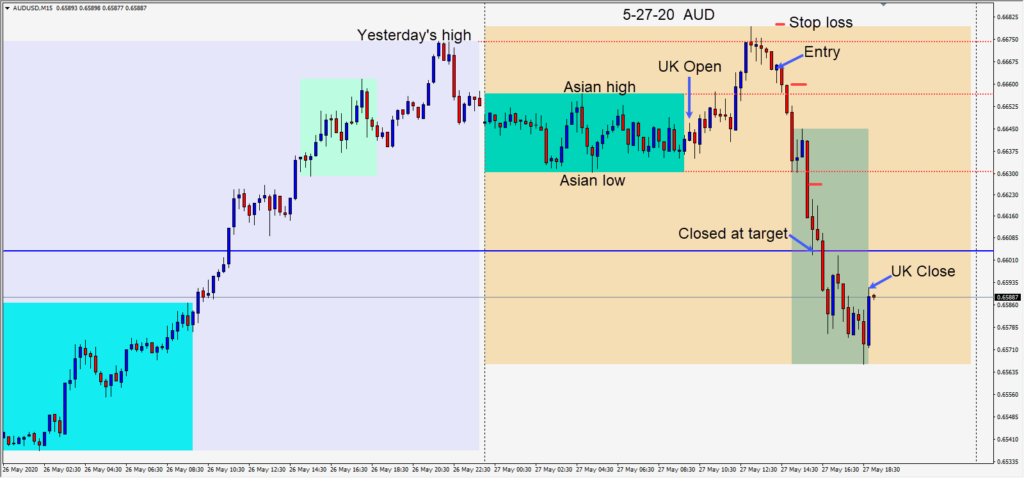

After falling precipitously since May 26th, the USD has bounced as equity markets recalibrate following Fed Chair Powell’s remarks on Wednesday.

The big question remains how economies will adjust following the pandemic coronavirus outbreak. Will reopening of economies as restrictions are eased result in a second wave of infections or not?

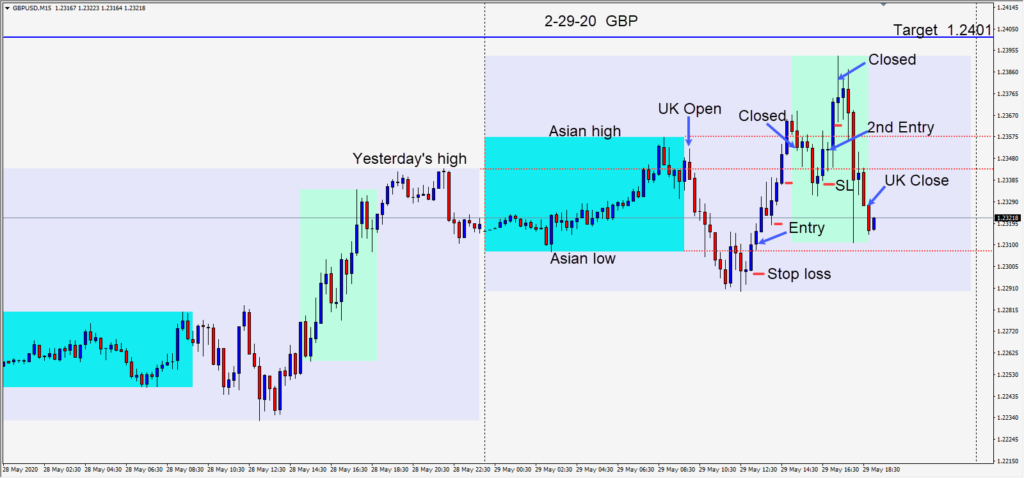

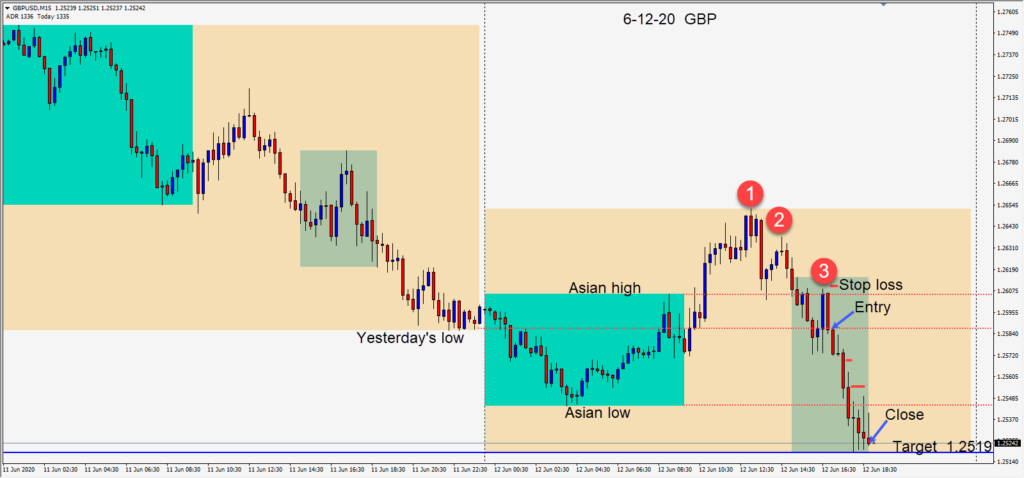

Today we shorted the GBPUSD risking 25 pips for a potential 67 pips to our daily target at 1.2519. After three lower highs the pair moved lower to test its Asian session low and then came very close to our target. The trade was closed at the U.K. close.

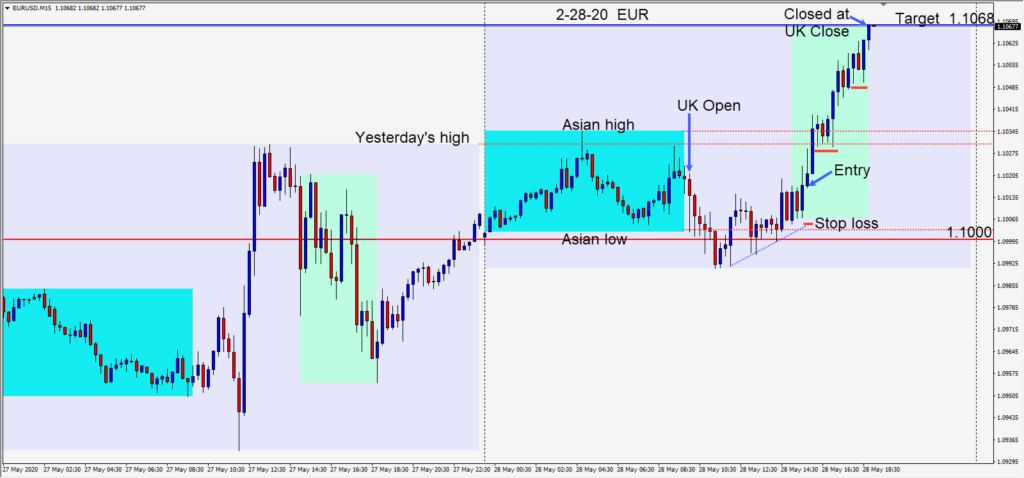

The moves today were quite uniform in the majors with the USDJPY looking a little left out.

Enjoy your weekend and good luck with your trading!