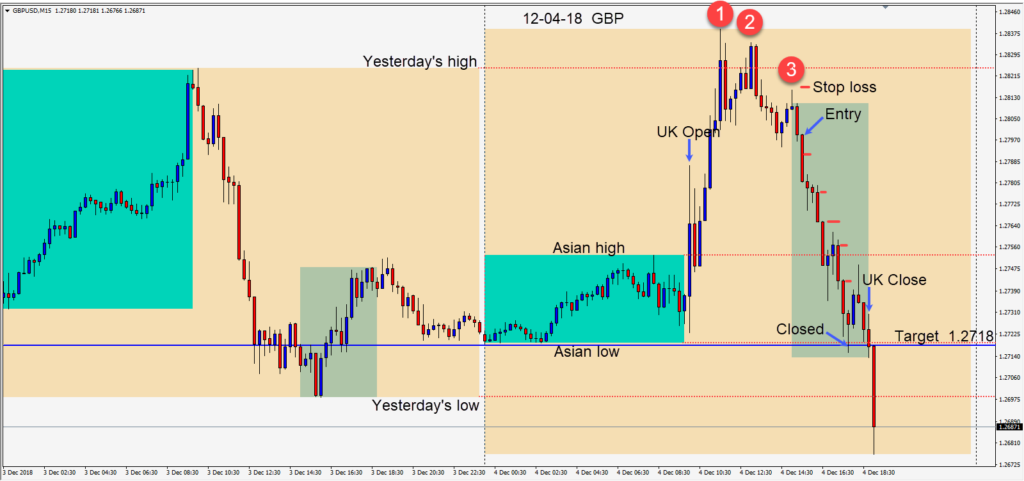

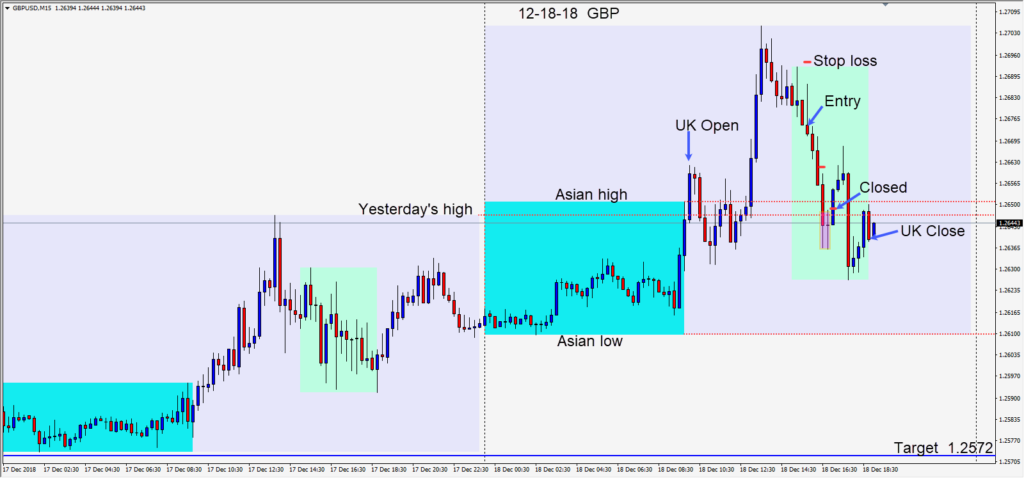

After initially moving higher today, the GBPUSD failed to close above the 1.2700 figure and began to move lower. Although tempted to enter earlier… waiting for the U.S. session economic news to be released still allowed us an entry, risking 20 pips for a potential 102 pips to our daily target at 1.2572.

As price moved down, we protected our profits moving our profit stop lower. Price made a double-bottom beneath yesterday’s high and the next candle closed our trade for modest profit.

Tomorrow the major event risk will be the FOMC economic projections statement and rate increase announcement. Jerome Powell is widely expected to raise rates by 25 basis points despite President Trump’s vocal objections. Traders will be listening carefully for clues as to how healthy the U.S. economy is projected to be in 2019 and how many future rate hikes can be anticipated.

Good luck with your trading!