Germany’s economy is contracting and a bearish sentiment prevails for the E.U.’s largest economy.

Despite all the volatility in U.S. stock markets on Wednesday, the USD index managed to move upward and continued higher today.

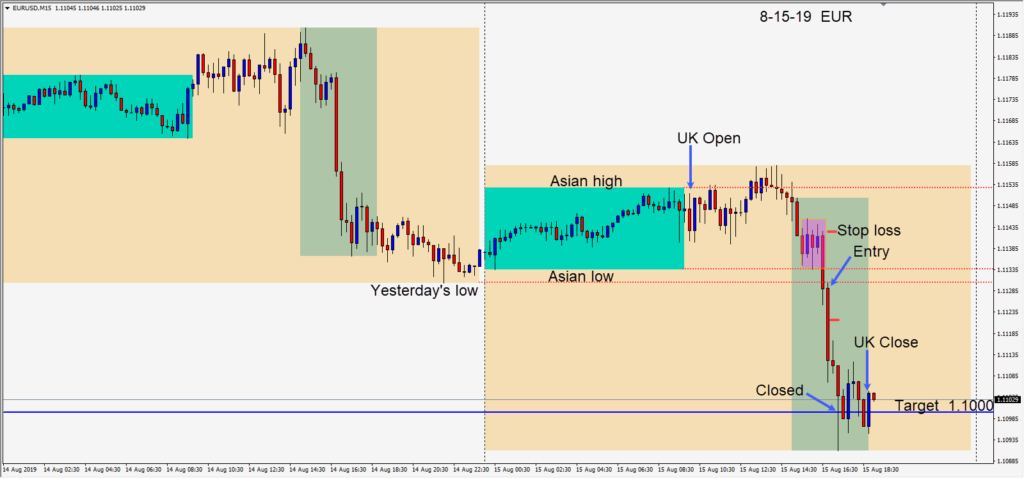

After a slew of economic news releases for the U.S. today, the EURUSD moved sideways for an hour then broke to the downside. A short was taken risking risking 14 pips for a potential 28 pips to our daily target at 1.1100.

Price continued down to our target and the trade was closed. The Euro weakness was also apparent in the higher octane EURJPY which also moved lower to test its Asian session low and yesterday’s low.

Building permits and housing starts will be closely watched on Friday for the U.S. It would not be unusual to see the USD pull back to close the week after four up days, but strong economic numbers may give it further resilience.

Good luck with your trading!