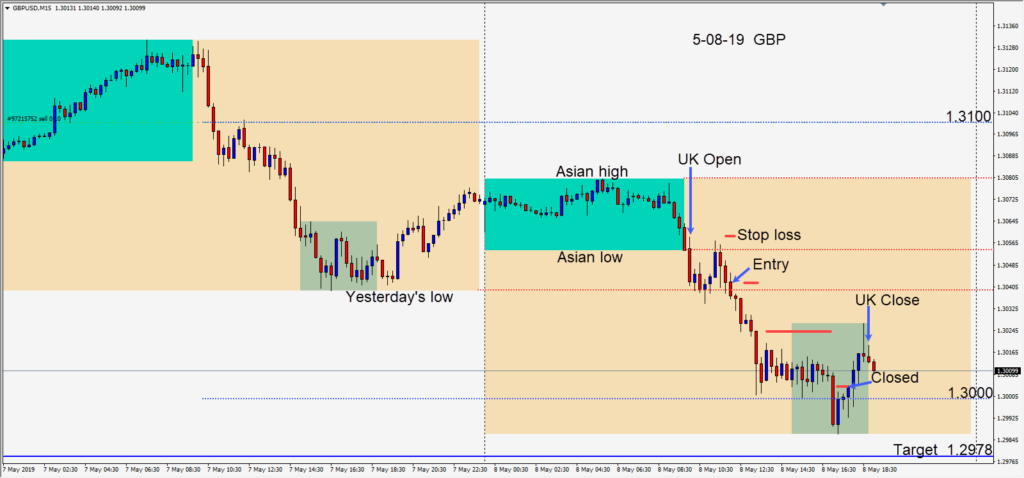

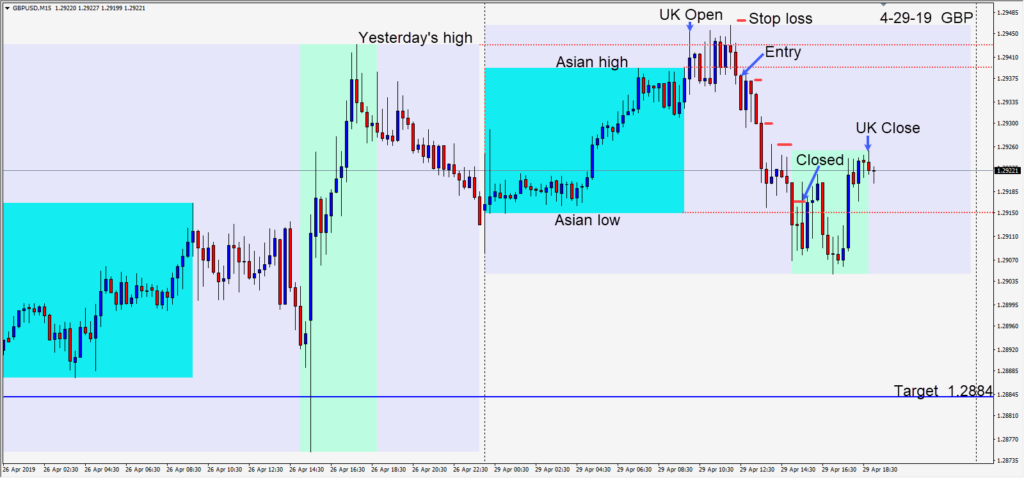

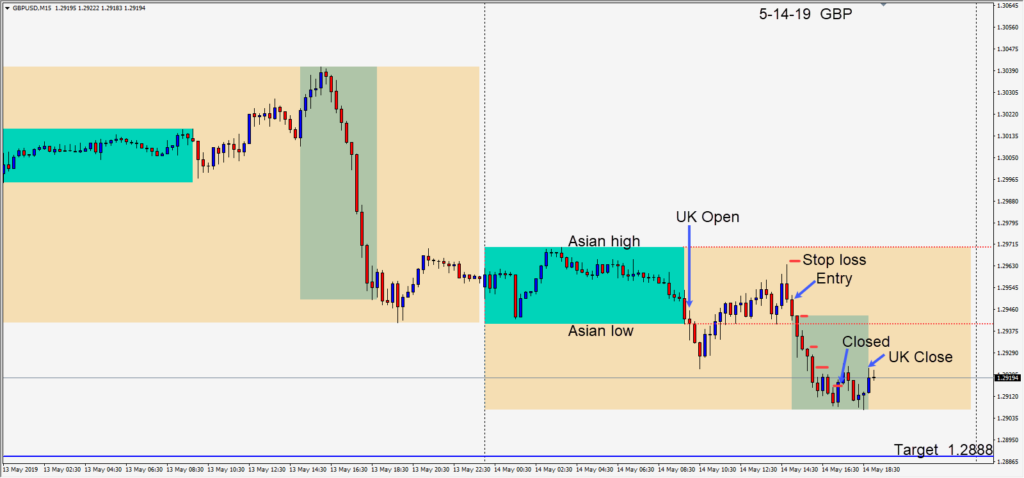

The GBPUSD is trending lower again and a failure to get above a critical level today near 1.2960 created a short entry…also ending its retracement wave higher.

The trade required a 15 pip stop loss for a potential 61 pips to our daily target at 1.2888. Price continued lower as the U.S. session got underway and the markets appeared less focused on the impact of tariffs.

The pair found buyers just above the 1.2900 level and our profit stop was triggered.

It looks like it could be active week.

Good luck with your trading!