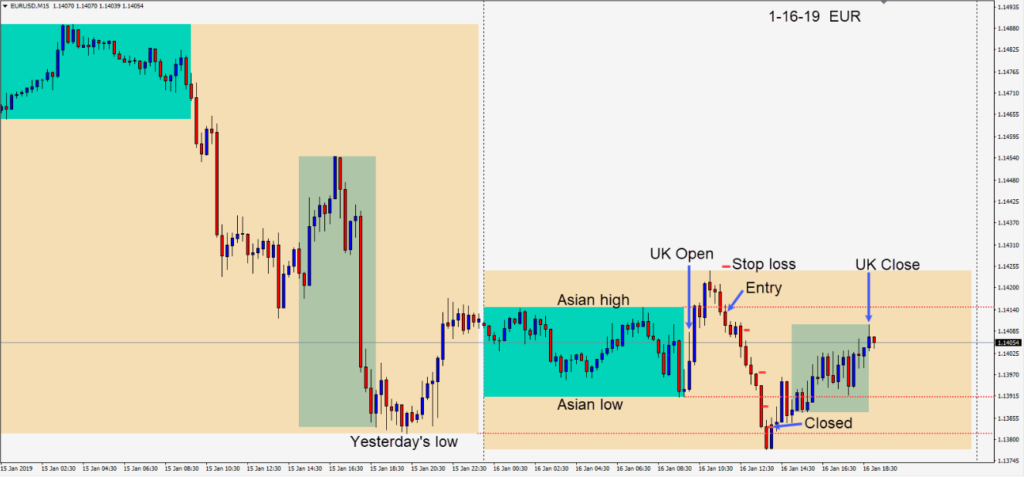

The EURUSD was more appealing with a risk of 13 pips for a potential 75 pips to our daily target at 1.1338. An entry short was taken, price moved down to yesterday’s low where it began to retrace in advance of the U.S. open closing our trade for modest gains well short of our target.

The AUDUSD and NZDUSD were very active today but I didn’t like the reward for the risk in either pair.

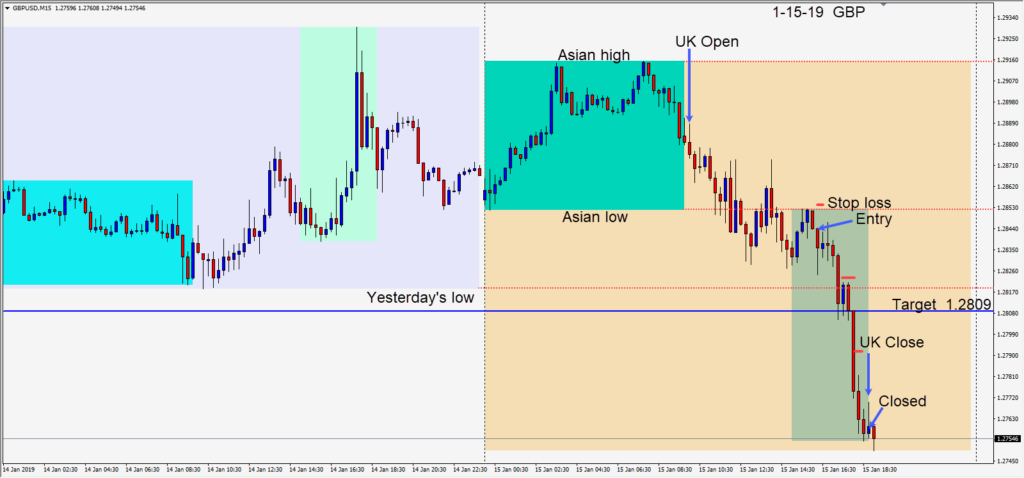

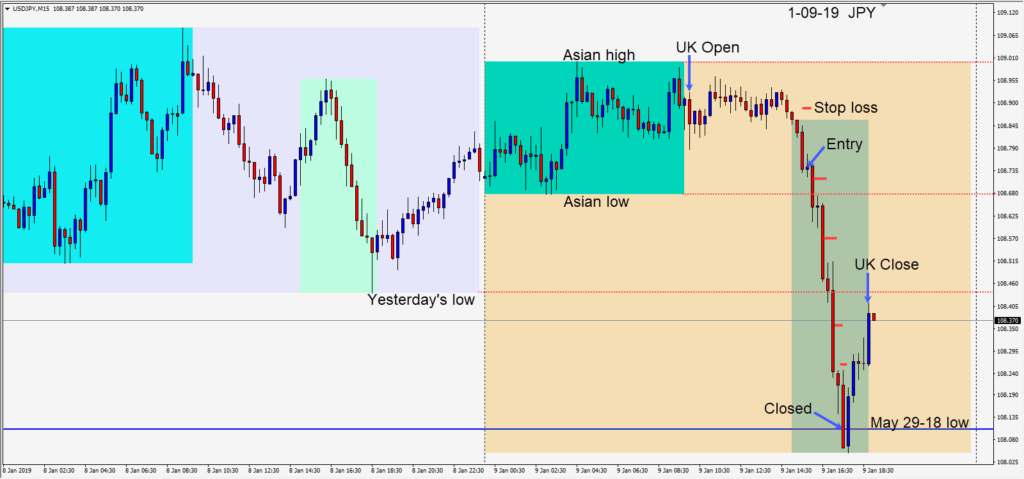

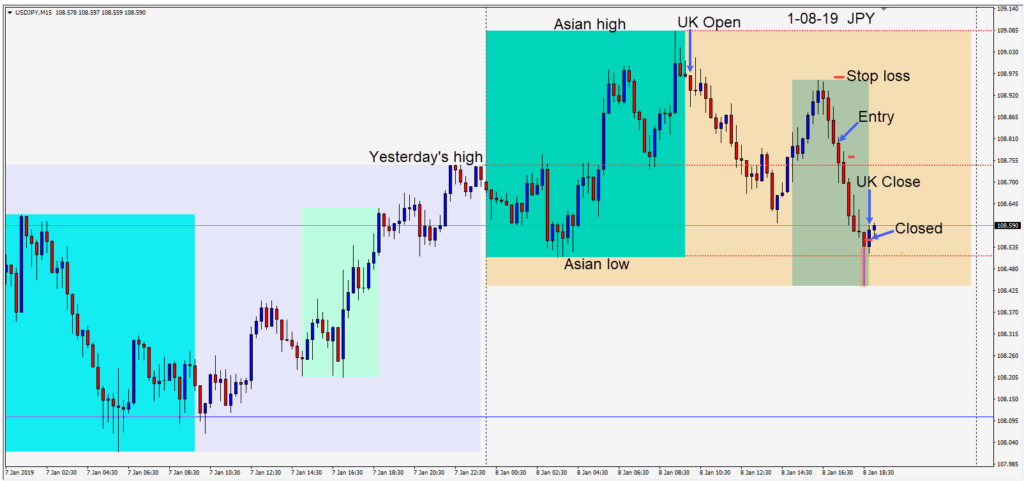

There are some mixed signals appearing once again which makes trading trickier and riskier than usual. The GBPUSD is extremely volatile, so be very cautious with it. There is some appetite for risk today but if this changes and U.S. equity markets start to decline substantially watch for flows to the safe haven yen. There are some major economic news releases tomorrow to be aware of.

Good luck with your trading!