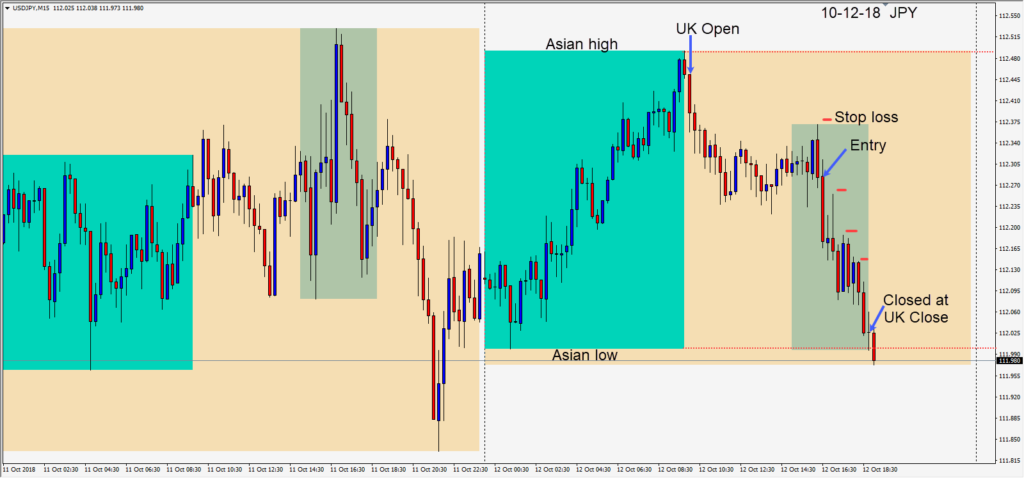

When the markets are anxious “risk off sentiment” money flows tend to move toward the yen, Swiss franc and gold. Equity markets can be seen as an indicator of fear and greed. The U.S. equity markets sold off on Wednesday erasing gains for 2018. On Thursday the markets rebounded and closing higher and recovering Wednesday’s losses. On Friday, the equity markets moved down again sharply as the U.S. session got underway.

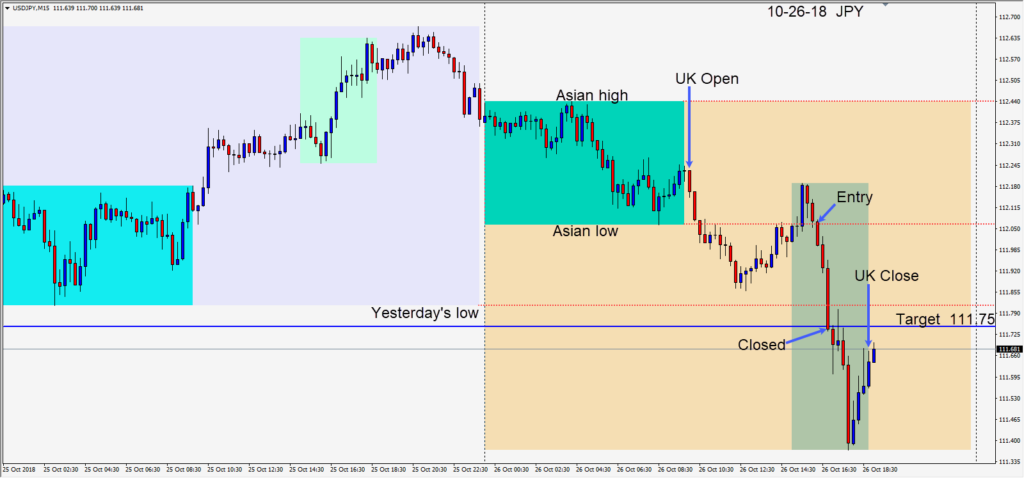

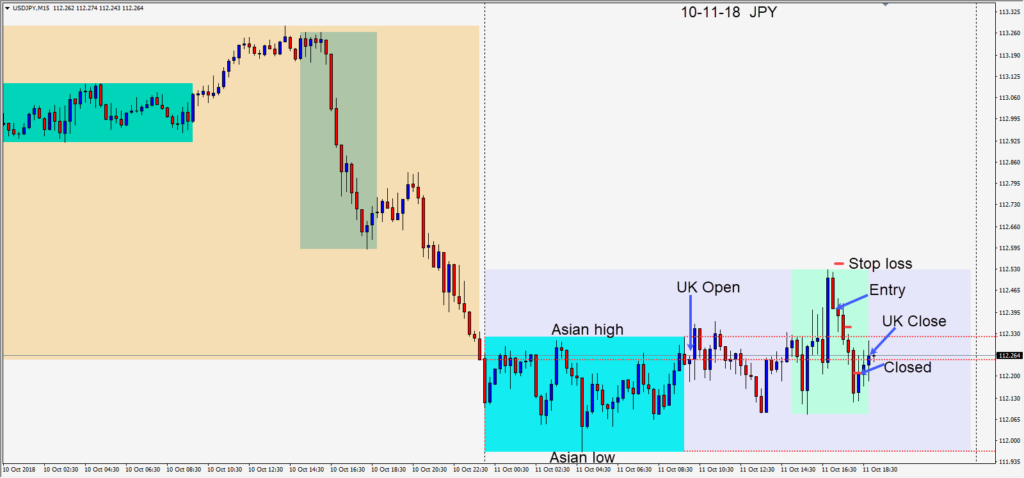

As price made a lower high early in the U.S. session, a short was taken in the USDJPY risking 13 pips for a potential 32 pips to our daily target at 111.75. Price moved down to our target and we closed the trade. Price gained further downside momentum and continued lower without us. As the U.S. equity markets began to pare some of their losses intraday, the pair reversed higher. The majors made uniformed moves today and the USD has been weaker once again.

I’m curious as to whether the U.S. equity markets can recover to close positively today to end the week. If not, next week may start off ugly with negative sentiment and continued selling.

Good luck with your trading and enjoy your weekend!