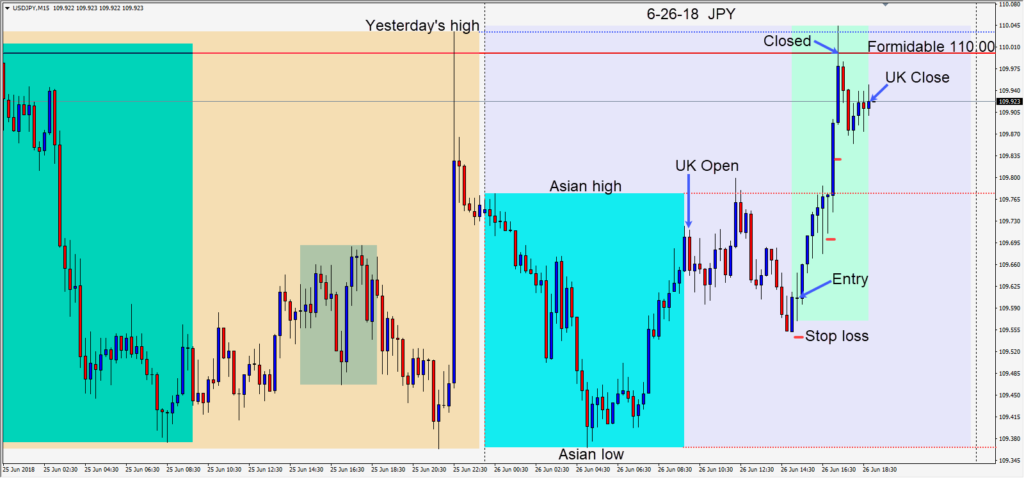

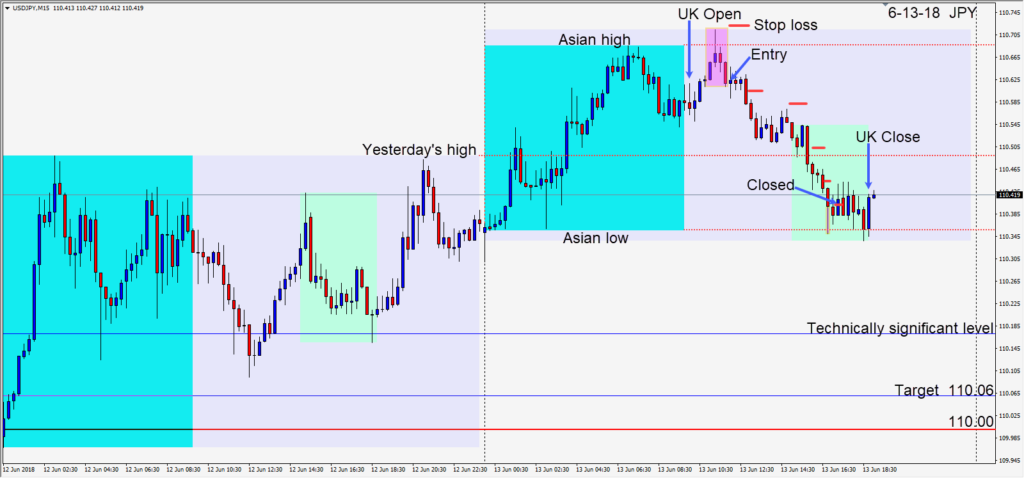

The USD showed moderate strength today and stock markets attempted to climb higher after yesterday’s sell off. With a stronger USD, and a moderate appetite for risk, a long was taken on the USDJPY risking 7 pips for a potential 40 pips to the formidable 110.00 barrier – as mentioned before.

Price moved up to its Asian session high and paused before moving sharply higher but was unable to close above 110.00

Until the U.S. trade tariffs show signs of getting sorted out, it may be difficult for the USDJPY to sustain itself above 110.00.

Good luck with your trading!