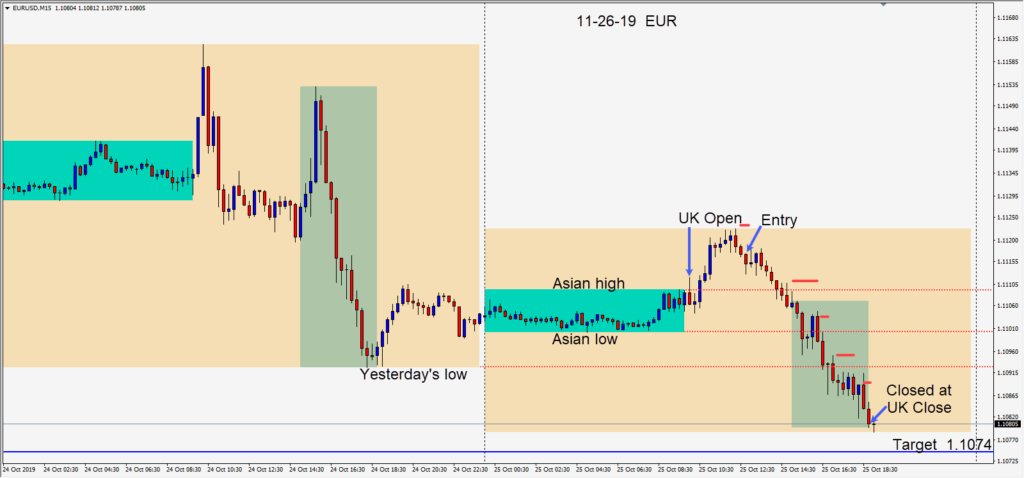

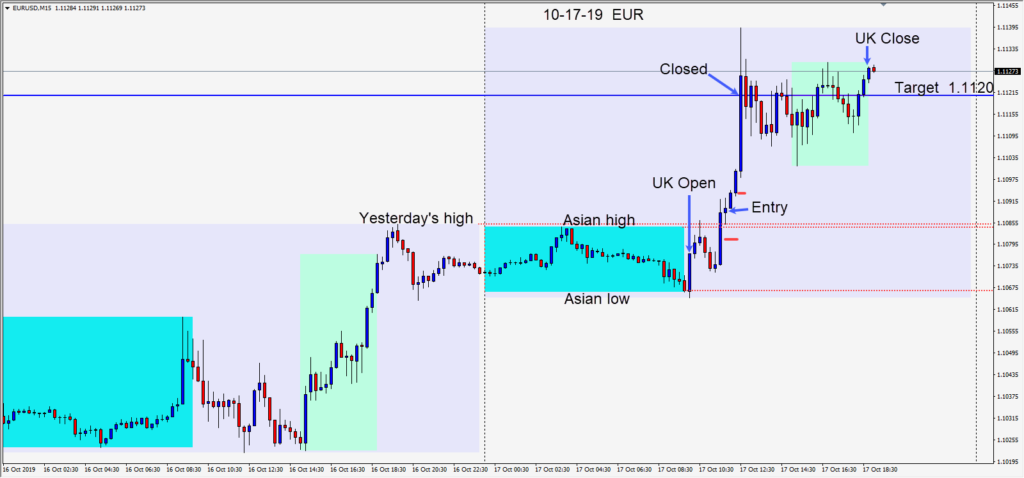

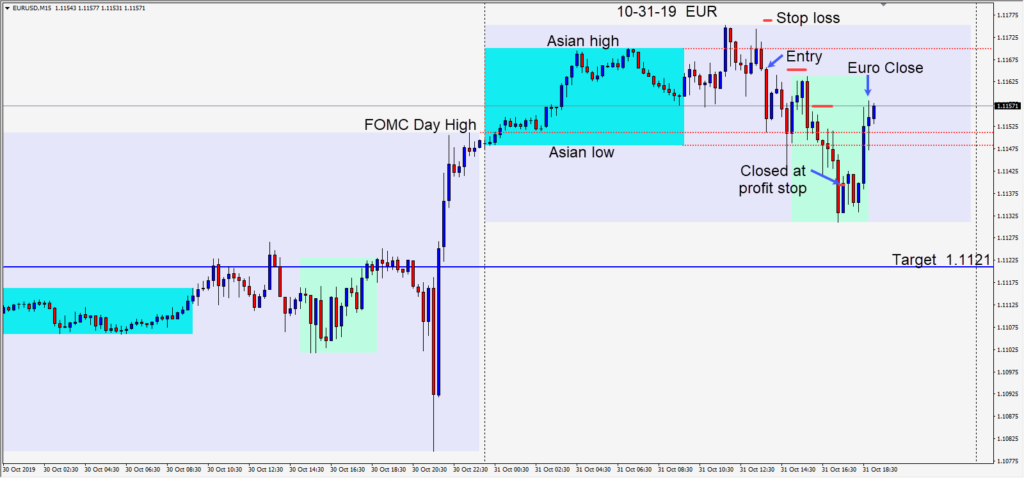

After a second failed attempt to rise above its Asian session high, and a bearish engulfing candle, a short was taken on the EURUSD risking 11 pips for a potential 44 pips to our daily target at 1.1121.

There were a number of U.S. economic news releases today so we tightened our stop loss to prevent getting closed by volatility. Price moved lower taking out yesterday’s high and the its Asian session low. As price continued lower we tightened out profit stop more to prevent giving back too much and it was hit closing our trade.

Tomorrow we have Non-Farm Payrolls which tends to make for volatility but recently not as much as in previous years. Much like FOMC days, I prefer to trade after the release or take the day off.

U.S. – China trade talks continue to progress positively currently. Britain will have a Dec.12th general election, so Brexit will remain unresolved for the time being. The USD has given back most of its gains from last week. We will find out tomorrow if the October 18 low will hold.

Be careful tomorrow and good luck with your trading!