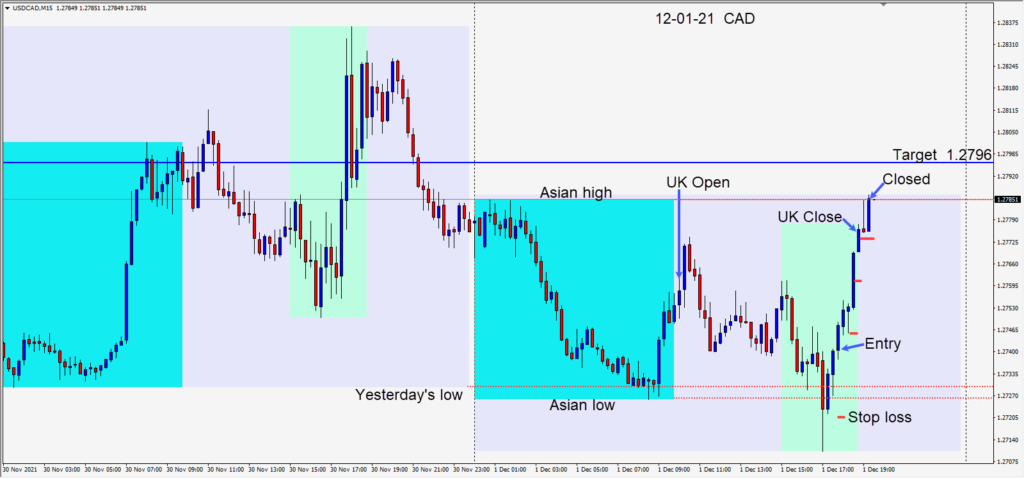

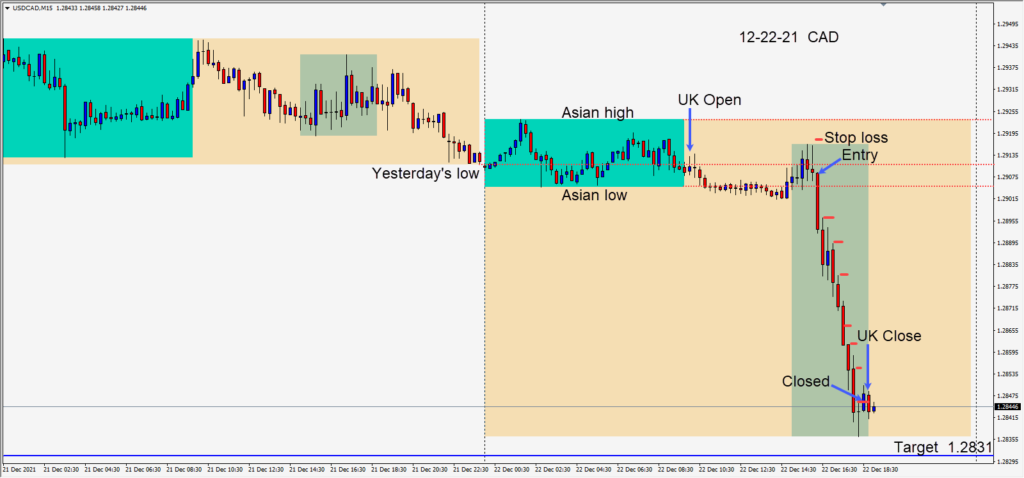

Some days trading is much easier and more rewarding than other days. The USDCAD went sideways through the first half of the U.K. session and made a very brief attempt to move higher as the North American traders began trading. A double top formed and the USD began weakening to the majors… with the commodity pairs showing the most strength – consistent with “risk on” trading.

A short was taken risking 10 pips for a potential 77 pips to our daily target at 1.2831. Price was able to move beneath the 1.2900 figure and then through the 1.2879 level which was a technical level on the hourly chart. With price continuing lower, the pair would next test the 1.2850 level where we gave it bit of room as we continued to lock in profit. A doji candle with a long lower wick followed and we were taken out of the trade as price subsequently hit the doji candle high.

With a strong correlation between the majors today, a second trade was also taken in the EURUSD as it maintained strength above the 1.1300 figure. (not shown)

There are a number of U.S. economic releases on Thursday as we wrap up the trading week. Tomorrow will be the last trading day of the year for many traders. I will be watching the charts and if I see anything that I like, I will post it. Otherwise I will be back next week, but less inclined to trade during the holidays.

Happy holidays and stay healthy!