing the trade at the London close.

The idea was to go short using a small stop loss due to the limited time left in the session and also to get the risk out of the trade as soon as possible…locking in profit as the trade progressed downward.

On a fundamental basis, the USD looks poised to strengthen with interest rate hikes beginning next week and a potentially more conciliatory North Korea. Also, with some of the changes in the White House, will oil begin to move up?

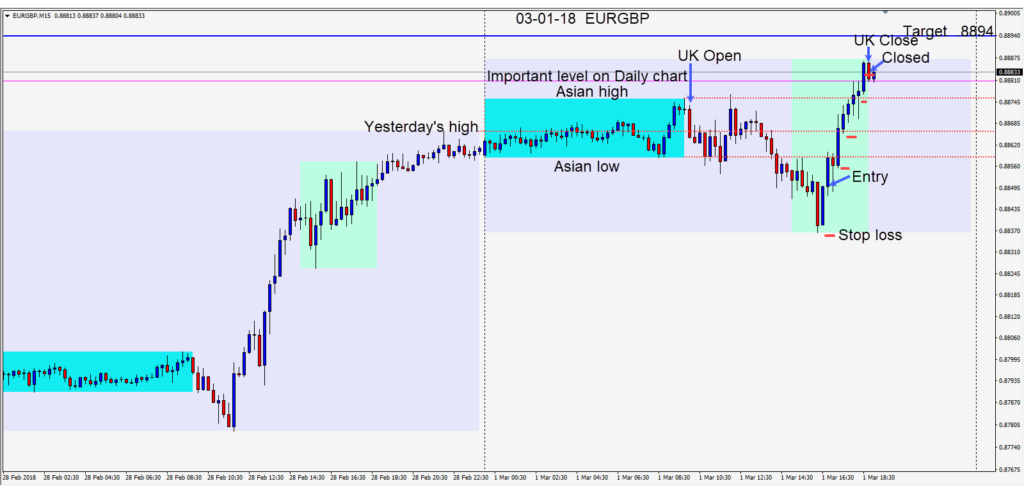

We have a very active markets at the moment. I’m beginning to hear more and more traders talking about how profitable February and March have been for them.

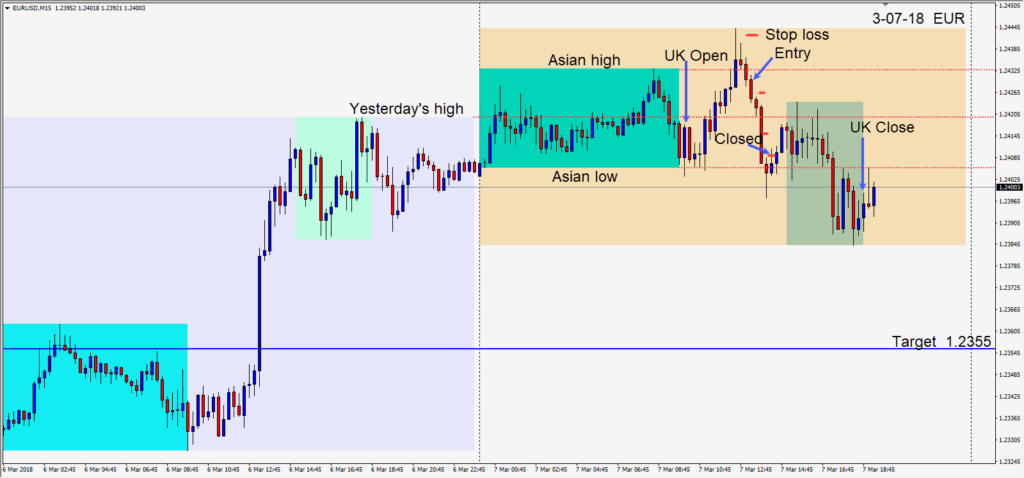

On Wednesday, ECB President Draghi will be speaking followed by a number of U.S. economic news releases.

Good luck with your trading!