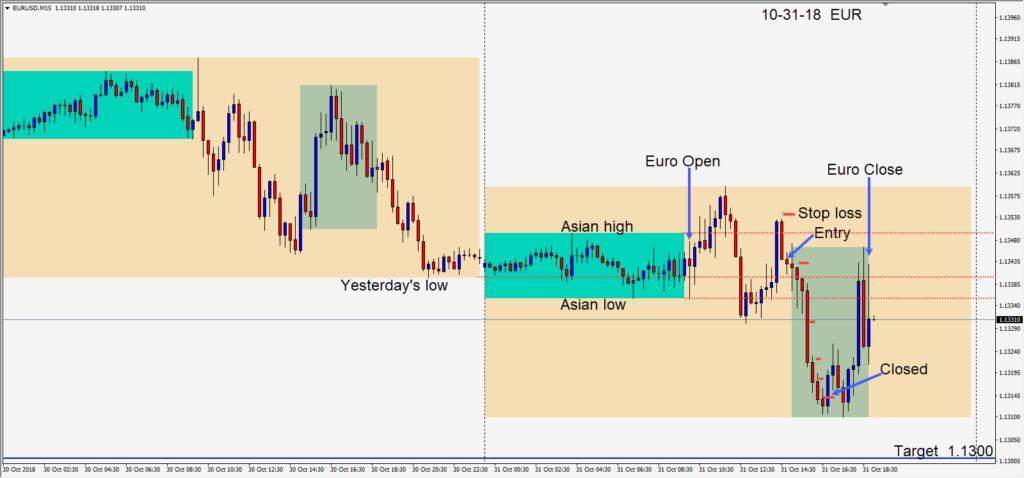

There was not a lot to glean from the FOMC statement yesterday. The market continues to expect a rate hike in December and likely 2 more rate hikes in 2019. Whether or not the U.S. economy has peaked or not, it continues to be strong and the USD continues to attract buyers. As the markets adjust to the mid-term election results implications and the latest statement from the FED, an air of caution was apparent today with the move down in equity markets and the U.S. 10 year yield declining.

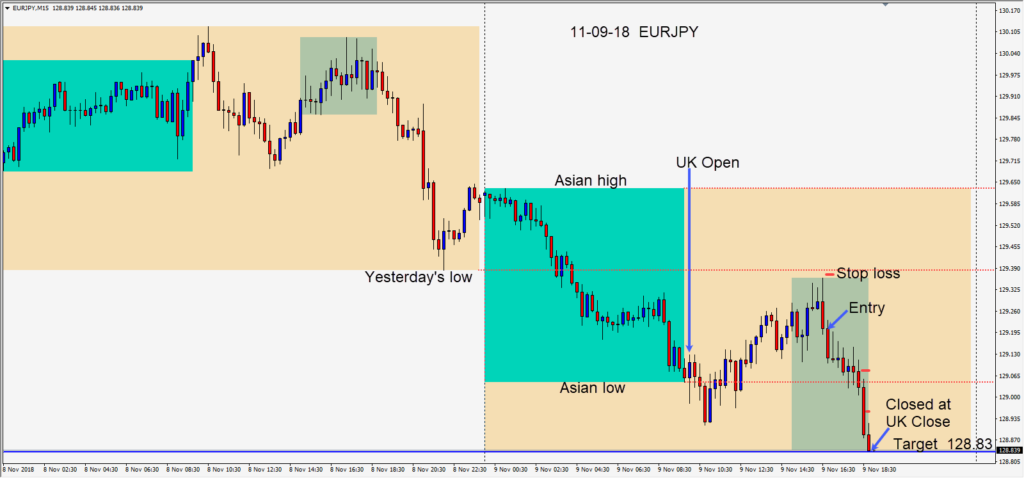

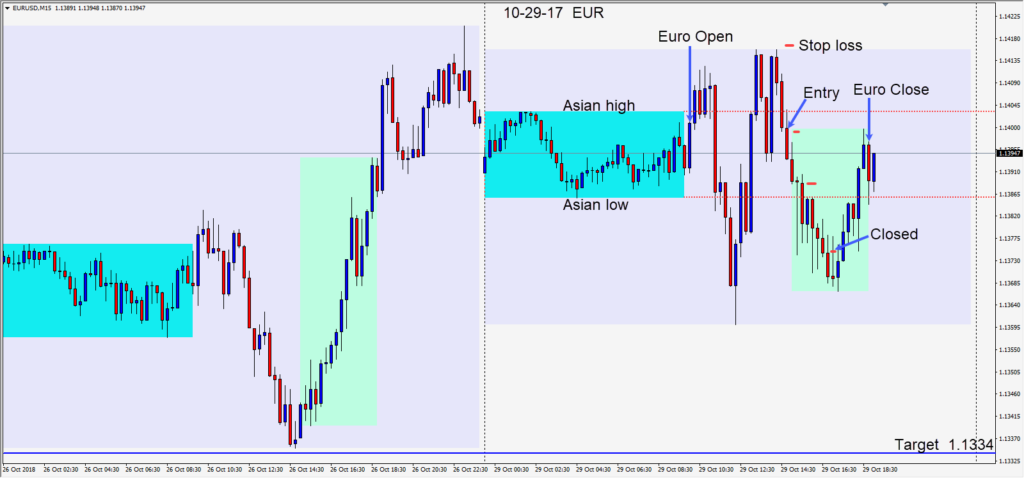

The EURUSD looks like it may test 1.1300 again before long – where it may find buyers once again. Today the EURJPY set up nicely for a short, risking 17 pips fr a potential 37 pips to our daily target at 128.83. Price began to move down in the U.S. session overlap after it ran into sellers unable to reach yesterday’s low. Price moved down to test its Asian session low and continued to our daily target just as the U.K. session ended.

Good luck with your trading and enjoy your weekend!