A stronger USD this week and a particularly strong USD today.

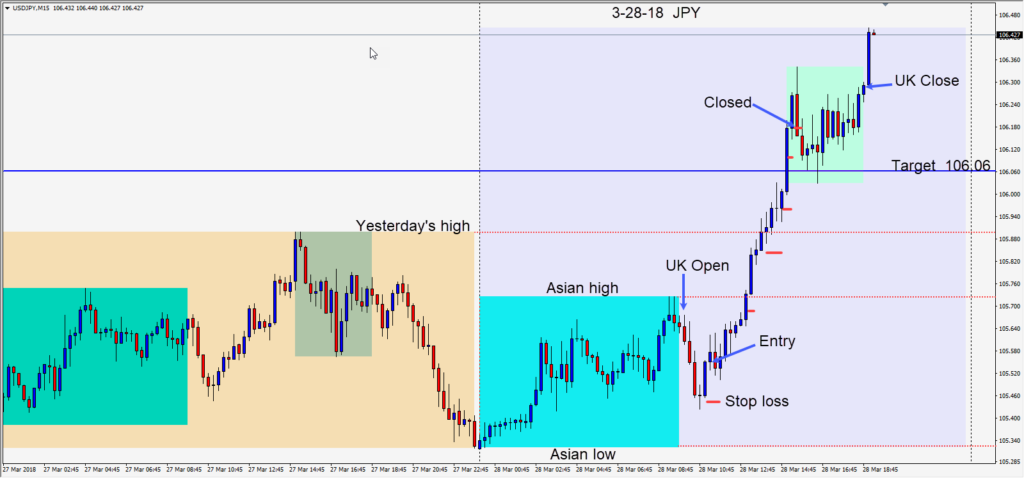

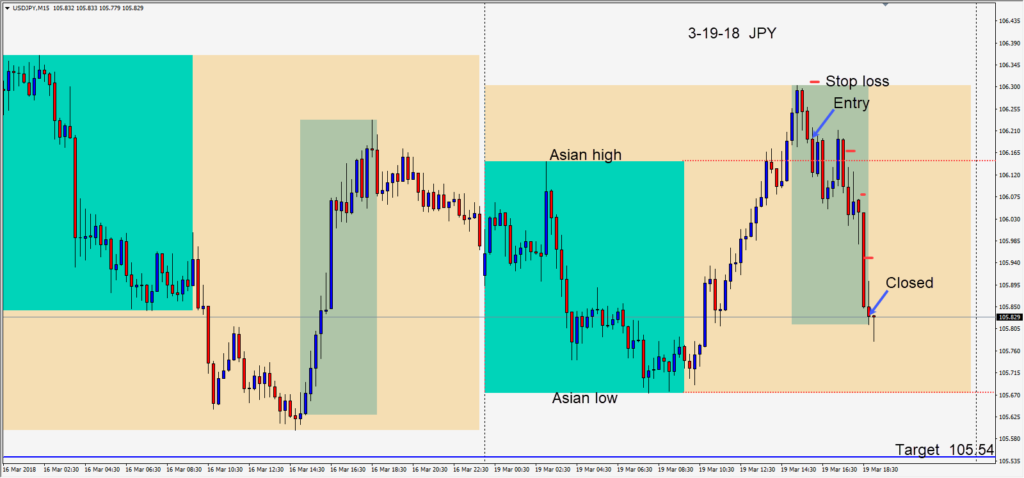

After the U.K. session got underway the USDJPY moved down and made a reversal pattern. A long was taken risking 15 pips for a potential 51 pips to our daily target at 106.06.

Price moved up to its Asian session high and higher into the U.S. session opening…moving beyond our daily target. We moved our profit stop higher and price began to pull back taking us out of the trade.

The markets continue to be very active. Tomorrow will be the last trading day of the month and first quarter.

I will be off on vacation until mid April. If there is anything urgent, I will have a computer with me but my response time may be slower than usual.

Good luck with your trading!