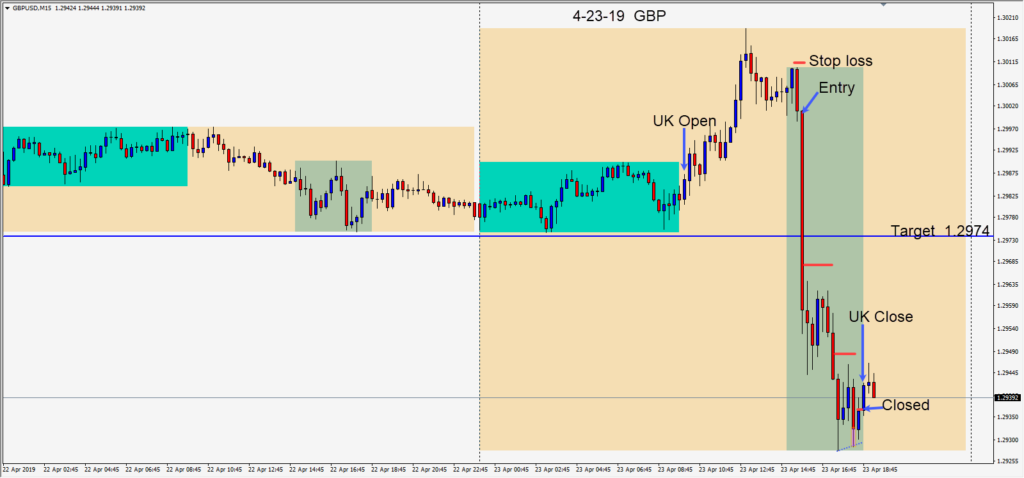

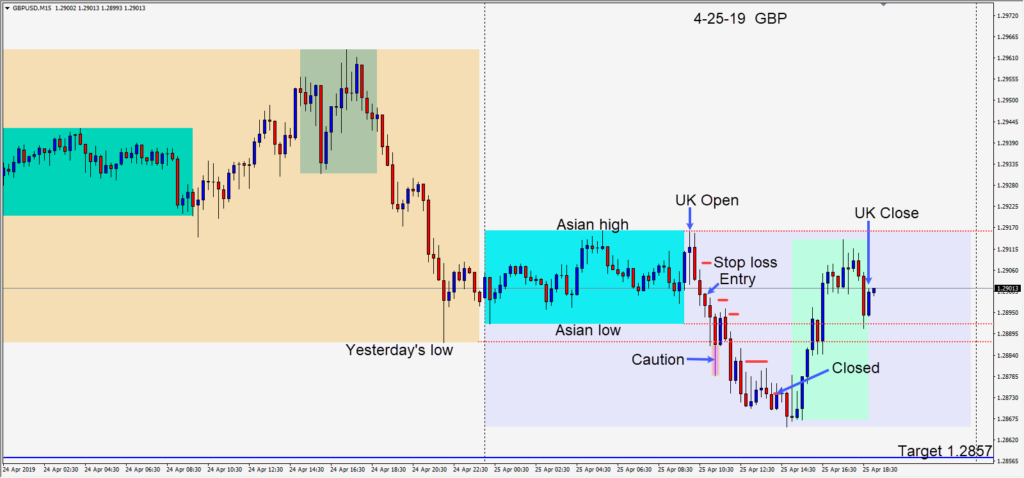

The USD continues to strengthen and the GBPUSD continues to trend lower. Since the middle of March, this pair has been moving lower – making a series of lower highs.

Price tested its Asian session high today as U.K trading began and reversed lower. We entered short risking 8 pips for a potential 42 pips to our daily target at 1.2857.

Price moved lower testing and retesting its Asian low and yesterday’s low. After leaving a long lower wick, we tightened our profit stop – removing risk from the trade, and continued to lock in profit as price appeared to stall. The trade was closed in advance of the U.S. session. It’s very common to see a retracement wave in advance of the U.S. session as traders take profit, so it’s better to lock in profit than to give it back.

As the Brexit drama continues with delays and little progress, this pair continues to be a favourite of mine.

I will be away tomorrow.

Good luck with your trading and enjoy your weekend!