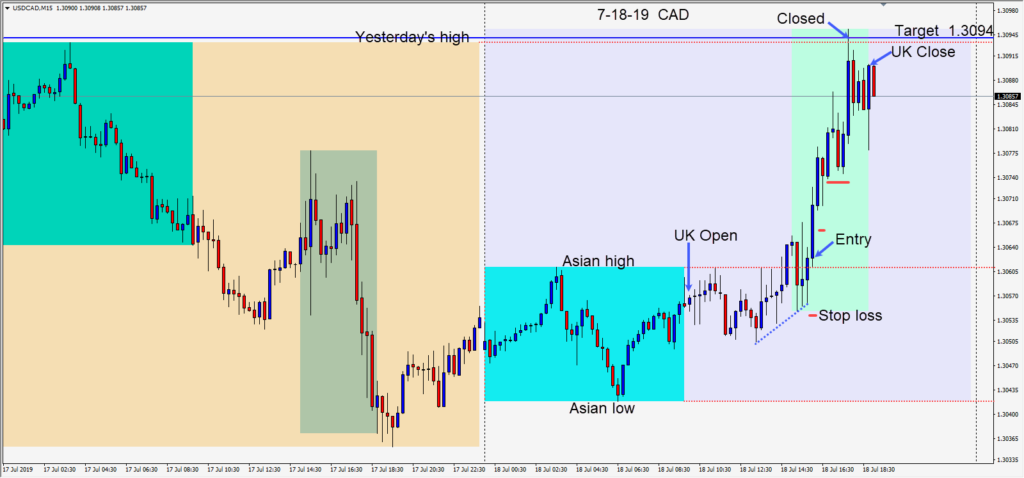

The USDCAD began climbing higher after the U.S. economic releases today. Both Brent and WTI oil were off more than 2%. The pair had been making a series of higher lows and a long entry was taken risking 9 pips for a potential 32 pips to our daily target at 1.3094.

As price closed above its Asian session high, we locked in some profit moving our stop loss to slightly positive. Price continued higher despite the USD index and gold being relatively flat.

After price moved higher and formed what looked like a reversal pattern, we moved our take profit beneath its structure and fortunately price moved up to test yesterday’s high and the trade was closed at our daily target.

The pair continues to find buyers just above 1.3000 and sellers near the 1.3150 levels.

The market continues to be focused on the progress of the U.S. – China trade talks.

In the meantime, the market is also beginning to price in a 50 bp cut as opposed to a 25 bp cut by the Fed this month.

Good luck with your trading!