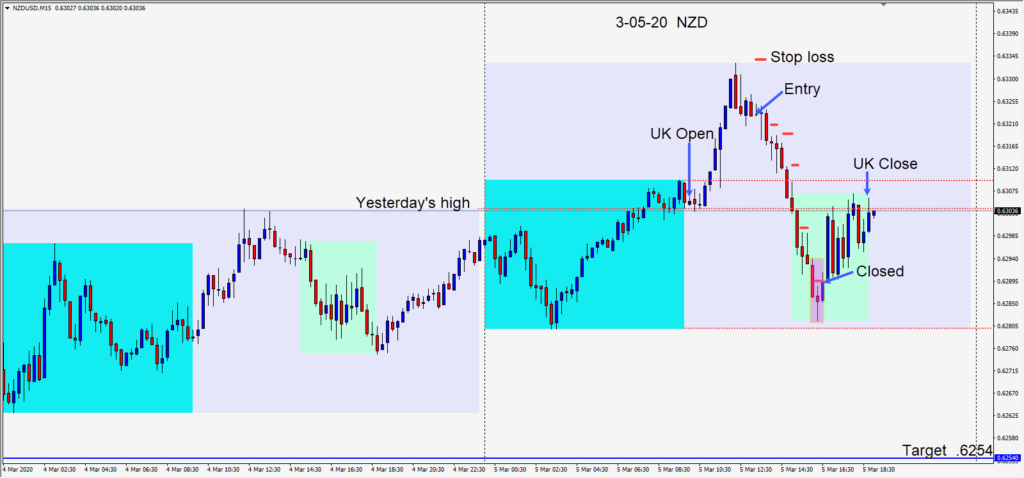

The AUDUSD and NZDUSD tend to trade in the same direction. Both pairs set up for a short today, but I preferred the Kiwi…risking 12 pips for a potential 68 pips to our daily target at .6254.

