Expect volatility this week as it’s month end and quarter end.

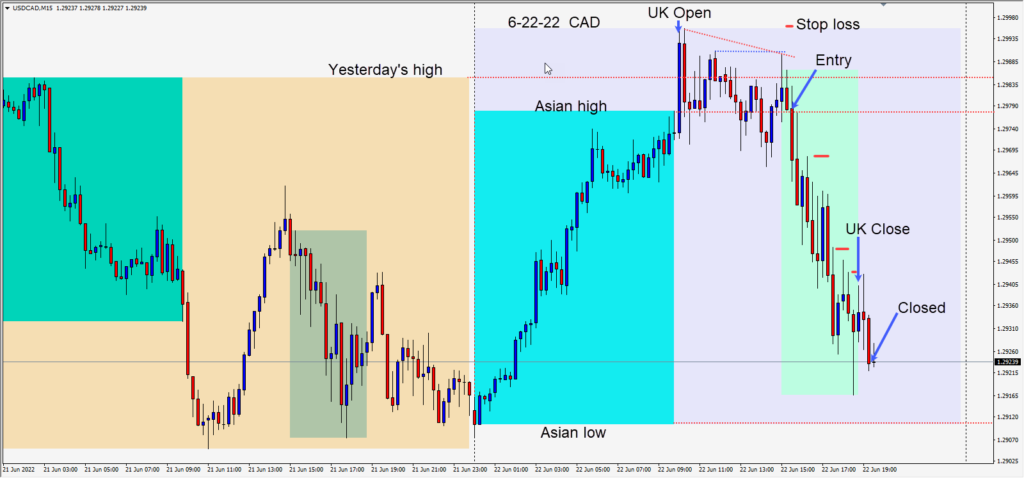

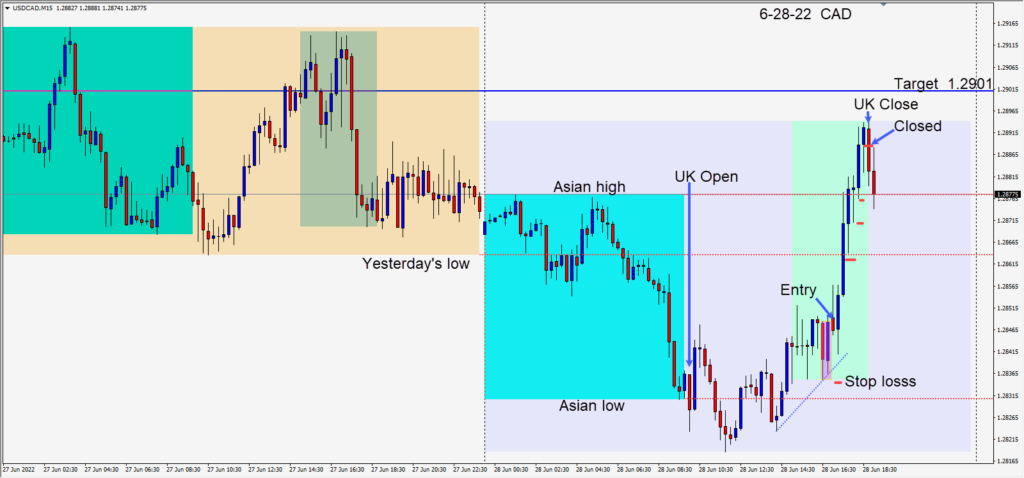

Today as the USD moved higher the USDCAD tested and retested it U.S. session lows then moved higher. A long was taken risking 14 pips for a potential 52 pips to our daily target at 1.2901. The Asian session high and another technical level near 1.2880 slowed the move higher going into the European close, but price was able to rise further as the U.K. close drew nearer.

Tomorrow we will hear from three central banks – the U.S. Fed, ECB and the BoE.

Good luck with your trading!