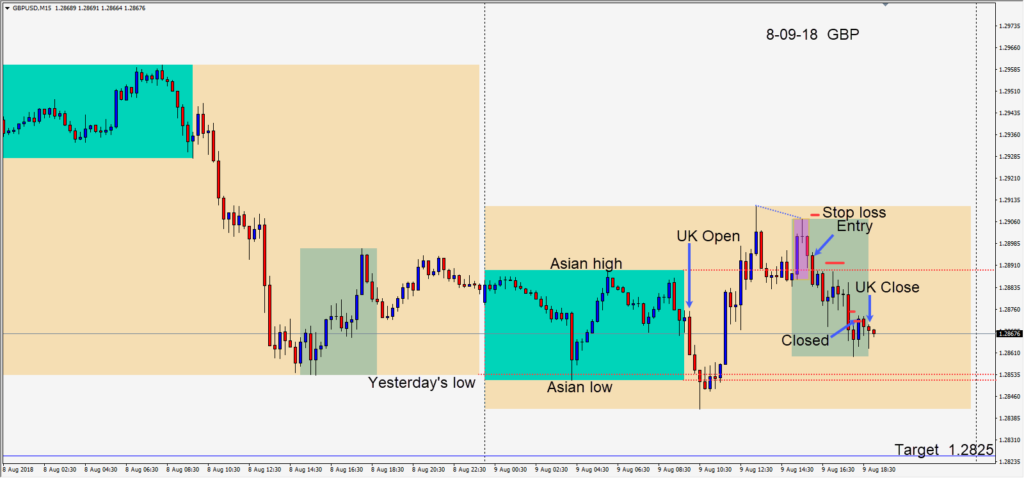

After 2 days of being basically flat the USD moved higher today. The GBPUSD continued to trend downward and a nice short setup occurred early in the U.S. session. Risking 15 pips for a potential 68 pips to our daily target at 1.2825 we entered short after a 3 candle reversal pattern. Price moved lower and as a long lower wick appeared just after the European close, we tightened our profit stop and the trade was closed.

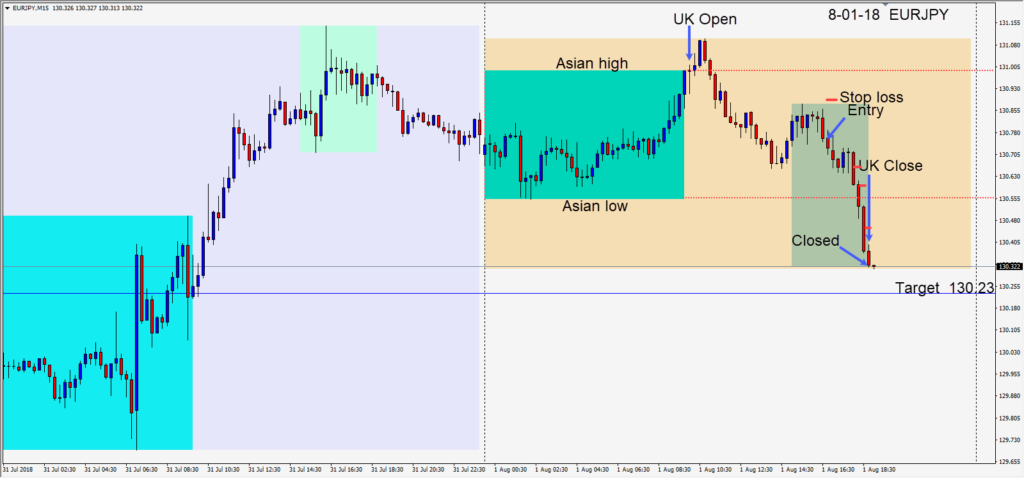

Although the USD was relatively strong today, money flows were toward safety as the USDJPY moved down, as did the U.S. 10 year yield.

A number of economic news releases are scheduled on Friday for Britain, Canada and the U.S.

Good luck with your trading!