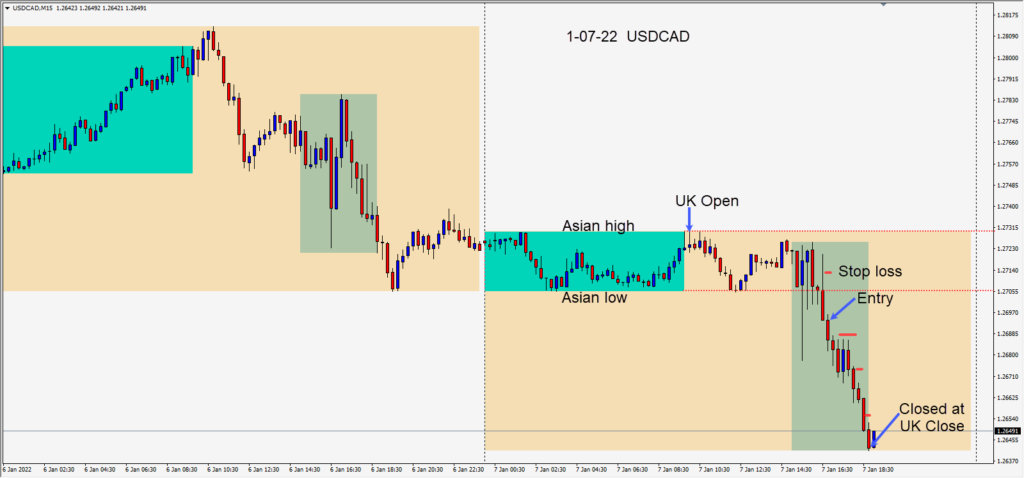

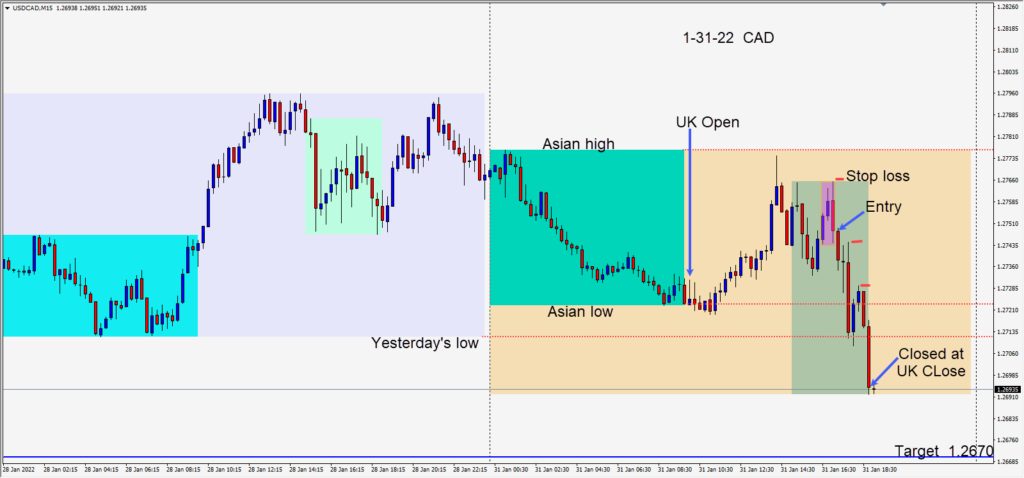

After the U.S. traders got underway today, the USDCAD made a lower high which was followed by a double top and reversal pattern… closing beneath 1.2750. A short was taken risking 19 pips for a potential 78 pips to our daily target at 1.2670.

Price moved lower going into the European close, then pulled back to retest its Asian session low before descending further to the 1.2700 figure. Unfortunately today it was not convenient to watch the trade past the U.K. close, so we exited.

China will be off this week for Chinese New Year celebrations – which will reduce volume in the Asian sessions. There will be numerous important economic news events tomorrow as February begins. Be careful trading near the releases.

Good luck with your trading!