The U.K. and Europe moved their clocks ahead on Sunday. North America is now in sync again having moved their clocks forward two weeks ago.

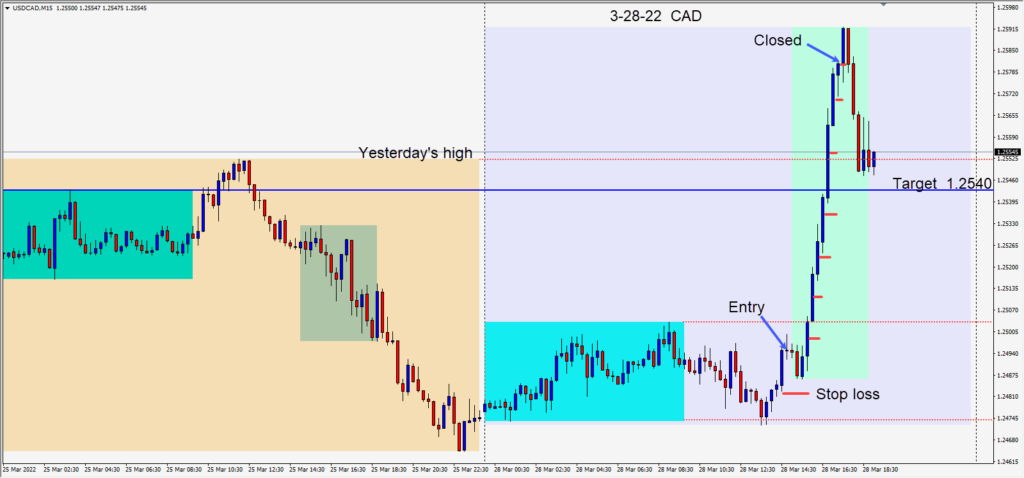

Today there were no economic news releases in the U.S. session, but oil was moving down. A long was taken in the USDCAD in advance of the U.S. open risking 13 pips for a potential 41 pips to our daily target at 1.2540. Price initially pulled back as the U.S. session got underway before moving higher.

Price continued higher through our target and we protected profits candle by candle until the trade was closed.

The market has been very choppy lately so it was nice to find a trade that ran, especially on a Monday.

It looks like it will be busy week for economic news and Friday will have the NFP release as April arrives.

Good luck with your trading!