As mentioned yesterday the Euro bulls are eyeing 1.2000 but we saw brief USD strength yesterday. It appears that the USD which has been sold sold sold of late may be attracting some buyers as we reach mid summer.

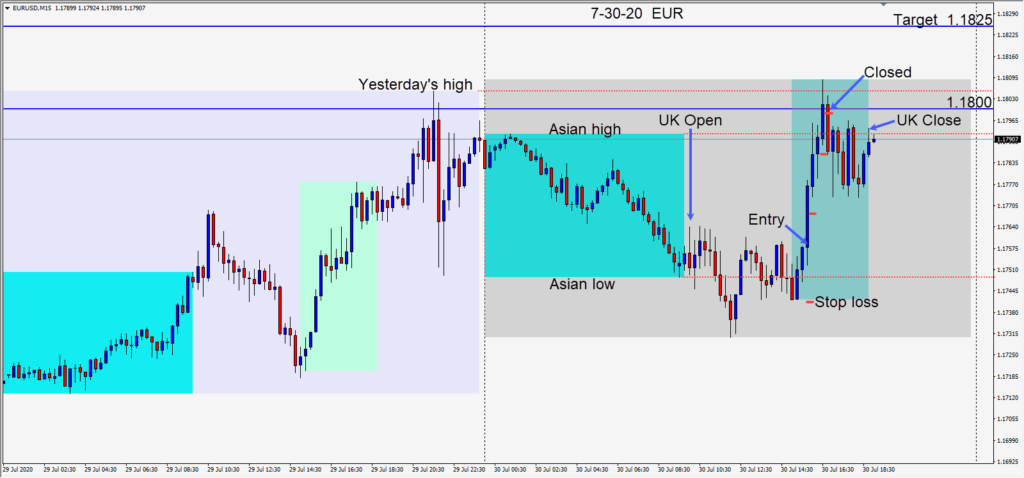

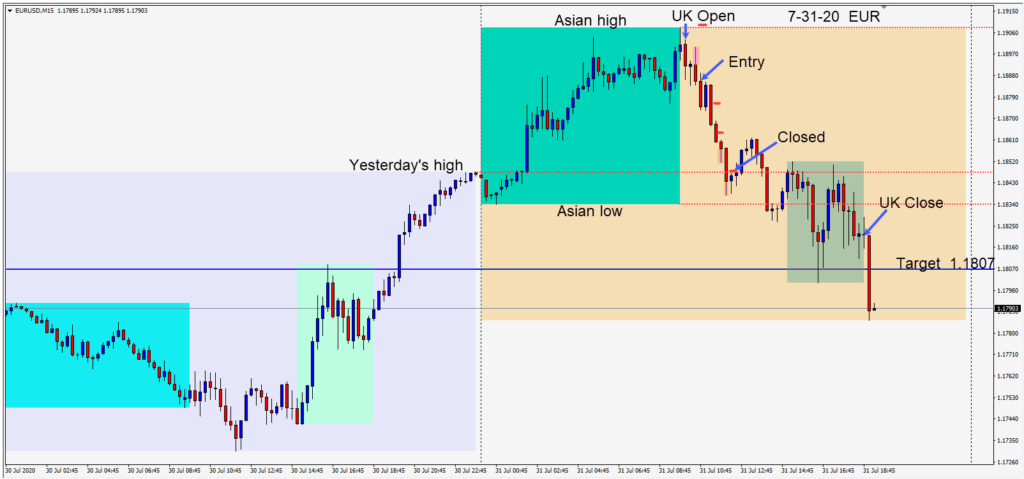

When the EURUSD could not extend above 1.1900 today a short was taken early in the U.K. session risking 24 pips for a potential 78 pips to our daily target at 1.1807.

Our first target was yesterday’s high, then the Asian session low and then to get down to our target just above the 1.1800 figure.

As price moved lower, we protected our profits and the long lower wicks began to form as price reached yesterday’s high. We closed the trade as price moved back to this level. This trade was countertrend as the market continues to be heavily weighted long in the pair since its move above 1.1500.

Next week the pair may reach 1.2000 but the climb is getting harder which may mean that we’re approaching the summit. Beneath the 1.1785 area will be revealing… as we see if the pullback attracts buyers on the dip. Some Euro bulls are targeting 1.2150 as resistance and further resistance at 1.2500.

A case for Euro strength and USD weakness to persist can be made, but I think caution is warranted around the figures as we watch price react.

Many years ago… a whale told me that if I had a very strong conviction on the direction of a pair… to go find another pair to trade. In other words, don’t get tunnel vision when you’re trading.

Good luck with your trading and enjoy your weekend!