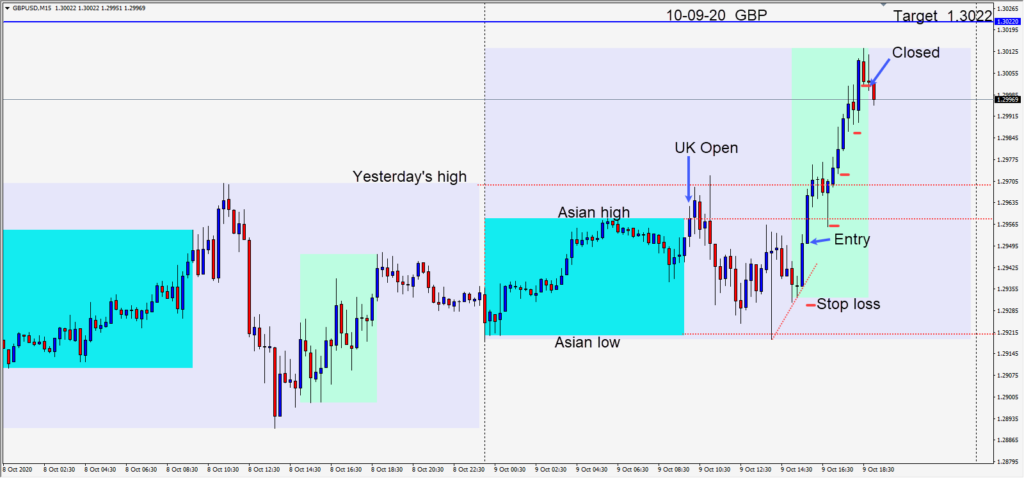

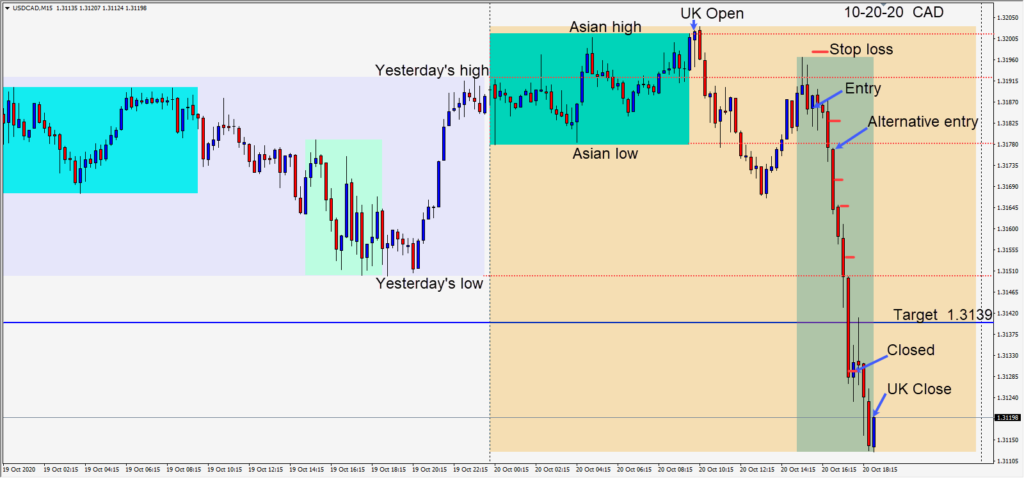

On Monday the USD started the week moving lower and this continued today.

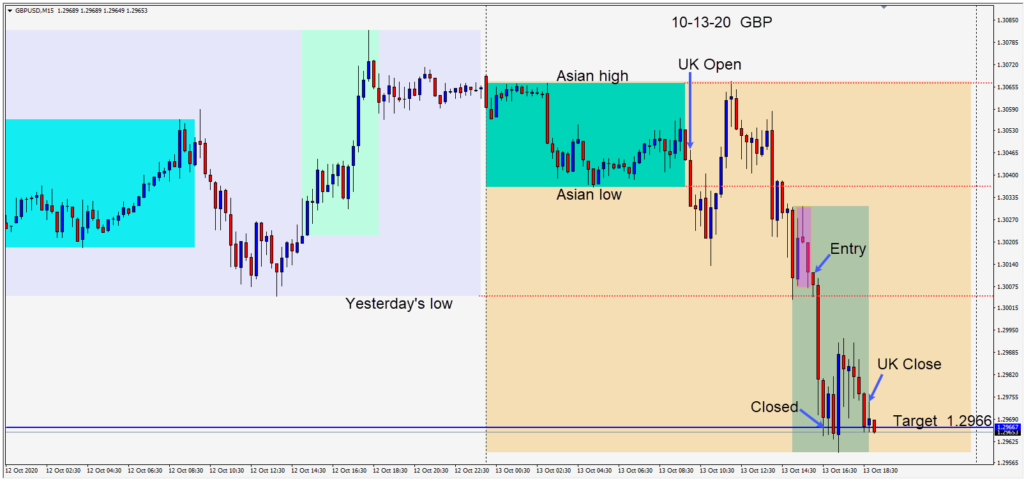

A short was taken in the USDCAD after the U.S. news, risking 13 pips for a potential 45 pips to our daily target at 1.3139.

Price moved lower taking out its Asian session low, yesterday’s low and continued right through our daily target for bonus pips. We locked in profit throughout the move lower and closed the trade on the first sign of a move upward – beneath our daily target.

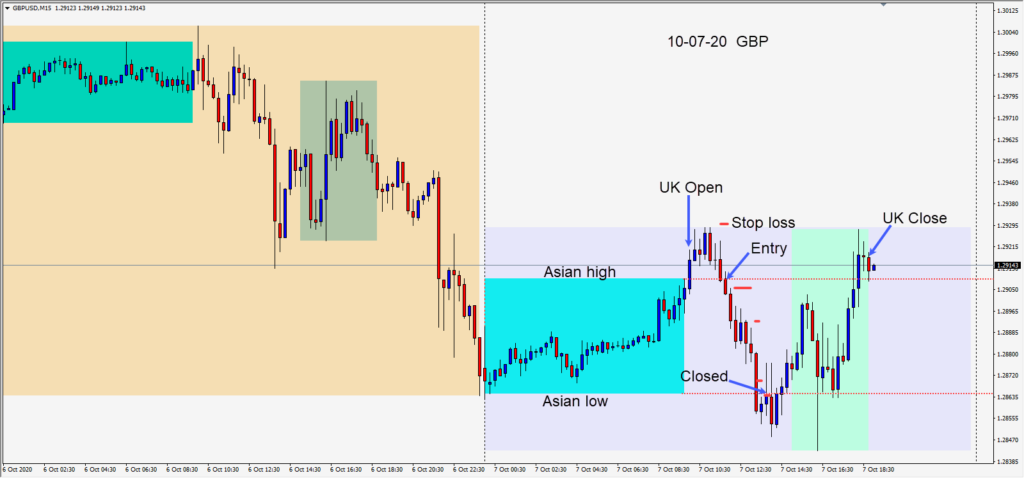

Yesterday the market gave very conflicting signals which caused me to wait on the sidelines. Expect volatility to continue with some big unknowns out there, including the Brexit outcome, the U.S. election results and when the rising corona virus infection rate will abate.

Always limit risk exposure.

Good luck with your trading!