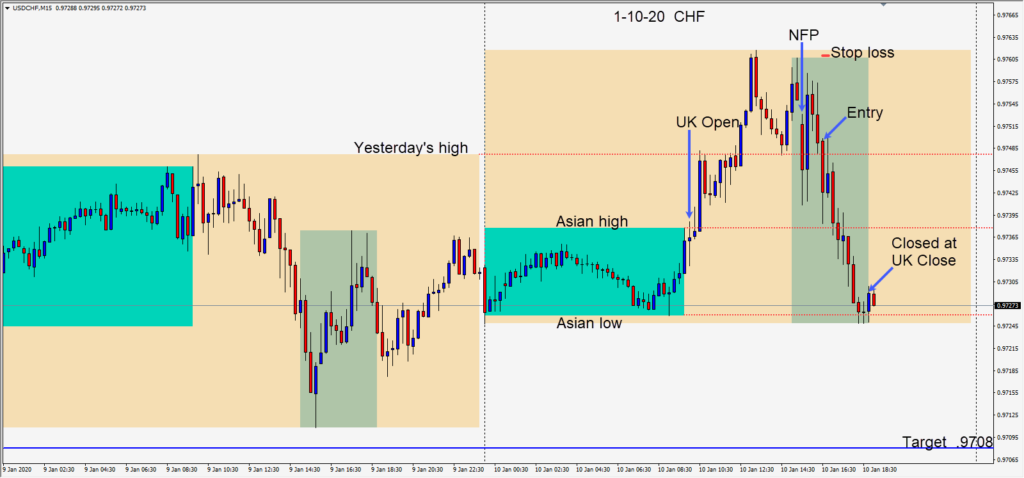

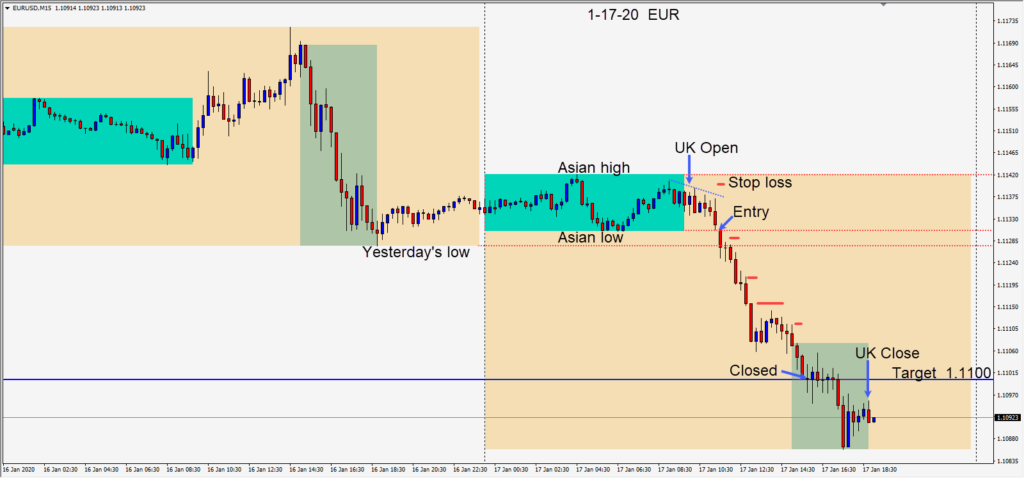

The markets are giving some mixed signals today, but the USD is stronger and the Euro is weaker. As the EURUSD began to trend lower, a short was taken early in the U.K. session risking 10 pips for a potential 31 pips to our daily target at 1.1100. With pending news not far away, we took the risk out of the trade quickly by placing our stop loss lower once we were in profit… just above yesterday’s low.

Price then continued lower before stalling and moving sideways into the U.S. open. The pair subsequently moved lower closing our trade at our daily target 1.1100 figure.

Both gold and the DXY moved up today which warrants caution. Equity markets too were all up. When this is the case, it’s a good idea to be cautious and lock in profits incrementally. It’s generally better to be conservative on a Friday as many participants will be closing positions in advance of the weekend.

Good luck with your trading and enjoy your weekend!