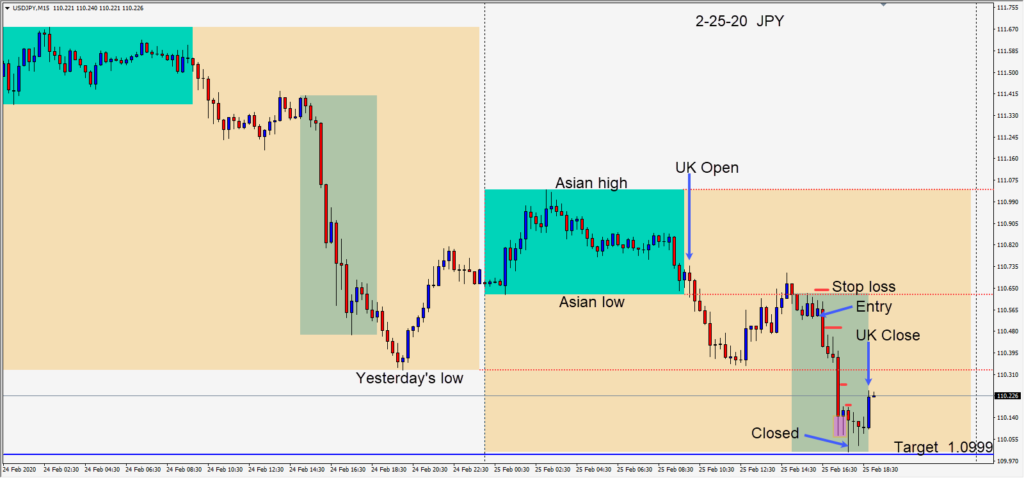

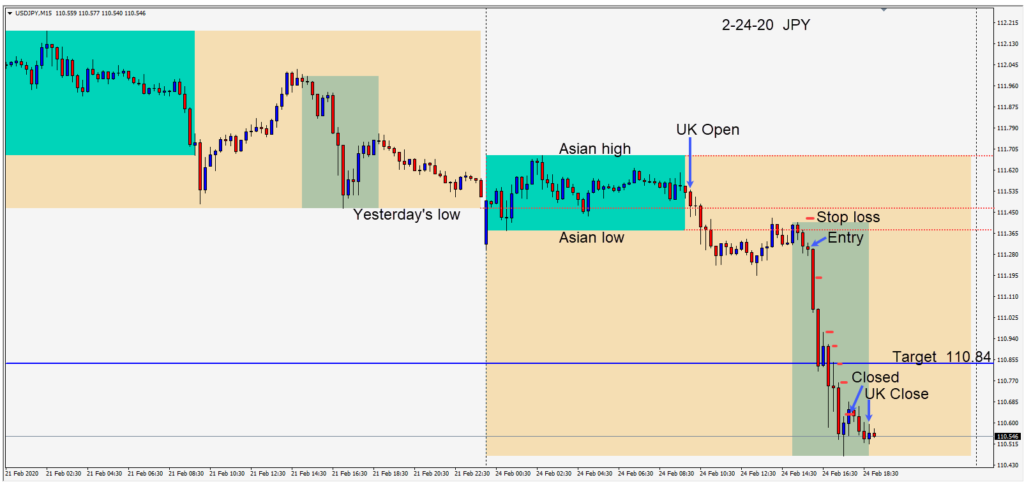

As price moved lower we moved our stop loss lower and continued to do so as the U.S. open approached. Price continued down to just above its Asian session low where it bounced and closed our trade.

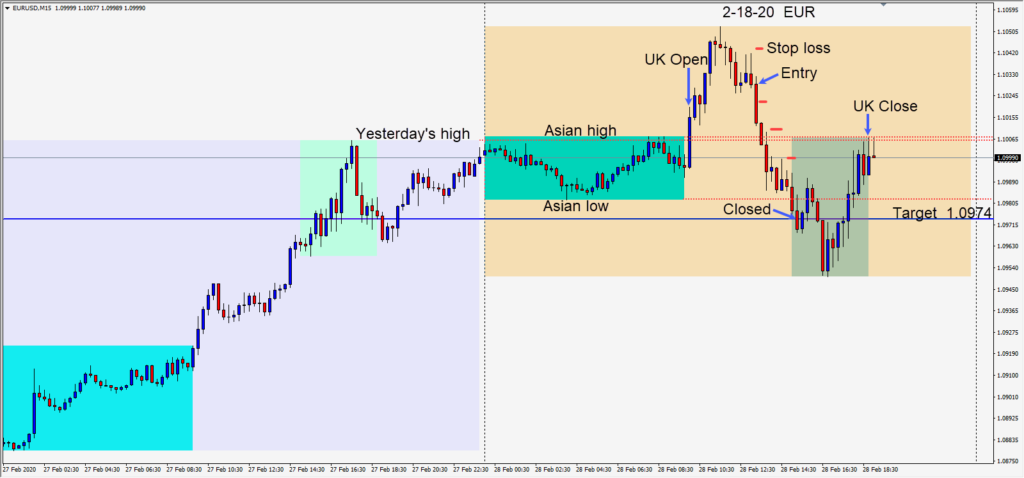

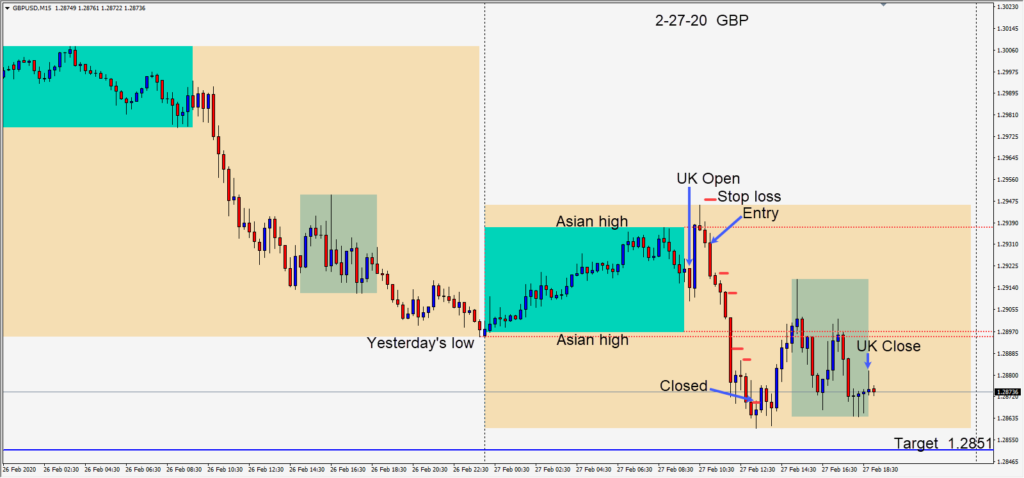

This week has been very volatile as the financial markets continue to unwind as a result of the coronavirus.

Tomorrow is NFP Friday, so be very cautious trading in advance of the release.

Good luck with your trading!