The market is moving the right direction but it was a little difficult for me to find entries today.

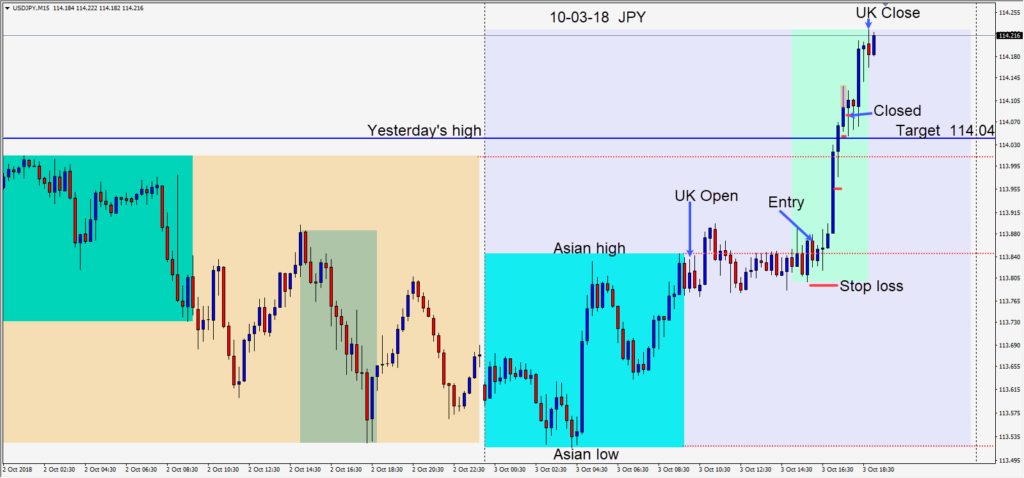

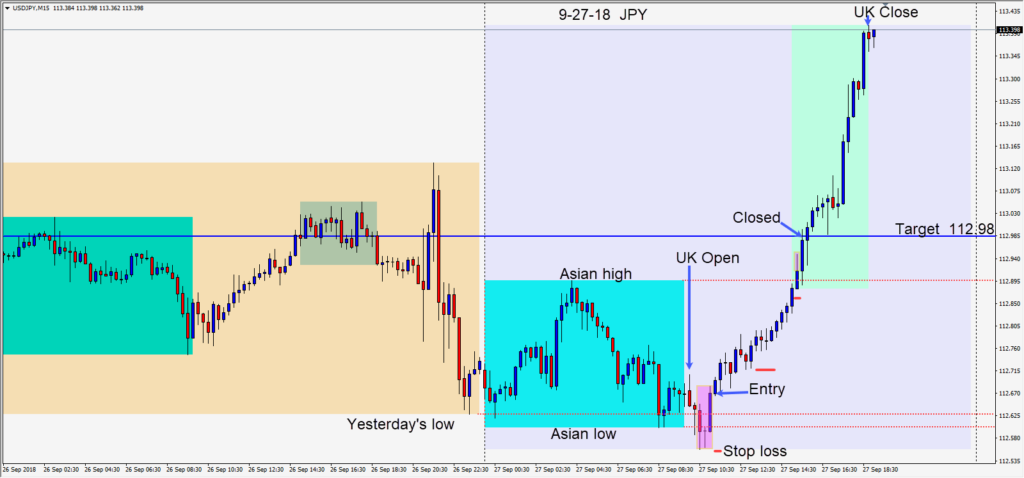

After the U.S. session got underway, the USDJPY setup for a trade risking 8 pips for a potential 18 pips to our daily target at 114.04

The good news is the trade ran past our target and we managed to get an extra couple of pips. As price was testing the 114.00 figure, we were cautious as this trade appeared to be quite limited. The bad news is the trade took off after we exited.

Let’s hope tomorrow is more rewarding.

Good luck with your trading!