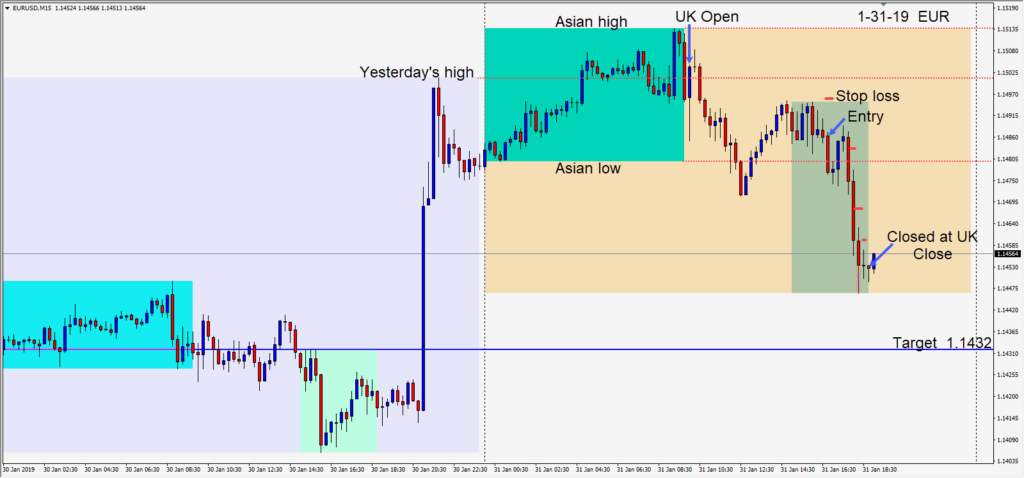

The USD continued higher and the EURUSD moved lower today. This pair has been ranging between 1.13 and 1.15, for the most part, since October last year.

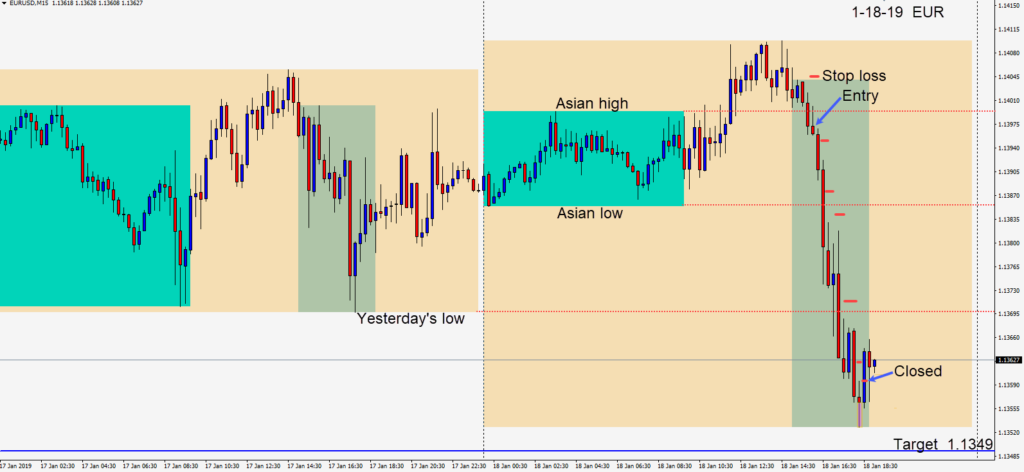

With the USD moving up for a fourth consecutive day, we looked for a short on the EUR and risked 9 pips for a potential 46 pips to our daily target at 1.1379.

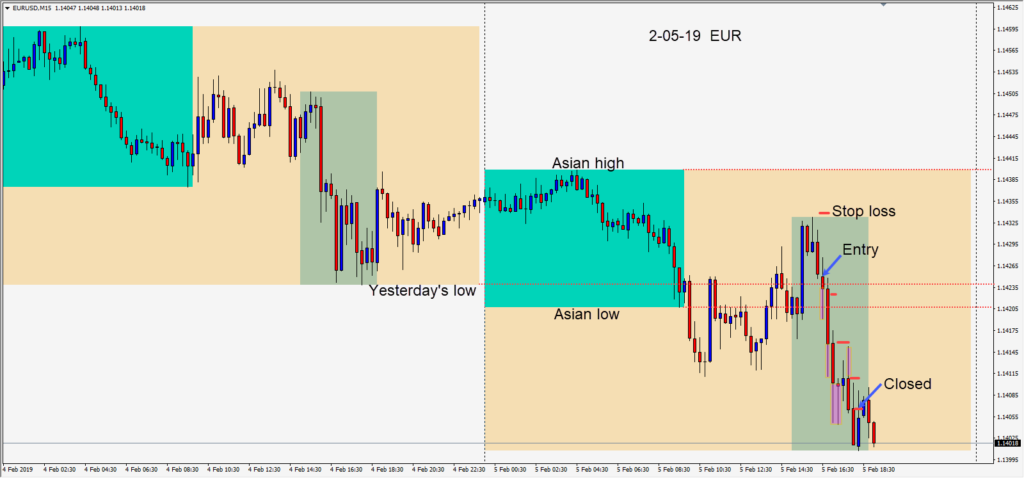

The 1.1400 level found buyers and our trade was closed for a very modest return.

A little profit taking in the USD is likely after four days of moving higher, but I remain USD bullish. Hopefully the U.S. – China trade talks work out favourably in the end. Brexit does not look any closer to be resolved as the deadline nears. Germany’s economy is slowing and that doesn’t bode well for the Euro.

Good luck with your trading!