It appears that many traders have been sitting on their hands as uncertainty continues regarding the U.S. – China trade tariffs eventual outcome, Trump versus Iran, how Boris Johnson who is the odds on favourite to replace Teresa May as Britain’s next prime minister, will succeed where she failed, and why the Euro is suddenly more attractive than the USD.

Since the FOMC meeting last week the USD has had its largest decline in four months and gold has surged, the most in three years.

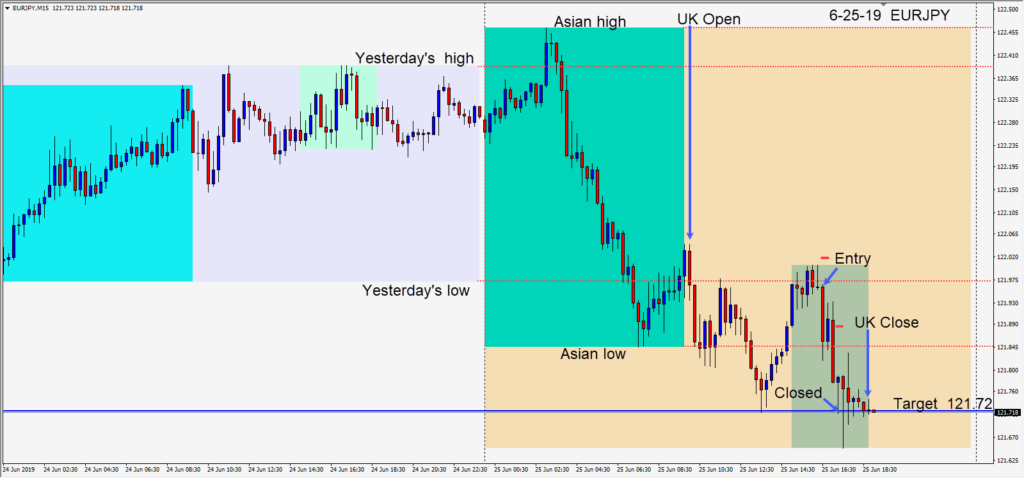

After a large move down during the Asian session today, the EURJPY failed to move higher during the U.S. session overlap and a short was taken risking 6 pips for a potential 24 pips to our daily target at 121.72. Price moved lower, we moved our profit stop down and very quickly our trade was closed as our target was reached.

Trading has been challenging as USD bulls continue to be squeezed out of the market, but we do have a U.S. President like none other. If the major pairs seem difficult to trade, there are always the yen crosses.

Good luck with your trading!