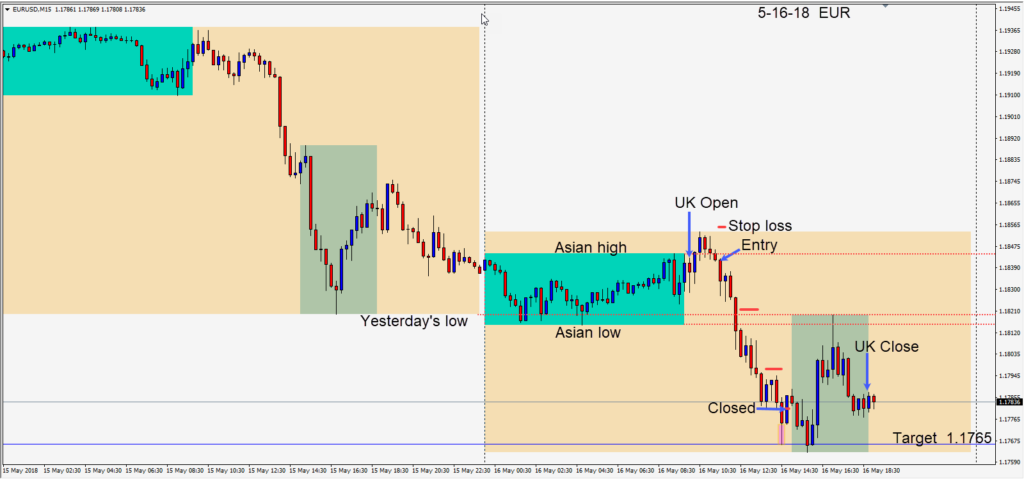

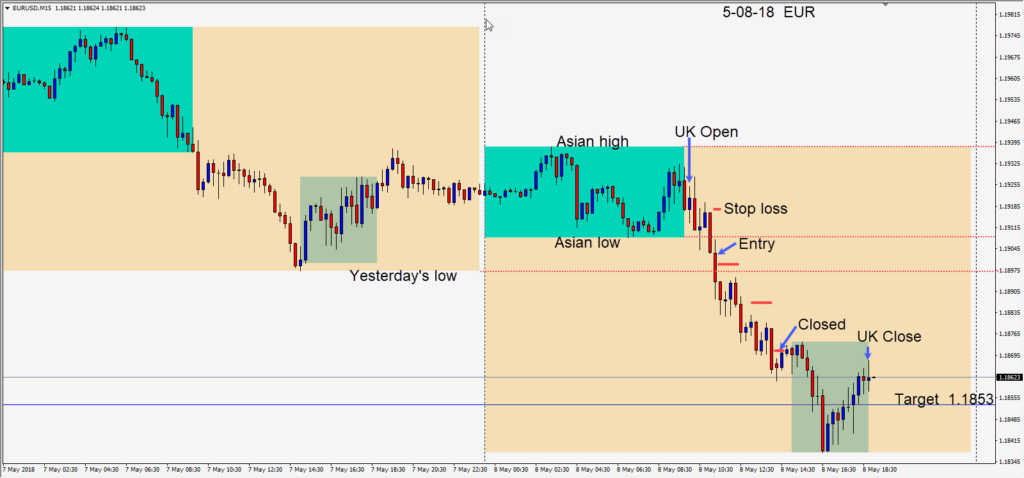

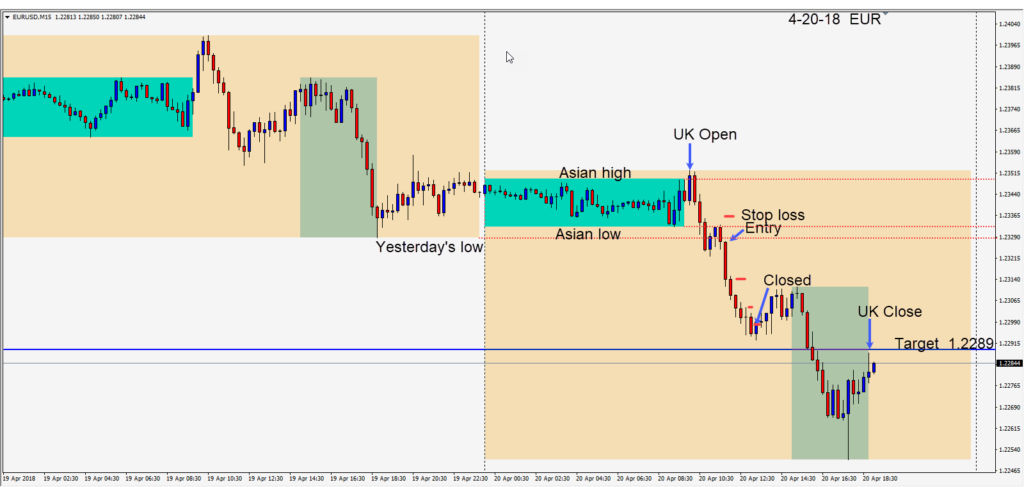

As mentioned a couple of week’s ago, our bias is to trade the EURUSD short… with the trend. It broke a very important technical level and we will continue to evaluate it daily for entry setups. On Wednesday after the U.K. open, the pair failed to stay above its Asian session high and an entry short was taken risking 14 pips for a potential 76 pips to our daily target. Price moved lower and bounced just above our target at 1.1765 leaving a long lower wick. We tightened our profit stop and price moved higher just before the U.S. open closing our trade.

