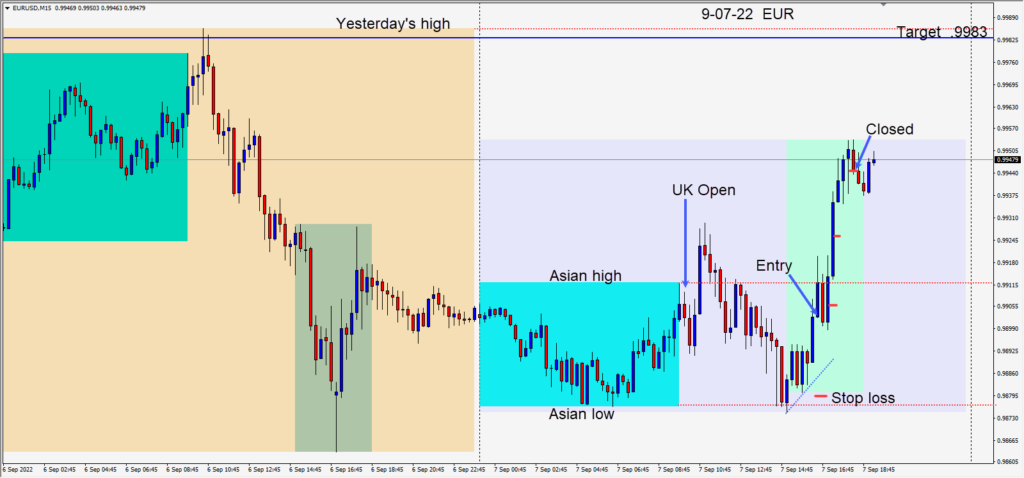

Countertrend trades are tricky and tend to yield less in profit. If you haven’t mastered trading with the trend, then taking lower probability trades against the trend, should in my opinion be avoided. The market may be trending strongly as the USD has this year – making waves to the upside, but it won’t go up every day.

Today when the U.S. session got underway, the pair traded essentially sideways for the first hour bouncing above its Asian low area… up and down 15 pips or so. This range broke with a bullish candle higher just before the U.S. equity markets opened. A long was taken risking 23 pips for a potential 80 pips to our target at .9983. The pair moved higher, but couldn’t close above its Asian session high. It eventually pushed higher and we locked in some profit but allowed for another retest of the Asian session high. Price continued higher going into the European close enabling us to lock in more profit. After the first bearish candle we closed the trade ahead of the U.K. close.

On a day of USD weakness, we were hoping for a retest of par, but getting to our target level before the U.K. close would have been a great trade. If the pair moves above par, I am anticipating shorts entering around the 1.0050 area on renewed USD strength.

Good luck with your trading!