USD strength has continued for a third day going into the non-farm payroll release tomorrow.

Earlier in the week the ECB’s chief economist Lane commented that the ECB does pay attention to the exchange rate. This has brought some Euro shorts into the market in advance of the ECB meeting next week.

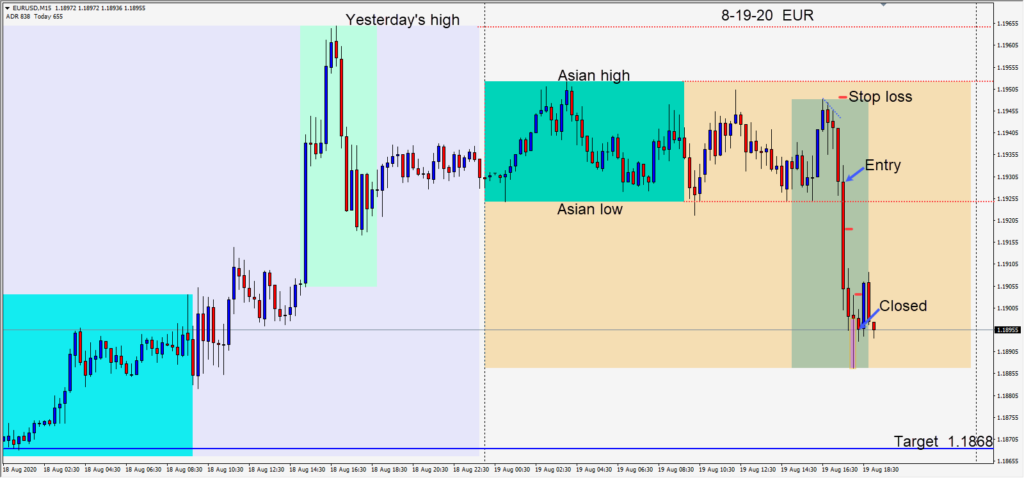

With the majority of the market caught off side, the EURUSD has been pulling back. In August the pair had two pullbacks in the 200 pip range. With 1.2000 rejected on Tuesday, many bulls will continue to remain long above 1.1800. A close below 1.1800 and another close below 1.1750 may cause the tide to change abruptly… with capitulation ensuing and a potential domino effect.

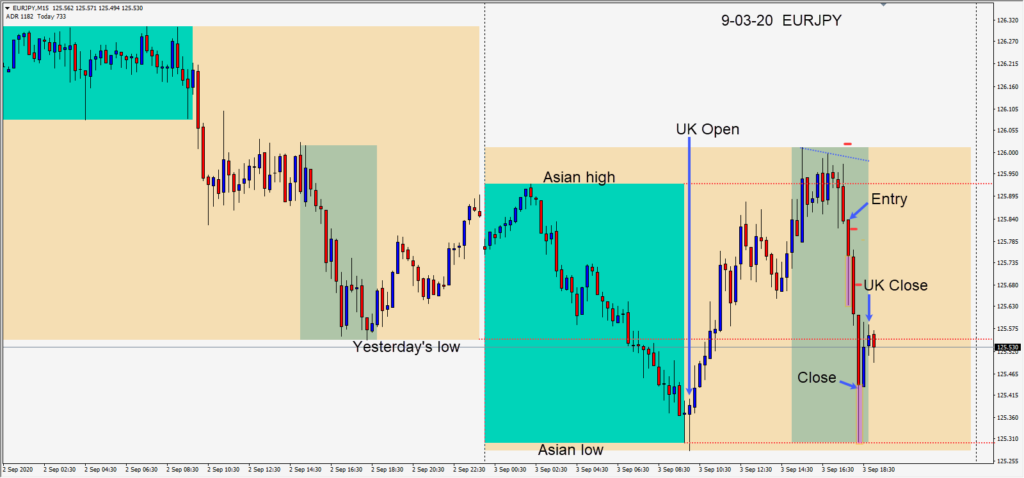

Today a short was taken in the higher octane EURJPY cross as upside momentum faded… risking 20 pips for a potential 100 pips to our daily target at 1.2483.

Price moved lower but left a long lower wick after the first candle, so we removed the risk from the trade by placing our profit stop to plus 2 pips. Price continued lower but bounced at its Asian session low and we closed the trade after giving back 13 pips.

Trading the higher octane JPY crosses requires a great deal of discipline and money management as the stop and reverses occur frequently and abruptly. The last time I traded the AUDJPY was during the early and extremely volatile days of the pandemic and my stop loss was hit in about 30 seconds after my entry. The market has calmed down considerably since then but these pairs tend to be volatile.

All eyes will be on the U.S. Non-farm payroll tomorrow, so be cautious and nimble if you’re trading in advance of it.

Good luck with your trading!