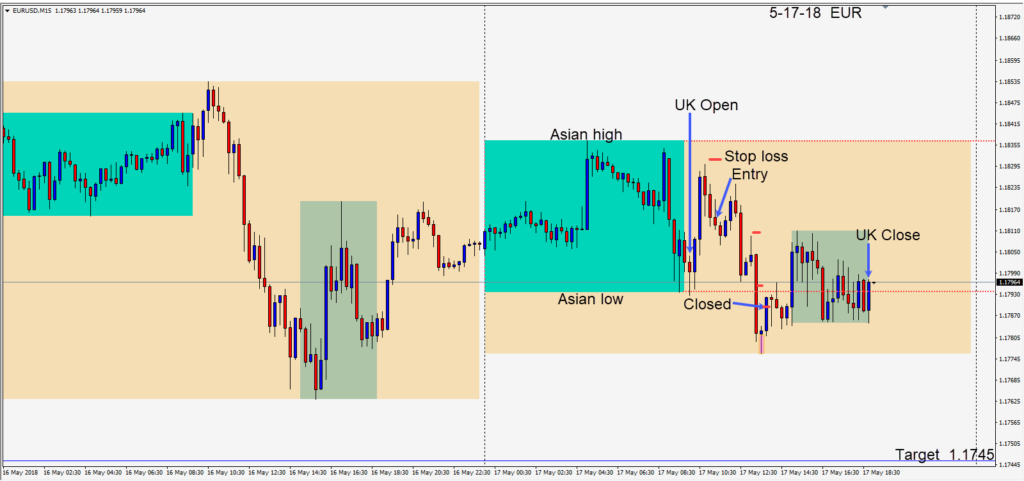

On Thursday, the EURUSD tested its Asian session low at the U.K. open and moved higher. After making a third lower high for the day, we found an entry short (with trend) risking 17 pips for a potential 69 pips to our daily target. Price moved lower then briefly retraced… making a fourth lower high for the day…moved lower again and found buyers just above its Asian session low. It then pulled back for 2 candles leaving a long upper wick before plunging lower. We moved our profit stop down to allow for a retest of the Asian session low. A long lower wick indicated that buyers were entering and we closed our trade on the following candle…giving back more than we wanted to of the move.

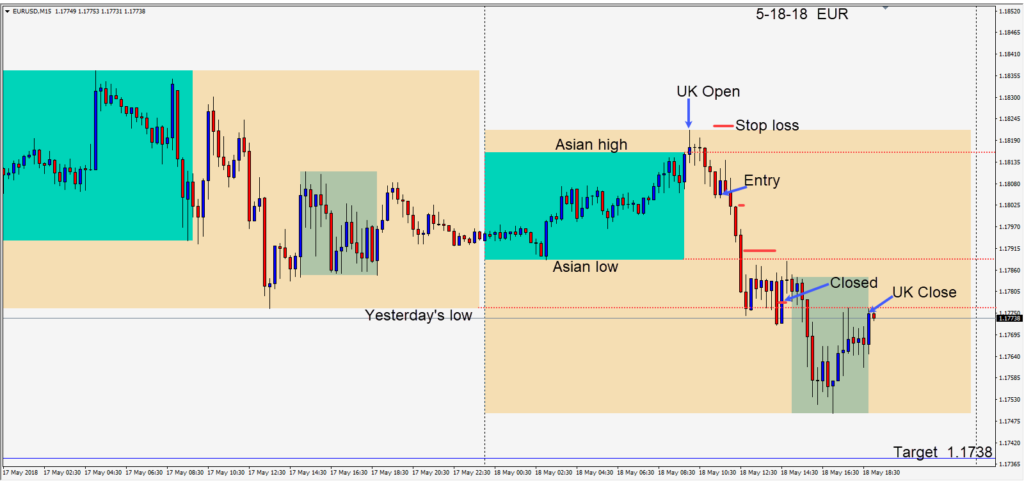

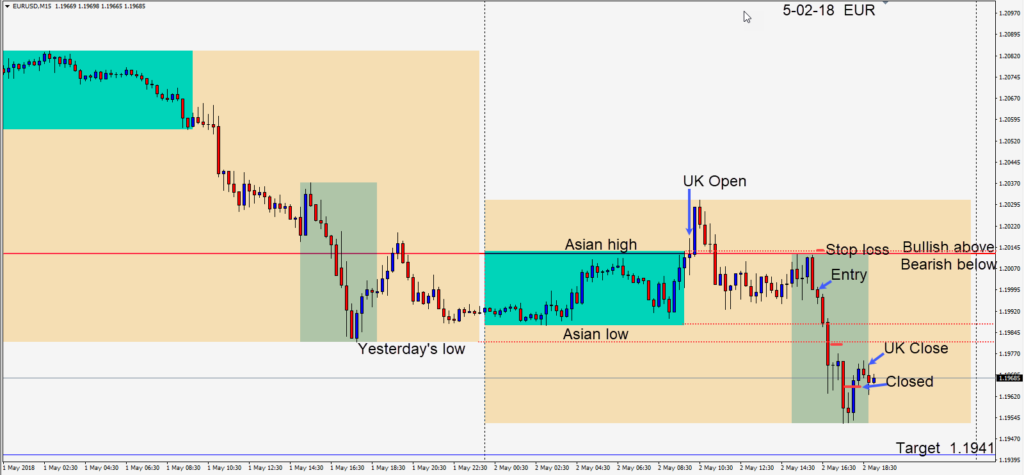

On Friday the EURUSD began to move very similarly to Wednesday. It poked above its Asian session high and moved lower. When price moved down and closed bearishly near its low, we entered short (with trend) risking 18 pips for a potential 67 pips to our daily target at 1.1738. Price moved lower, then plunged through its Asian session low testing the previous day’s low. We moved our profit stop down to allow for a retest of the Asian session low. From there price went sideways… before finally closing below yesterday’s low. We moved our profit stop lower to allow for a retest and we were closed the following candle.

This has been a great week to trade. Looking forward to what next week brings us.

Enjoy your weekend!