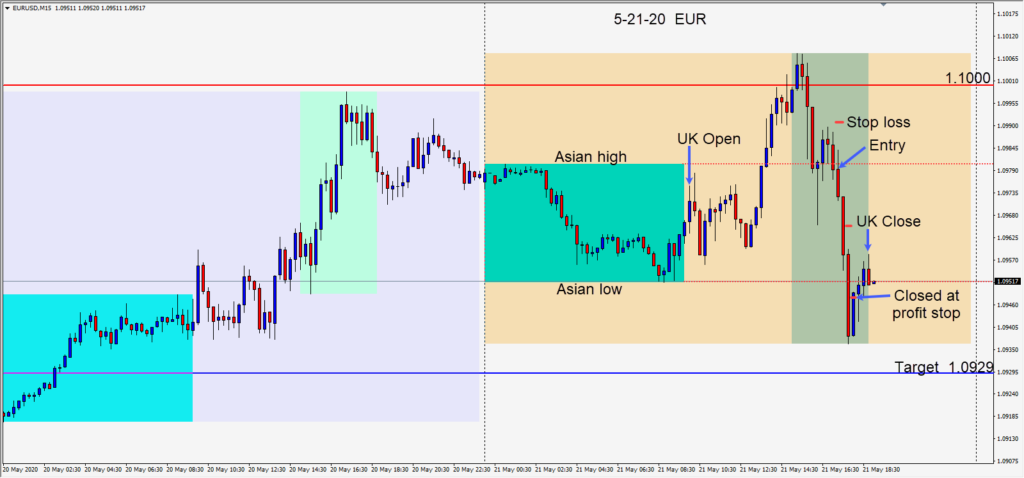

The elusive close above the 1.1000 – 1.1020 level didn’t happen and sellers emerged today as the EURUSD tested the 1.1000 figure. Global bourses were lower today and the USD was moderately up…accompanied by the move lower in gold.

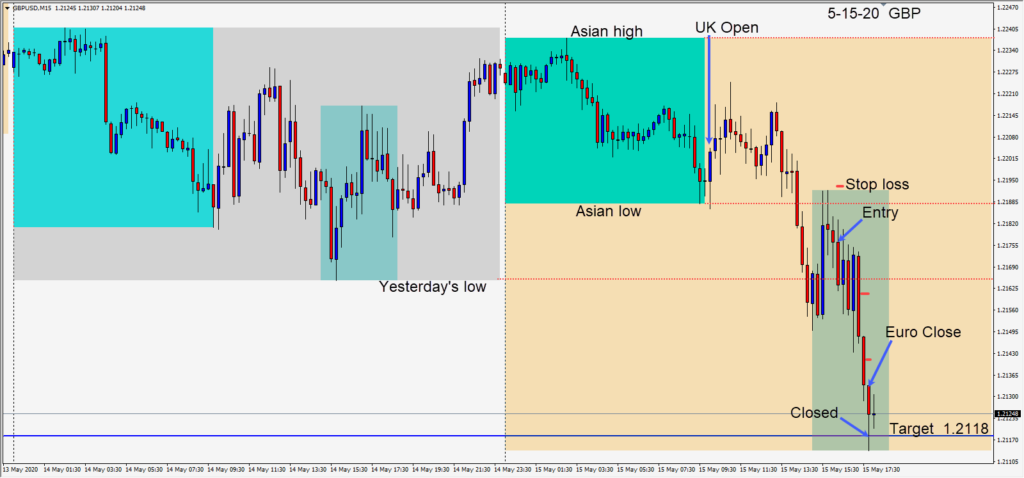

A short setup was found risking 12 pips for a potential 50 pips to our daily target at 1.0929. Price moved lower after making a lower high and closing back within its Asian range. As price continued down, we protected our profits, but gave back some on the retracement after the European close.

Increasing tensions between the U.S. and China appear to be having an impact on the global equity markets. Currently equity weakness equates to a stronger USD and vice versa.

If the EURUSD closes the week below 1.0880 then the rally may be over. A close above 1.1020 is bullish. Keep an eye on the DXY.

Good luck with your trading!