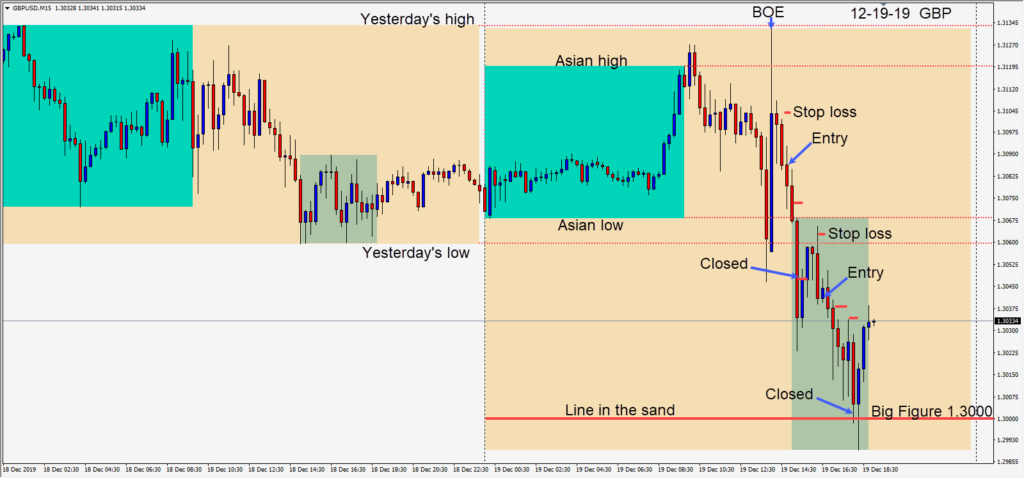

It didn’t take long for the GBPUSD to move down after the U.K. election…another case of “buy the rumour, sell the news”. The GBPUSD had rose as the polls reported… and the markets projected a Conservative majority for Boris Johnson. The good news is, we will have “Brexit watch” for another year, as the markets sort out the economic implications of Boris Johnson’s coordinated U.K. exit from the E.U. I anticipate the GBPUSD will continue being actively traded throughout 2020.

As mentioned earlier this week, a downside target of 1.3000 was a reasonable target this week on any negative sentiment. After the Bank of England today, we waited for the candles to confirm that price was headed lower. We entered first at 1.3086 and our trade was closed at 1.3047 early in the U.S. session overlap. A second entry was taken at 1.3040 as price began moving lower again.

Buyers began entering below 1.3050… ahead of the 1.3000 big figure causing some long lower wicks on the candles. Not wanting to be caught on the wrong side of the market, nor wanting to give back profit from the first entry, we locked in profit waiting for 1.3000 to be tested to close our trade.

This may have been our last trade of the year, but we will be here tomorrow just in case opportunity presents itself. Volumes are down and spreads have widened somewhat… even during normally very active trading hours.

If we’re not back tomorrow… I wish you all a happy, healthy and prosperous 2020. I will be back looking for trades on January 3rd.

Good luck with your trading!