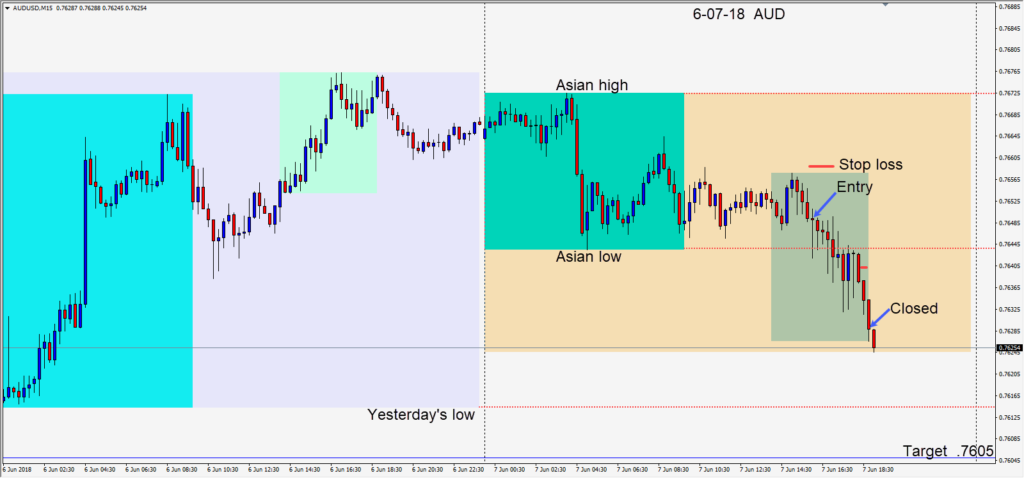

As the U.S. session got underway on Thursday, the AUDUSD began to roll over and a short was taken risking 10 pips for a potential 44 pips to our daily target at .7605. The trade inched lower slowly and we exited at the U.K. close.

Trade tariff implications remain the subject of concern and discussion this week. The G7 meetings will be interesting, but may not be overly productive in changing President Trump’s perspective.

This week did not have a lot of economic news drivers for the market…the calm before the storm. Next week is going to be exciting and hopefully some trades will set up for us. The Trump-Kim meeting in Singapore on Tuesday, is followed by FOMC on Wednesday, ECB on Thursday and BOJ to complete the week.

Good luck with your trading and enjoy your weekend.